- United States

- /

- Specialty Stores

- /

- NYSE:HD

Assessing Home Depot’s Value After Recent Digital Investment and Price Swings in 2025

Reviewed by Bailey Pemberton

- Wondering if Home Depot's stock is actually a bargain right now? You are not alone, as many investors are reviewing the numbers to determine whether it is time to buy, hold, or move on.

- The share price has experienced ups and downs recently, rising 6.3% in the past week but still down 7.7% over the last month and off 8.5% this year to date.

- Recent headlines have highlighted Home Depot's continued investment in digital infrastructure and customer service improvements. These efforts aim to boost both in-store and online traffic. At the same time, reports of softer consumer spending in the home improvement sector have kept investors cautious, even as the company launches new initiatives.

- When it comes to valuation, Home Depot currently scores a 1 out of 6 on our checks for undervalued factors. Next, we will break down the different ways that investors and analysts assess value. If you are looking for a smarter approach, stay tuned for what could be the most insightful method at the end of the article.

Home Depot scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Home Depot Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the true value of a company by projecting its future cash flows and then discounting those amounts back to today's value. This method provides a snapshot of what Home Depot could be worth based on its ability to generate cash in the coming years.

Currently, Home Depot generates Free Cash Flow of approximately $14.1 billion. Analysts have provided cash flow forecasts for the next five years, with projections suggesting future Free Cash Flow could grow to $17.8 billion by 2029. Looking out over a ten-year period, models extrapolated by Simply Wall St estimate Free Cash Flow reaching up to $23.3 billion by 2035, still denominated in $.

Using the 2 Stage Free Cash Flow to Equity model, Home Depot's estimated intrinsic value is $312.80 per share. Compared to the current market price, this calculation suggests the stock is around 13.6% overvalued based on today’s expectations.

For investors, this means the current share price sits above what the DCF model sees as fair value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Home Depot may be overvalued by 13.6%. Discover 926 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Home Depot Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is often the go-to metric when valuing profitable companies like Home Depot. It tells investors how much they are paying for each dollar of earnings, which is a helpful measure if the business has a consistent profit track record.

A company’s PE ratio can reflect not only its current earnings strength but also expectations for future growth and the risks investors perceive. Higher growth or lower risk usually justify higher PE ratios, while slower growth or increased uncertainty push the multiple lower.

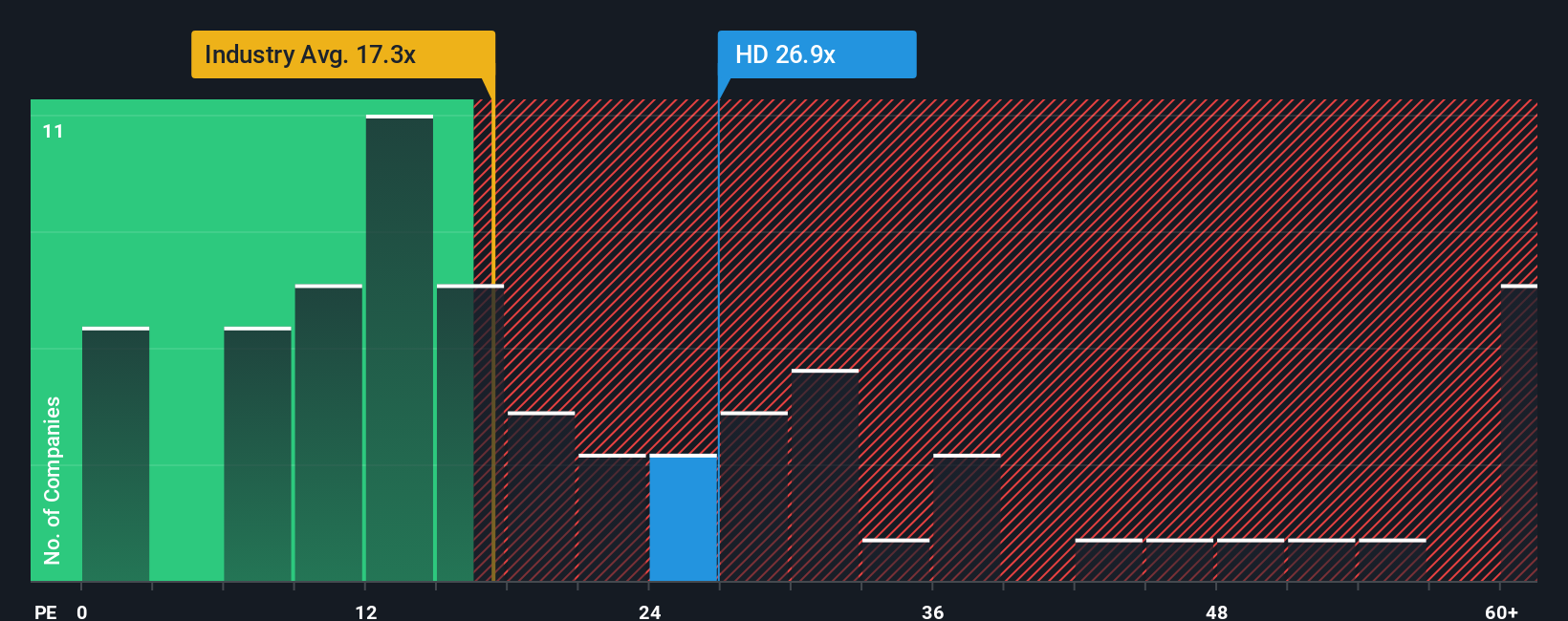

Home Depot’s current PE ratio sits at 24.3x, which is slightly below the average among its closest peers (26.4x) but well above the Specialty Retail industry average of 18.0x. While these benchmarks offer some perspective, they are just starting points and do not capture all that is unique about Home Depot’s business.

To address this, Simply Wall St calculates a proprietary "Fair Ratio" of 22.7x for Home Depot. This metric weighs factors like the company’s earnings growth, profit margins, market cap, industry dynamics, and risk profile to produce a more tailored benchmark. Unlike a simple industry or peer comparison, the Fair Ratio helps investors answer whether this stock is fairly priced for its specific outlook.

Comparing Home Depot’s current PE of 24.3x to its Fair Ratio of 22.7x, the difference is just 1.6x. This places it in a range where the stock looks fairly valued by this approach.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Home Depot Narrative

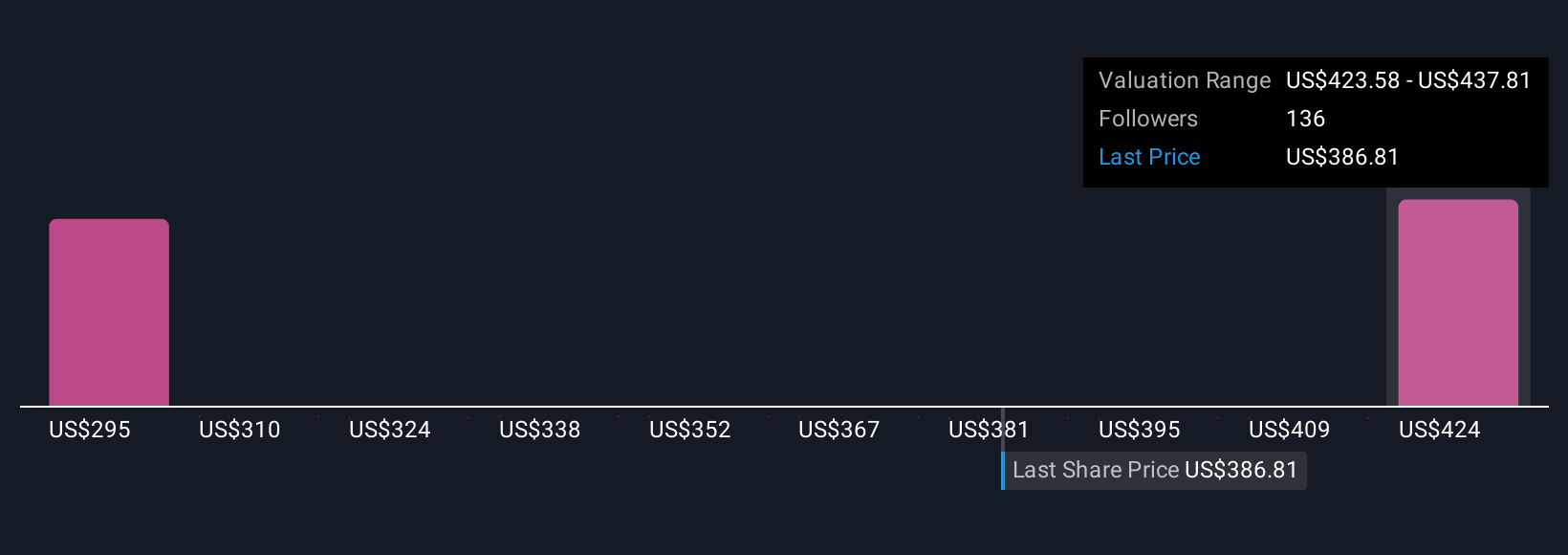

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story, a set of beliefs or expectations about where Home Depot is headed, backed by your own assumptions about its future revenue, profit margins, and fair value. With Narratives, you link a company’s business outlook and industry trends to a specific forecast and a target share price, creating a clear, personalized investment thesis.

Narratives are an intuitive tool on Simply Wall St’s Community page, where millions of investors share, browse, and update their perspectives. Narratives make decision-making easier by comparing your Fair Value to today’s market Price, helping you decide when a stock is in your buy, hold, or sell zone. Since Narratives update dynamically as new company results or news emerge, your investment thesis always reflects the latest information.

For example, some Home Depot Narratives see strong technology investments and renovation demand driving fair values as high as $481 per share, while others, more concerned about persistent cost pressures and weak project spending, set fair values as low as $335. No matter your outlook, Narratives let you build and track your unique story about Home Depot, then translate that thesis directly into an actionable valuation.

Do you think there's more to the story for Home Depot? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success