- United States

- /

- Specialty Stores

- /

- NYSE:HD

Does the Recent 7% Dip Make Home Depot Shares a Better Value in 2025?

Reviewed by Bailey Pemberton

- Wondering if Home Depot’s share price is a bargain, overpriced, or right on the money? You’re not alone, and a fresh look at its value could reveal some surprises.

- The stock has dipped recently, dropping 2.8% over the last week and down 7.1% in the past month. Yet it still boasts gains of over 40% in the last three years and nearly 51% over five years.

- Recent attention has centered on shifting trends in consumer spending and the ongoing debate about the post-pandemic home improvement boom. News stories have highlighted how changing interest rates and housing data are affecting retailer sentiment, adding some new twists to the stock’s recent moves.

- Right now, Home Depot scores just 1 out of 6 on our value checks. The next step is to unpack how we arrive at that number and then explore a better way to judge valuation that most investors overlook.

Home Depot scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Home Depot Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s worth by forecasting its future cash flows and then discounting those amounts back to their present-day value. This approach provides investors with a sense of what the business might be worth based on expected performance rather than current market sentiment.

For Home Depot, recent data shows its trailing twelve-month Free Cash Flow comes to $14.34 billion. Analysts supply projections through 2029, estimating steady growth in Free Cash Flow, reaching $18.45 billion by the 2030 fiscal year. After analyst estimates, future growth is extrapolated using moderate assumptions based on industry trends. All figures are presented in US dollars, providing consistency regardless of varied reporting or listing currencies.

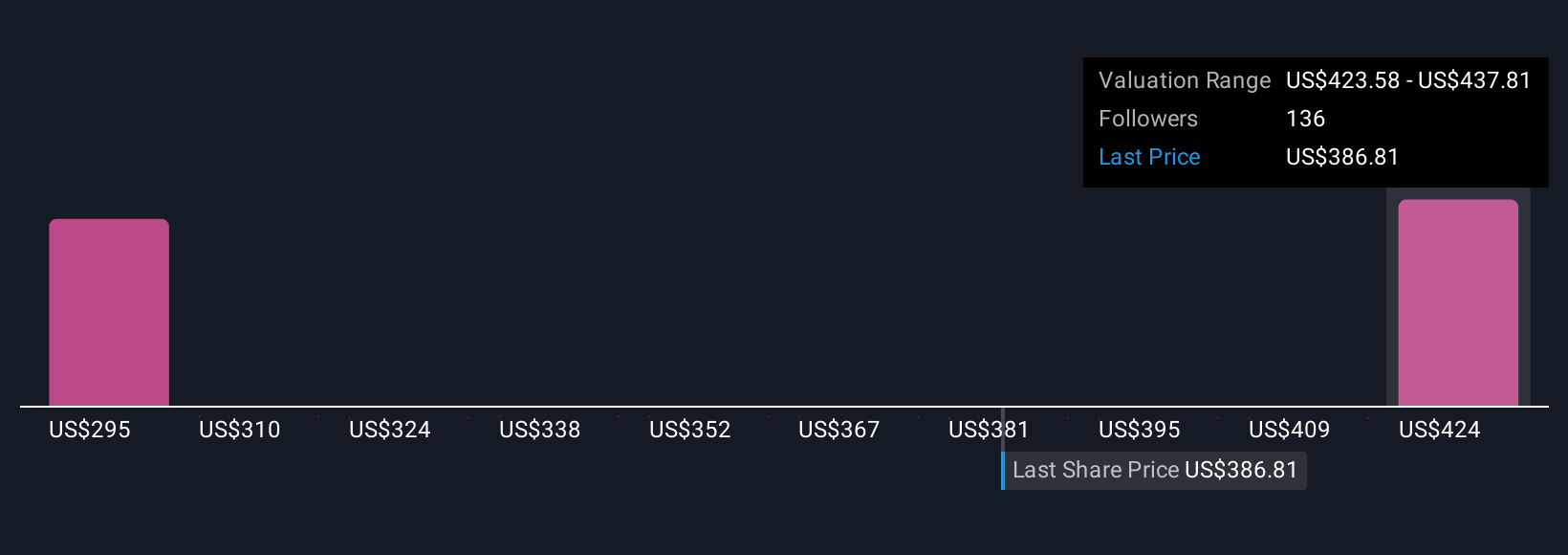

Based on this model, the estimated intrinsic value for Home Depot’s shares is $295.88. Compared to the company’s current market price, this DCF calculation suggests the stock is trading at a 27.8% premium. In other words, it appears significantly overvalued by this methodology.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Home Depot may be overvalued by 27.8%. Discover 856 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Home Depot Price vs Earnings

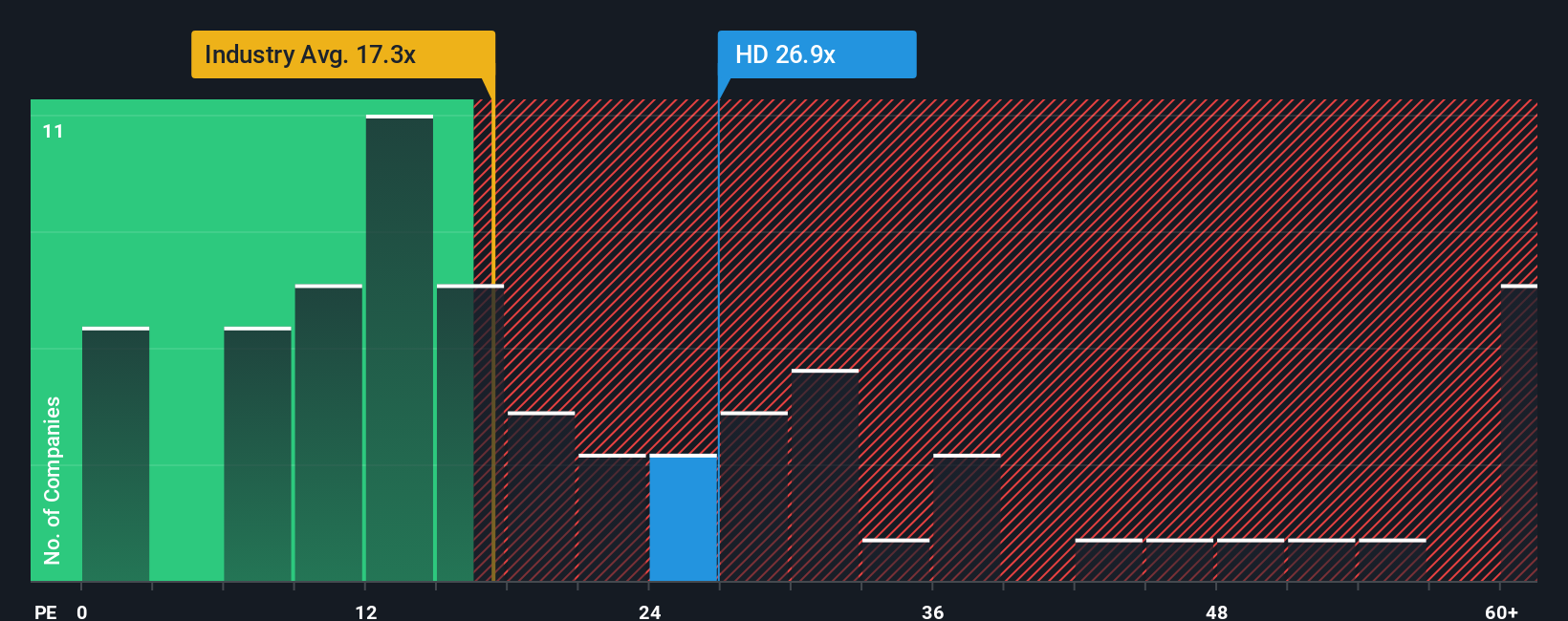

The Price-to-Earnings (PE) ratio is a widely used metric for analyzing profitable companies, as it reflects how much investors are willing to pay for each dollar of current earnings. For established businesses like Home Depot that consistently generate profits, the PE ratio provides a straightforward way to gauge value relative to those earnings.

What counts as a “fair” PE ratio often depends on factors such as a company’s expected growth rate and the risks it faces. Higher growth companies typically command higher PE ratios, while greater risks or slower growth tend to pull the ratio lower. Market sentiment and industry trends can also influence what investors consider normal.

At present, Home Depot trades at a PE ratio of 25.7x. This is notably above the Specialty Retail industry average of 16.6x but slightly below the peer group average of 26.4x. While these benchmarks are informative, Simply Wall St's proprietary Fair Ratio estimate takes this analysis further by considering Home Depot’s specific growth prospects, profit margins, business risks, industry dynamics, and its market capitalization. For this company, the Fair Ratio is calculated at 23.6x.

Comparing the Fair Ratio to Home Depot’s actual PE ratio reveals a premium of about 2x. Since this gap exceeds 0.10, the results suggest Home Depot’s shares are currently overvalued by this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Home Depot Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a personalized way of making sense of a company’s prospects, allowing you to tell the story behind the numbers by setting your assumed fair value and making estimates about Home Depot’s future revenue, earnings, and profit margins.

Narratives help you connect the company’s story and industry context with your own financial forecasts, then instantly turn those forecasts into a fair value for the shares. This approach is not only more dynamic, it’s also easy to use. Simply Wall St’s platform provides Narratives directly within the Community page, and millions of investors rely on this tool to bring clarity to their investment decisions.

With Narratives, you can see precisely when your own Fair Value diverges from the current share price, making it easier to decide whether to buy, hold, or sell. Plus, your Narrative always stays up to date, automatically factoring in the latest company news, earnings releases, and market developments.

For example, some Home Depot investors set their Narrative with high conviction in digital expansion and assign a fair value above $480 per share, while more cautious users, focused on margin risks and slowing demand, estimate a fair value closer to $335. Your Narrative brings together your unique viewpoint and the data that matters most to you.

Do you think there's more to the story for Home Depot? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives