- United States

- /

- Specialty Stores

- /

- NYSE:HD

How Holiday Boycott Efforts Could Shape Home Depot’s (HD) Brand Narrative This Season

Reviewed by Sasha Jovanovic

- In recent days, Home Depot has faced a growing grassroots boycott over its perceived connection to ICE raids, raising concerns about consumer sentiment during the important holiday shopping season.

- This backlash coincides with Home Depot’s expansion of holiday marketing campaigns and community-focused initiatives, increasing scrutiny of the company's brand values as it aims to strengthen its customer base and reputation.

- We’ll examine how reputational risks during peak retail periods may affect Home Depot's investment narrative and future expectations.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Home Depot Investment Narrative Recap

To own shares of Home Depot, investors must believe in the company's ability to convert ongoing digital and supply chain investments into operational gains, while weathering cyclical demand swings and reputational risks. The emerging grassroots boycott linked to ICE raids could weigh on near-term sentiment during the pivotal holiday shopping period, but initial indications suggest the overall impact on the company's primary sales catalysts appears immaterial when compared to more persistent risks, such as softer demand for large-scale remodeling projects.

One recent announcement drawing attention is Home Depot’s new holiday campaign, “The Right Tree,” which aims to boost customer engagement and sales during the peak season. This initiative stands out amid scrutiny about the company’s social policies, illustrating the tension between effective retail marketing and reputational risk management at a critical time for sales momentum.

However, with persistent softness in big-ticket renovation projects and mounting inventory levels, the bigger concern for investors might be around how...

Read the full narrative on Home Depot (it's free!)

Home Depot's outlook projects $182.4 billion in revenue and $17.4 billion in earnings by 2028. This implies annual revenue growth of 3.4%, and an earnings increase of $2.8 billion from the current $14.6 billion.

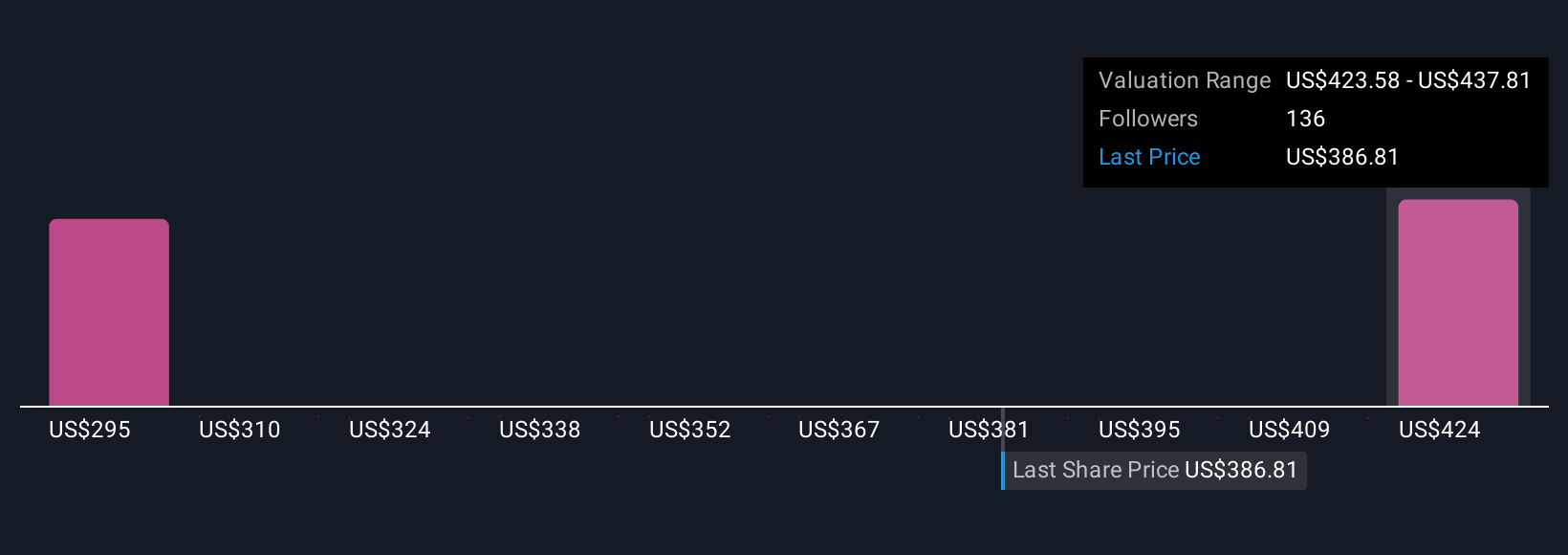

Uncover how Home Depot's forecasts yield a $437.81 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community set fair value for Home Depot shares between US$298 and US$438. With consumer sentiment under pressure and reputational risks in focus, see how these diverse opinions reflect shifting expectations for revenue growth and profitability.

Explore 7 other fair value estimates on Home Depot - why the stock might be worth 19% less than the current price!

Build Your Own Home Depot Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Home Depot research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Home Depot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Home Depot's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives