- United States

- /

- Specialty Stores

- /

- NYSE:HD

A Look at Home Depot's Valuation as Boycott Draws Investor and Public Scrutiny

Reviewed by Simply Wall St

Home Depot (HD) is in the spotlight as a grassroots boycott, sparked by concerns over its perceived ties to ICE raids and diversity commitments, gains momentum during the holiday shopping season, drawing both public and investor attention.

See our latest analysis for Home Depot.

Home Depot’s share price recently slipped to $371.13, with a 90-day price return of -7.3% as the grassroots boycott and softer U.S. comparable sales weigh on sentiment. Despite these headwinds, the company’s five-year total shareholder return of 55% points to substantial long-term value. However, current momentum is fading as investors assess evolving risks and opportunities.

If this shakeup in retail has you thinking beyond the usual picks, it might be the right moment to broaden your search and discover fast growing stocks with high insider ownership

With shares down in recent months and analysts still seeing upside, the question for investors is whether Home Depot’s current pressures have created an undervalued entry point or if future growth is already reflected in the price.

Most Popular Narrative: 15% Undervalued

With Home Depot’s last close at $371.13, the most widely followed narrative values the stock at $437.81. This marks a notable gap that could catch investors’ attention as long-term assumptions drive this outlook.

Home Depot's sizable investments in advanced supply chain technologies, machine learning-based delivery optimization, and in-store digital enhancements are yielding faster delivery, higher customer satisfaction, and improved operational productivity. These trends are expected to boost net margins and drive long-term earnings growth.

Want to know the financial engine powering this bullish case? The market story hinges on projections of profit growth, margin recovery, and an earnings multiple rarely seen in traditional retail. Ready to uncover what ambitious forecasts are backing this valuation leap? The answer may surprise you.

Result: Fair Value of $437.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer demand for large-scale remodeling and pressure on profit margins could challenge Home Depot’s growth outlook if these trends persist.

Find out about the key risks to this Home Depot narrative.

Another View: Not All Models Agree

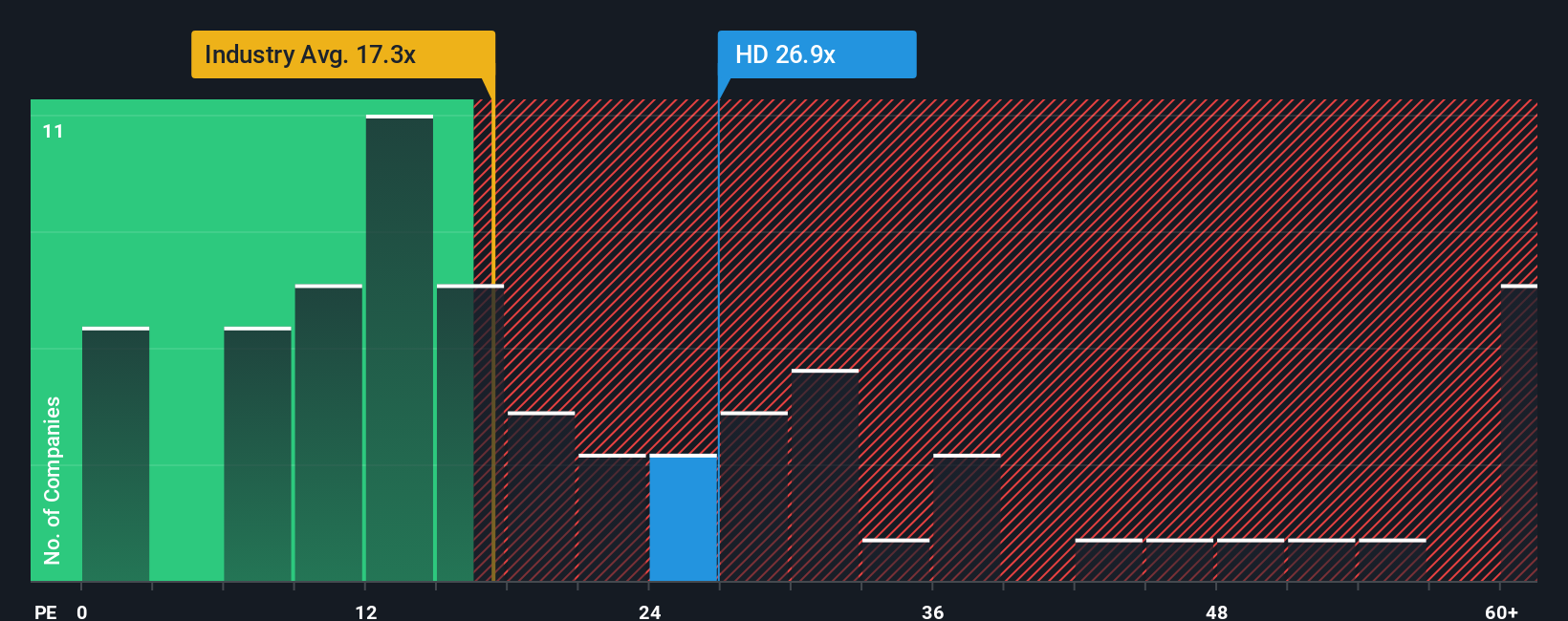

While many investors emphasize Home Depot’s future growth potential, a different lens suggests caution. The company’s price-to-earnings ratio stands at 25.3 times, noticeably higher than both the industry average of 18.3 and the peer average of 25.1. Even compared to its own fair ratio of 22.9, shares look stretched. This kind of premium often translates to higher valuation risk if expectations fall short. What will it take for the stock to justify this pricing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Home Depot Narrative

If you see Home Depot’s story differently or want fresh data at your fingertips, why not put together your own view with just minutes of effort? Do it your way

A great starting point for your Home Depot research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing means being ready for the next opportunity. Get ahead of the crowd by targeting stocks that fit your own growth, income, and innovation goals.

- Explore high-potential companies with strong cash flows by checking out these 865 undervalued stocks based on cash flows for stocks that may be trading below their true worth.

- Capitalize on the rise of artificial intelligence by scanning these 25 AI penny stocks for businesses making advancements in AI research and applications.

- Pursue steady income by reviewing these 14 dividend stocks with yields > 3% featuring attractive yields and consistent dividends in today's dynamic market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives