- United States

- /

- Specialty Stores

- /

- NYSE:HVT

Havertys (HVT): Margin Slide Challenges Bull Case Despite 90% Annual Earnings Growth Forecast

Reviewed by Simply Wall St

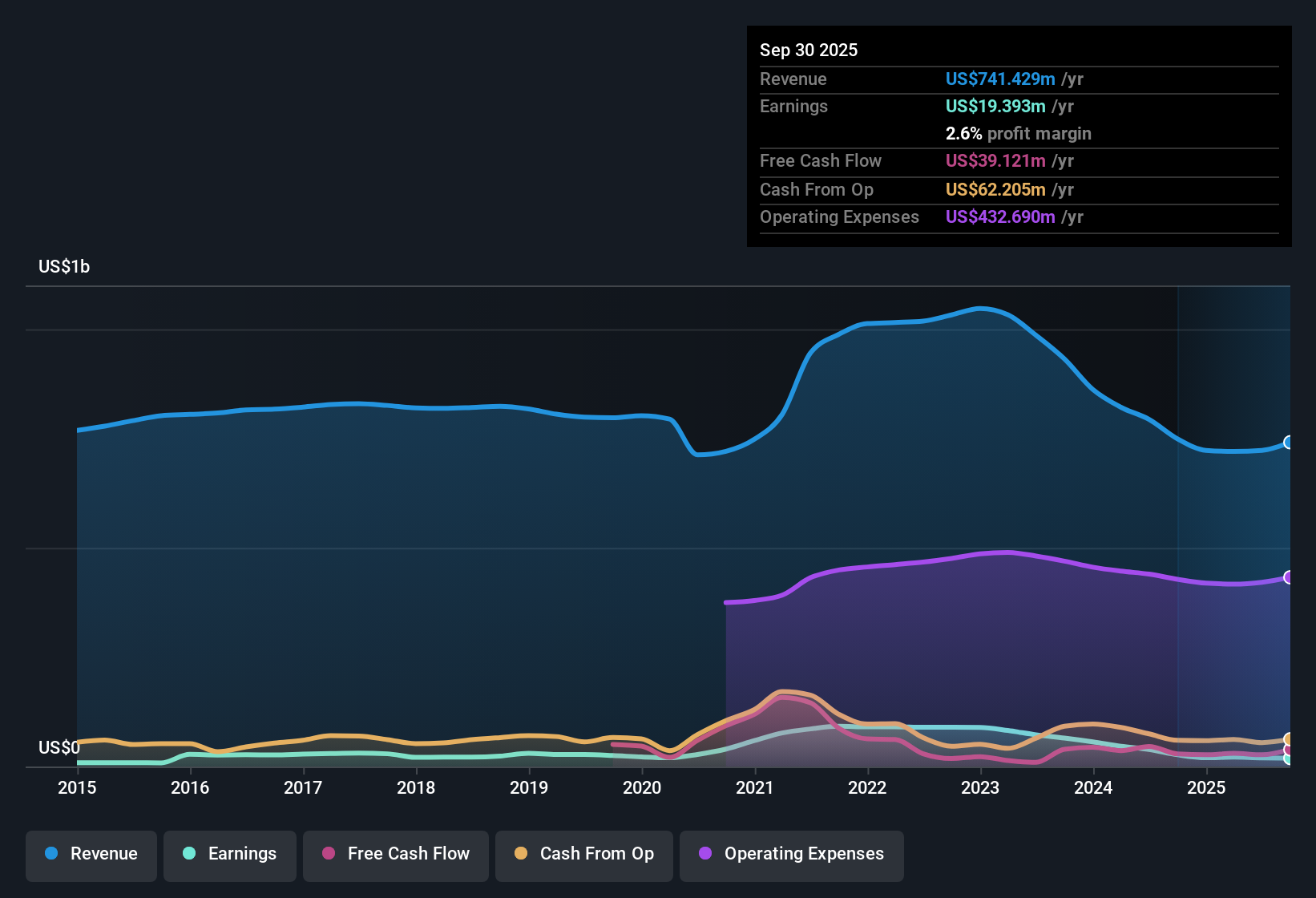

Haverty Furniture Companies (HVT) is set for a sharp turnaround as earnings are forecast to grow at an impressive 90.1% per year, far exceeding the expected 15.7% pace for the broader US market. Despite this robust outlook, net margins have slipped to 2.6%, down from 3.6% last year, and the company has posted annual earnings declines of 21.1% over the past five years. With a revenue growth projection of 6.9% per year that lags the national average, investors face a mixed set of signals as the stock trades below fair value and sports a competitive price-to-earnings ratio.

See our full analysis for Haverty Furniture Companies.Next, we will put these headline numbers side by side with the Simply Wall St community’s prevailing narratives for Haverty to see which themes get confirmed and where expectations could shift.

See what the community is saying about Haverty Furniture Companies

Profit Margins Set to Climb Sharply

- Analysts expect profit margins to climb from 2.7% today to 12.1% within three years. If realized, this would mark a dramatic recovery from current lows.

- According to analysts' consensus view, several trends drive this optimism:

- Digital sales are increasing, with web sales up 8.4% in Q2, alongside new investments in omnichannel and digital marketing efficiency.

- Supply chain shifts to reduce China exposure and grow partnerships in Vietnam are meant to boost gross margins and stabilize profit, highlighting a proactive approach to future disruptions.

Valuation Discount Despite Growth Forecasts

- At a share price of $21.65, Haverty trades well below both its DCF fair value of $60.94 and the consensus analyst target of $29.00. Its price-to-earnings ratio of 18.2x is a deep discount to peer averages at 34.9x.

- Analysts' consensus narrative emphasizes this rare combination:

- Storm clouds from weak housing and macro headwinds have not derailed a forecast of 7.2% annual revenue growth or the expectation for earnings to climb from $19.6 million to $107.4 million by 2028, showing potential for long-term upside.

- Sustained focus on brand loyalty and deeper market penetration in the southern U.S. is expected to drive long-term demand, while a discount to DCF fair value and peer multiples provides an added margin of safety for new investors entering at today’s price.

Even analysts who take a wait-and-see approach acknowledge the substantial gap between the current price and projected value, suggesting plenty of room for sentiment to shift if the fundamentals play out as forecast. 📈 Read the full Haverty Furniture Companies Consensus Narrative.

Dividend and Cost Pressures Remain Manageable

- Despite some flagged risks around dividend sustainability and higher SG&A costs, no major risks were highlighted, and there is no evidence of significant recent insider selling.

- Analysts' consensus view highlights that persistent cost pressures, such as rising advertising and occupancy costs, are in focus. However, operational improvements via supply chain diversification and expanding store footprint are expected to offset much of this, with only minor risk to the company’s ability to deliver forecasted earnings growth.

- The company's plan to grow physical presence in high-potential southern U.S. markets aims to leverage fixed costs and capture market share, potentially enhancing long-term earnings durability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Haverty Furniture Companies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from a fresh angle? Share your point of view and shape your own story in just minutes. Do it your way

A great starting point for your Haverty Furniture Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Haverty’s earnings are expected to rebound, its history of recent profit declines and lagging revenue growth reveal some persistent volatility in the face of industry headwinds.

If you want steadier returns and fewer surprises, check out stable growth stocks screener (2100 results) to discover companies with a track record of consistent growth and reliable performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Haverty Furniture Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HVT

Haverty Furniture Companies

Operates as a specialty retailer of residential furniture and accessories in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives