- United States

- /

- Specialty Stores

- /

- NYSE:GPI

Is Group 1 Automotive’s Valuation Attractive After Recent Acquisition Headlines in 2025?

Reviewed by Bailey Pemberton

- Wondering if Group 1 Automotive stock is actually a good deal right now? You are not alone, especially with big moves in the automotive retail space lately.

- Group 1 Automotive’s shares have shifted in recent weeks, falling 2.1% over the past 7 days but holding close to flat for the past month, while still showing a 229.8% gain over five years.

- In the wider market, several auto retailers have seen notable swings as industry headlines around electric vehicle adoption, dealer network expansion, and shifting consumer demand spark renewed investor interest. Group 1 Automotive has featured in news stories about acquisitions and its continued strategy to grow footprint in key U.S. markets, helping frame its recent moves in a broader growth context.

- Currently, Group 1 Automotive scores a 3 out of 6 on our valuation checklist, meaning it is undervalued in half of the key measures we track. Let’s unpack how analysts often approach valuation, and why there may be an even more insightful way to judge the stock’s real value. Stay tuned for that at the end of our analysis.

Find out why Group 1 Automotive's -7.0% return over the last year is lagging behind its peers.

Approach 1: Group 1 Automotive Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation tool that estimates a company’s intrinsic value by projecting its future cash flows and discounting them to today’s value. Essentially, it asks what all those future dollars are worth in today’s terms, taking into account the time value of money and risk.

For Group 1 Automotive, the DCF model uses the 2 Stage Free Cash Flow to Equity approach. The company’s latest reported Free Cash Flow stands at $573 million, with analyst forecasts suggesting a slight decline over the next several years and $516 million projected in 2027. Looking further ahead, extrapolated projections estimate Free Cash Flow to reach about $551 million in 2035. It is worth noting that projections beyond five years are less reliable and are based on analyst assumptions and historical patterns.

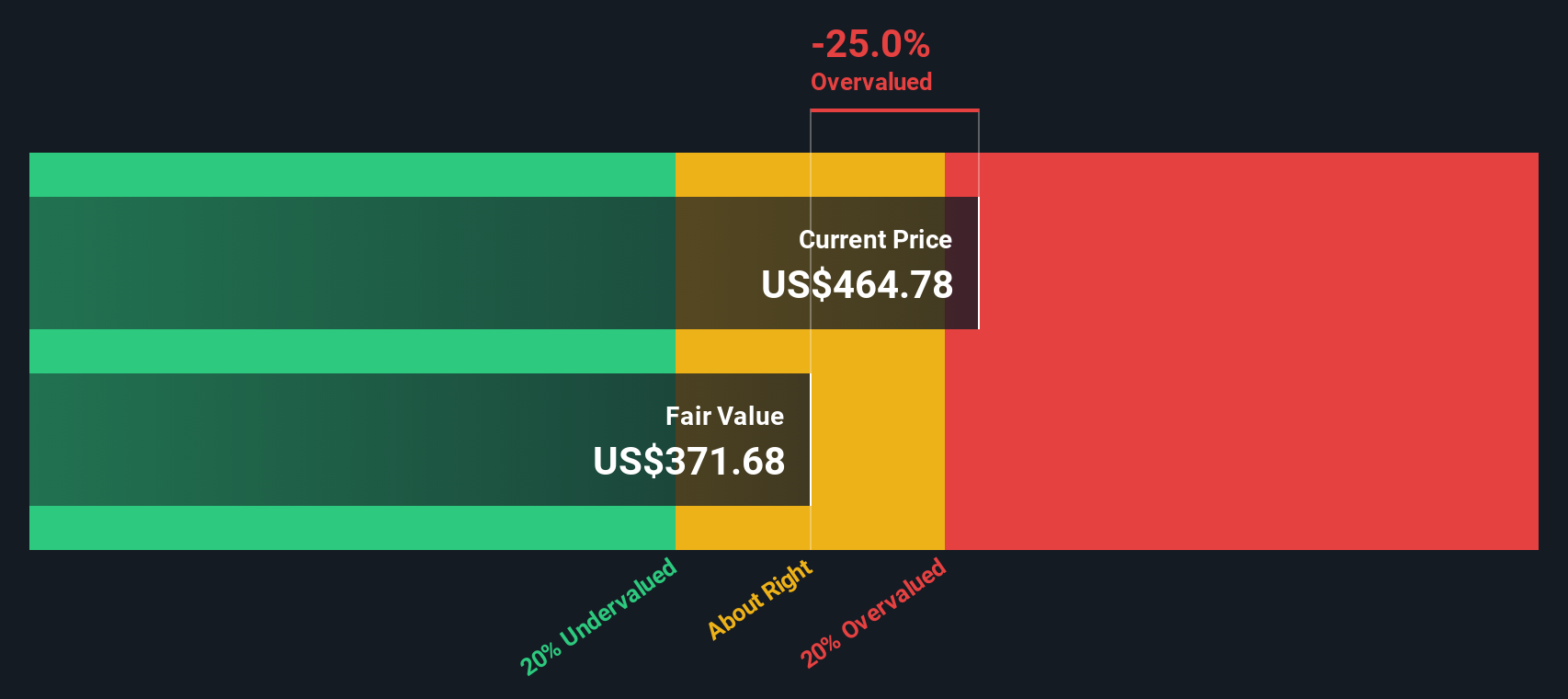

Based on these projections, the DCF calculation sets Group 1 Automotive’s estimated intrinsic value at $428 per share. With the DCF model suggesting the stock is 6.5% undervalued relative to its current market price, investors are seeing an opportunity, but not a dramatic discount.

Result: ABOUT RIGHT

Group 1 Automotive is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Group 1 Automotive Price vs Earnings

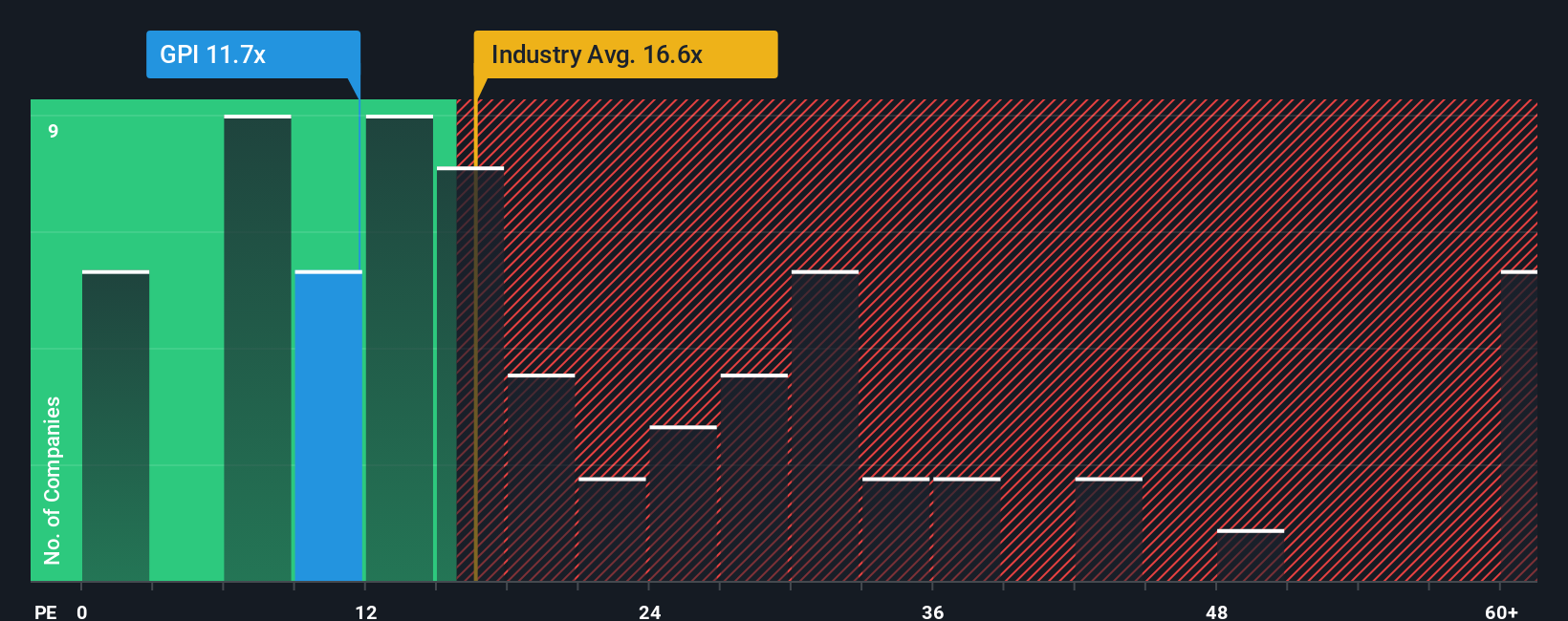

The Price-to-Earnings (PE) ratio is the preferred multiple for valuing profitable companies like Group 1 Automotive, as it directly relates a company's share price to its per-share earnings. The PE ratio helps investors assess how much they are paying for each dollar of earnings, which is especially meaningful when the company has strong and consistent profitability.

Growth expectations and risk profiles play an important role in what constitutes a “normal” or “fair” PE ratio for any stock. Companies with higher expected earnings growth or lower risk often command higher PE multiples, while those with uncertain futures or limited growth potential tend to trade at lower multiples.

Group 1 Automotive is currently trading at a PE ratio of 13.4x. This is above the peer average of 11.4x but still well below the specialty retail industry average of 18.1x. To provide deeper insight, Simply Wall St calculates a “Fair Ratio” using a proprietary formula that considers not just industry averages and peer comparisons, but also factors like Group 1’s profit margins, earnings growth, market cap, and unique risk profile. In this case, the Fair Ratio is 17.9x.

The Fair Ratio is a more customized benchmark than traditional comparisons because it reflects the company’s specific opportunities and challenges, as well as broader market and sector trends. This means it offers a more accurate framework for investors who want a nuanced perspective on valuation.

With Group 1’s actual PE ratio (13.4x) coming in close to the Fair Ratio (17.9x), but still meaningfully below it, the numbers suggest the company’s shares are currently undervalued based on earnings potential balanced for growth and risk.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Group 1 Automotive Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a concise story that presents your perspective on a company’s future, where you set out your assumptions around fair value, revenue growth, earnings, and profit margins, then connect those assumptions directly to a financial forecast and a fair value estimate.

Narratives turn investing from simply looking at static numbers into telling the story behind them. This makes it easy for anyone, regardless of experience level, to see how different stories lead to different valuations. Available to everyone on the Simply Wall St Community page, Narratives are trusted by millions and automatically update when new developments or earnings reports arrive, which helps ensure your view stays current and relevant.

This approach supports your investment decisions by allowing you to compare your own fair value to the current share price and assess if your reasoning justifies a potential trade. For example, some investors see Group 1 Automotive’s growing aftersales revenue, dealership expansion, and digital investments as reasons to justify a higher price target of $560. Others focus on risks such as digital disruption, EV adoption, or operational leverage and arrive at a significantly lower target of $401.

Do you think there's more to the story for Group 1 Automotive? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPI

Group 1 Automotive

Through its subsidiaries, operates in the automotive retail industry in the United States and the United Kingdom.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026