- United States

- /

- Interactive Media and Services

- /

- NasdaqCM:BZFD

May 2025's Top Penny Stocks To Watch

Reviewed by Simply Wall St

Major U.S. stock indexes have experienced slight declines as investors await Nvidia's earnings report, a significant event that could impact market sentiment. Amidst this anticipation, the broader market has been influenced by fluctuating trade policies and economic indicators, creating a dynamic backdrop for investment decisions. While penny stocks might seem like relics from an earlier era, they continue to represent smaller or newer companies with potential value; focusing on those with strong financials can uncover promising opportunities in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Perfect (NYSE:PERF) | $1.77 | $184.35M | ✅ 3 ⚠️ 0 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.06 | $169.86M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.25 | $58.05M | ✅ 1 ⚠️ 2 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.77 | $364.62M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.84 | $95.67M | ✅ 4 ⚠️ 2 View Analysis > |

| Table Trac (OTCPK:TBTC) | $4.51 | $21.81M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.811 | $6.02M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.41 | $72.17M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.8601 | $28.94M | ✅ 3 ⚠️ 5 View Analysis > |

| Greenland Technologies Holding (NasdaqCM:GTEC) | $2.07 | $35.83M | ✅ 2 ⚠️ 5 View Analysis > |

Click here to see the full list of 729 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

BuzzFeed (NasdaqCM:BZFD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BuzzFeed, Inc. is a digital media company that distributes content across its own platforms and third-party platforms both in the United States and internationally, with a market cap of approximately $73.97 million.

Operations: The company's revenue primarily comes from its advertising segment, which generated $188.90 million.

Market Cap: $73.97M

BuzzFeed's performance as a penny stock is characterized by financial challenges and strategic shifts. Despite a market cap of US$73.97 million, the company remains unprofitable with losses increasing over the past five years at 21.2% annually. Recent moves include securing a US$40 million loan to enhance financial flexibility and reduce convertible debt obligations, alongside expanding commerce capabilities through AI partnerships to drive revenue growth. While its cash runway supports operations for over a year, volatility and increased debt-to-equity ratio highlight risks in its investment profile amidst efforts to stabilize finances and pursue long-term growth initiatives.

- Click here to discover the nuances of BuzzFeed with our detailed analytical financial health report.

- Learn about BuzzFeed's historical performance here.

Vasta Platform (NasdaqGS:VSTA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vasta Platform Limited offers educational printed and digital solutions for private schools in Brazil's K-12 sector, with a market cap of $321.64 million.

Operations: The company's revenue is primarily derived from its Educational Services segment, specifically Education & Training Services, which generated R$1.64 billion.

Market Cap: $321.64M

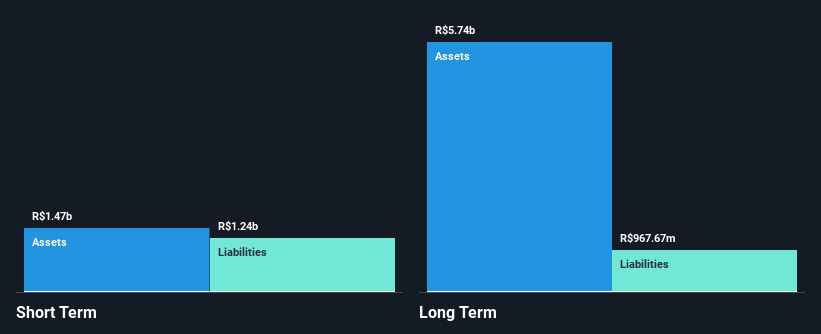

Vasta Platform's position among penny stocks is underscored by its recent profitability and financial restructuring. The company reported a net income of R$486.49 million for 2024, reversing a prior year's loss, although Q1 2025 saw a net loss of R$3.27 million. Despite this setback, Vasta's debt management is robust with satisfactory net debt to equity and strong coverage by operating cash flow. However, earnings are forecast to decline significantly over the next three years while revenue is expected to grow modestly at 12.77% annually, presenting both opportunities and challenges in its investment outlook.

- Dive into the specifics of Vasta Platform here with our thorough balance sheet health report.

- Assess Vasta Platform's future earnings estimates with our detailed growth reports.

Grove Collaborative Holdings (NYSE:GROV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Grove Collaborative Holdings, Inc. is a consumer products company that develops and sells household, personal care, beauty, and other consumer products in the United States with a market cap of $49.92 million.

Operations: Grove Collaborative Holdings generates revenue primarily through its online retail segment, which accounts for $193.43 million.

Market Cap: $49.92M

Grove Collaborative Holdings faces challenges typical of penny stocks, reflected in its recent NYSE non-compliance notice due to a market cap below US$50 million. The company reported a Q1 2025 revenue decline to US$43.55 million from US$53.55 million the previous year, with a net loss of US$3.55 million, highlighting ongoing financial pressures despite strategic acquisitions aimed at enhancing its product portfolio and sustainability focus. While Grove's short-term assets exceed liabilities and it has reduced debt over time, profitability remains elusive with no forecasted turnaround in the near term, emphasizing caution for potential investors.

- Jump into the full analysis health report here for a deeper understanding of Grove Collaborative Holdings.

- Explore Grove Collaborative Holdings' analyst forecasts in our growth report.

Seize The Opportunity

- Navigate through the entire inventory of 729 US Penny Stocks here.

- Ready For A Different Approach? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BuzzFeed might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BZFD

BuzzFeed

A digital media company, distributes content across owned and operated, and third-party platforms in the United States and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives