- United States

- /

- Specialty Stores

- /

- NYSE:GPI

Group 1 Automotive (GPI) Is Down 6.2% After Quarterly Net Income Drops Despite Rising Revenue

Reviewed by Sasha Jovanovic

- Group 1 Automotive reported its third quarter and nine-month 2025 earnings, showing increased revenue to US$5.78 billion and US$16.99 billion respectively, but net income fell sharply to US$13 million in Q3 and US$281.6 million year-to-date compared to the same periods last year.

- The decline in profitability contrasts with steady revenue growth and continued share repurchases, highlighting cost pressures and margin compression affecting the company’s bottom line.

- We’ll examine how the sharp fall in quarterly net income alters Group 1 Automotive’s investment narrative and outlook.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Group 1 Automotive Investment Narrative Recap

To be a shareholder in Group 1 Automotive, you need to believe the company can convert robust revenue momentum and a strong presence in used and aftersales segments into sustainable profit growth, despite rising costs and shrinking margins. The recent sharp dip in quarterly net income puts margin pressure front and center, reinforcing profit compression as the most important short-term risk. For now, this earnings setback does not materially impact the ongoing catalyst of aftersales expansion, but it does spotlight the need to restore profitability.

One major announcement relevant here is the steady pace of share buybacks, with the company completing the repurchase of 6.2 million shares for about US$1.35 billion since 2020. This ongoing program may be seen as a sign of management’s confidence in long-term value and capital discipline, even as temporary margin pressures persist. Investors tracking catalysts around operational scale and capital returns will note buybacks as a supportive factor amid earnings variability.

By contrast, factors such as persistent margin compression and cost inflation may continue to challenge earnings, and investors should be aware of...

Read the full narrative on Group 1 Automotive (it's free!)

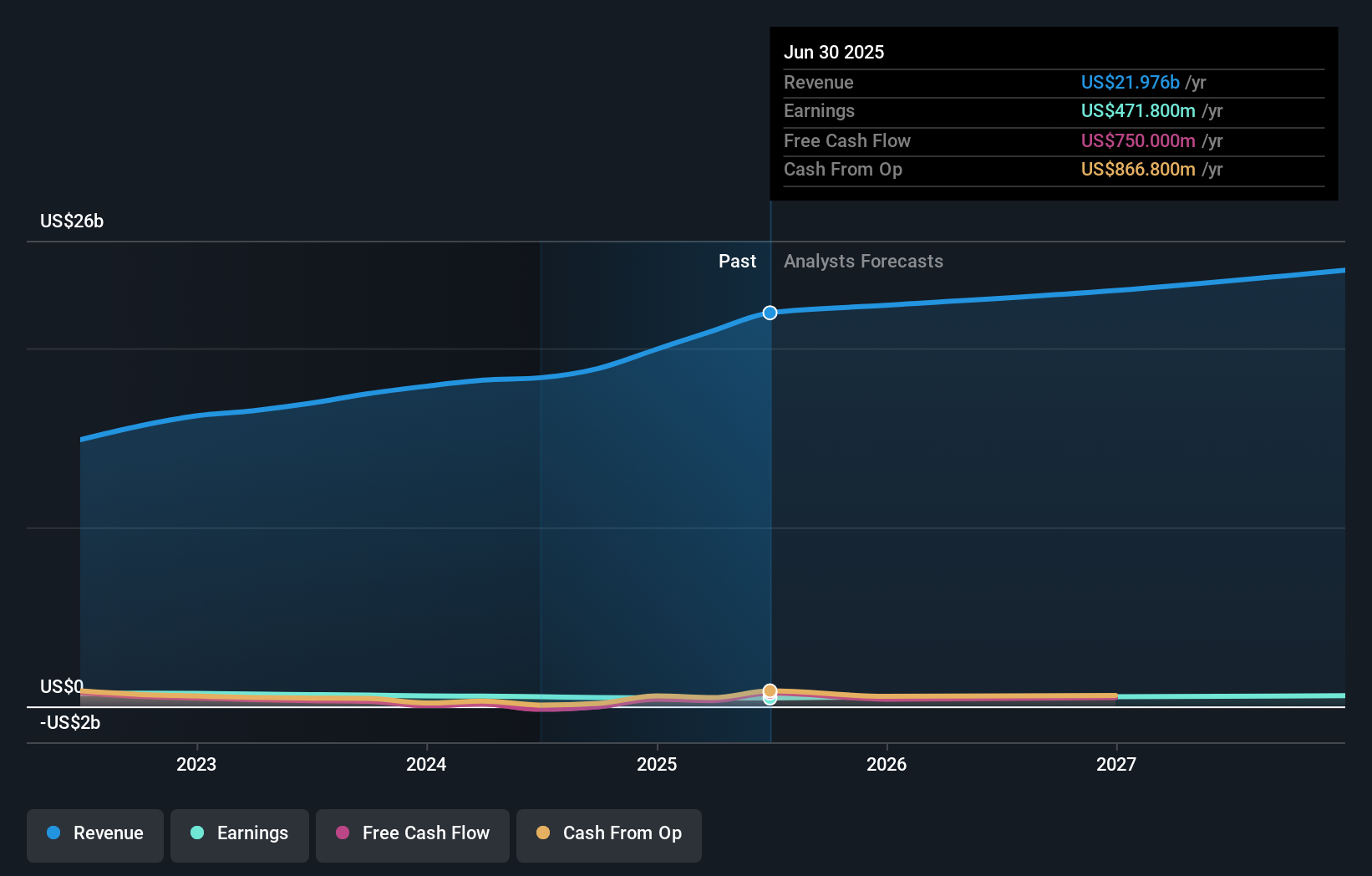

Group 1 Automotive's narrative projects $25.0 billion revenue and $636.8 million earnings by 2028. This requires 4.4% yearly revenue growth and a $165 million earnings increase from $471.8 million currently.

Uncover how Group 1 Automotive's forecasts yield a $483.38 fair value, a 22% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community includes 2 perspectives on fair value for Group 1 Automotive, ranging from US$433 to US$491 per share. While margin compression has become a near-term headwind, you can see how market participants interpret value differently and should consider several viewpoints.

Explore 2 other fair value estimates on Group 1 Automotive - why the stock might be worth just $433.39!

Build Your Own Group 1 Automotive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Group 1 Automotive research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Group 1 Automotive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Group 1 Automotive's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPI

Group 1 Automotive

Through its subsidiaries, operates in the automotive retail industry in the United States and the United Kingdom.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives