- United States

- /

- Retail Distributors

- /

- NYSE:GPC

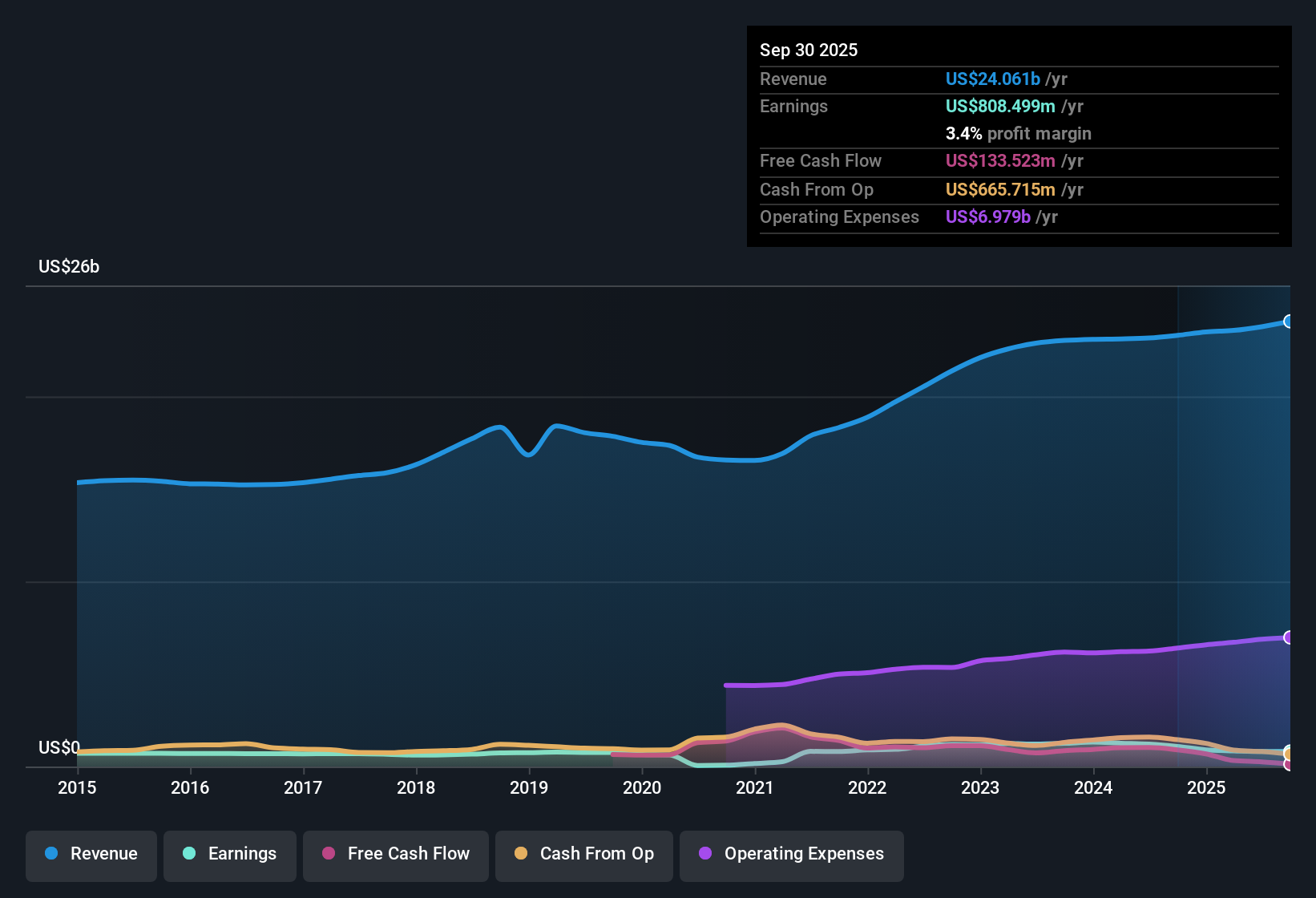

Genuine Parts (GPC) Margin Compression Challenges Bullish Narratives Despite Ongoing Revenue Growth

Reviewed by Simply Wall St

Genuine Parts (GPC) delivered annual revenue growth of 3.4%, trailing the broader US market’s 10.1% pace. The company’s earnings are forecast to climb 12.7% per year, though that also falls short of the market’s expected 15.5% growth rate. Net profit margins narrowed to 3.4% from 4.7% last year, signaling margin compression that investors will want to monitor during this earnings season.

See our full analysis for Genuine Parts.Next, we will set these results against the dominant market narratives to highlight where the numbers may challenge or reinforce common assumptions about Genuine Parts.

See what the community is saying about Genuine Parts

Profit Margin Compression Raises Efficiency Stakes

- Net profit margins for Genuine Parts have slipped to 3.4%, down from 4.7% last year, as expenses outpaced revenue gains and narrowed profitability across the business.

- Analysts' consensus view frames this efficiency challenge as central to the ongoing narrative:

- Persistent inflation in salaries, wages, and freight is driving SG&A expenses up faster than sales. This highlights a 100 basis point spread between top-line growth and these critical costs.

- Consensus still expects profit margins to recover to 4.8% within three years, but flagged risks around international headwinds and cost management could delay or obstruct this improvement.

- Results like these put Genuine Parts' margin recovery efforts under a bright spotlight. It is essential for investors to track the company’s path toward operating leverage and cost control. 📊 Read the full Genuine Parts Consensus Narrative.

Mixed Valuation Picture vs Industry Averages

- The company appears expensive on a Price-To-Earnings basis compared to both market peers and the US retail distributors industry, though some fair value estimates suggest it currently trades below intrinsic value.

- Analysts' consensus view cuts both ways for valuation:

- Current analyst consensus price target is $144.11 versus the latest share price of $134.51, implying just a 7% upside and reflecting broad agreement that the stock is fairly valued.

- The projected 2028 P/E ratio of 18.8x would put Genuine Parts below the industry’s average P/E of 24.7x. This points to a move toward sector norm over time if targets are achieved.

Digital, International Growth Holds Long-Term Promise

- Strategic investments in digital transformation and global expansion have diversified revenue streams, with online sales now accounting for about 40% of the Motion segment and ongoing revenue growth in regions like Asia Pacific.

- Analysts' consensus view sees these themes as powerful offsets to macro challenges:

- Genuine Parts' heavy focus on digital sales, proprietary e-commerce tools, and supply chain automation is expected to accelerate topline growth and structural efficiency over the next 3 years.

- Meanwhile, international expansion is reducing geographic risk by increasing exposure to high-growth markets outside North America. This counters sluggish conditions in Europe.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Genuine Parts on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own interpretation? Share your perspective and build your narrative in just a few minutes. Do it your way

A great starting point for your Genuine Parts research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Genuine Parts faces challenges with shrinking profit margins and struggles to outperform peers on earnings growth and valuation. This signals potential for steadier options elsewhere.

If you’re seeking businesses delivering consistent financial strength and reliable performance across cycles, consider our list of stable growth stocks screener (2087 results), where resilient growth leaders stand out from the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPC

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives