Can Jumia Technologies (JMIA) Drive Sustainable Growth While Narrowing Losses?

Reviewed by Sasha Jovanovic

- Jumia Technologies AG recently announced third quarter 2025 earnings, reporting sales of US$45.63 million, up from US$36.43 million a year earlier, with a net loss of US$17.94 million compared to US$16.9 million previously.

- An important insight is that for the first nine months of 2025, Jumia reduced its net loss to US$51.24 million from US$79.55 million a year before, suggesting progress in improving efficiency and cost management.

- We'll examine how Jumia's progress in narrowing losses while growing sales could influence its investment narrative and future expectations.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Jumia Technologies Investment Narrative Recap

To be a Jumia shareholder, you need to believe that expansion into Africa’s underserved markets and scaling digital payments will unlock sustained growth, yet ongoing losses and a competitive e-commerce scene remain front of mind. The recent Q3 results show continued sales growth alongside narrowing year-to-date losses, but the increased quarterly loss means the news doesn’t materially change the most immediate catalyst or the core risk: Jumia’s unresolved path toward sustainable profitability amid margin pressures.

Among recent announcements, Jumia’s October Analyst/Investor Day stands out for its relevance. It provided management with an opportunity to present updates on growth initiatives and margin improvement efforts, directly relating to the catalysts and risks investors are watching, especially as efficiency gains and expansion strategies weigh against ongoing losses and cost concerns.

However, against hopes for margin progress, investors should note that Jumia’s current cost structure and cash burn remain significant challenges that...

Read the full narrative on Jumia Technologies (it's free!)

Jumia Technologies' narrative projects $236.6 million revenue and $20.6 million earnings by 2028. This requires 13.0% yearly revenue growth and a $90.3 million increase in earnings from -$69.7 million today.

Uncover how Jumia Technologies' forecasts yield a $6.99 fair value, a 29% downside to its current price.

Exploring Other Perspectives

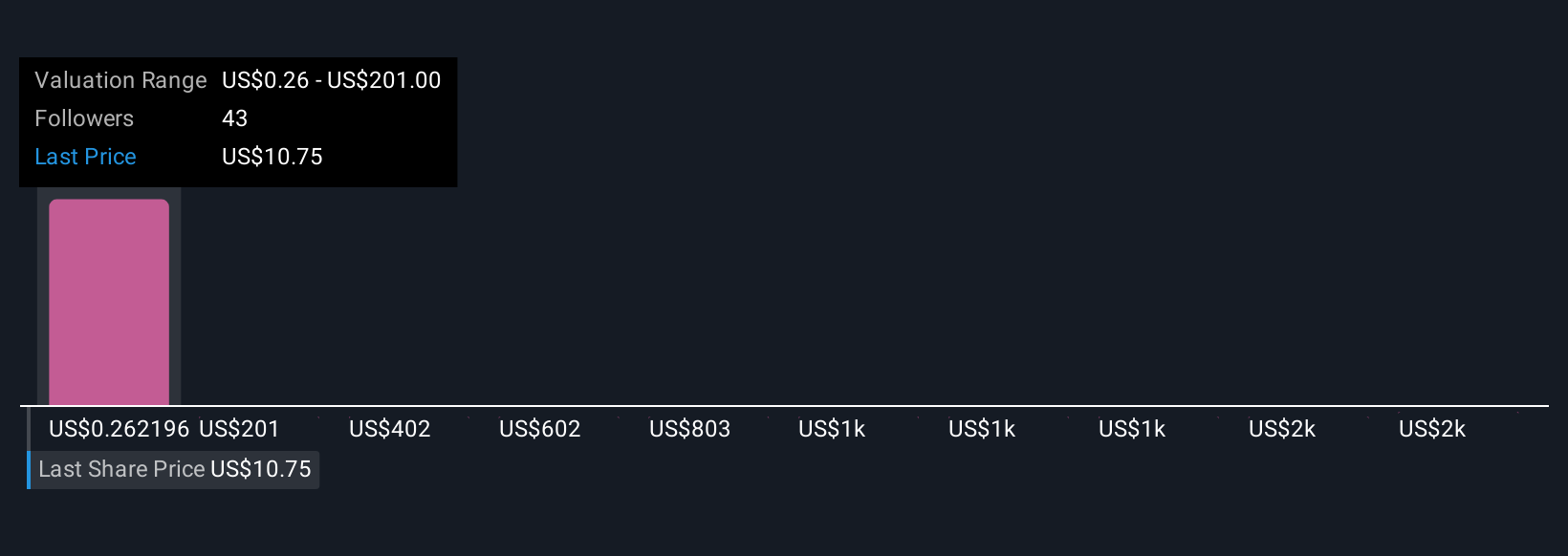

Fair values on Jumia from seven Simply Wall St Community members span a wide range, from US$0.19 up to US$46.28. While some expect operational efficiency gains to drive improved margins, others remain cautious about persistent losses; take the time to review these varying viewpoints.

Explore 7 other fair value estimates on Jumia Technologies - why the stock might be worth less than half the current price!

Build Your Own Jumia Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jumia Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Jumia Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jumia Technologies' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JMIA

Jumia Technologies

Operates an e-commerce platform in West Africa, North Africa, East and South Africa, Europe, the United Arab Emirates, and internationally.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives