- United States

- /

- Specialty Stores

- /

- OTCPK:FTCH.Q

Did You Manage To Avoid Farfetch's (NYSE:FTCH) Painful 60% Share Price Drop?

The nature of investing is that you win some, and you lose some. And unfortunately for Farfetch Limited (NYSE:FTCH) shareholders, the stock is a lot lower today than it was a year ago. In that relatively short period, the share price has plunged 60%. We wouldn't rush to judgement on Farfetch because we don't have a long term history to look at. It's down 64% in about a quarter.

Check out our latest analysis for Farfetch

Farfetch isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

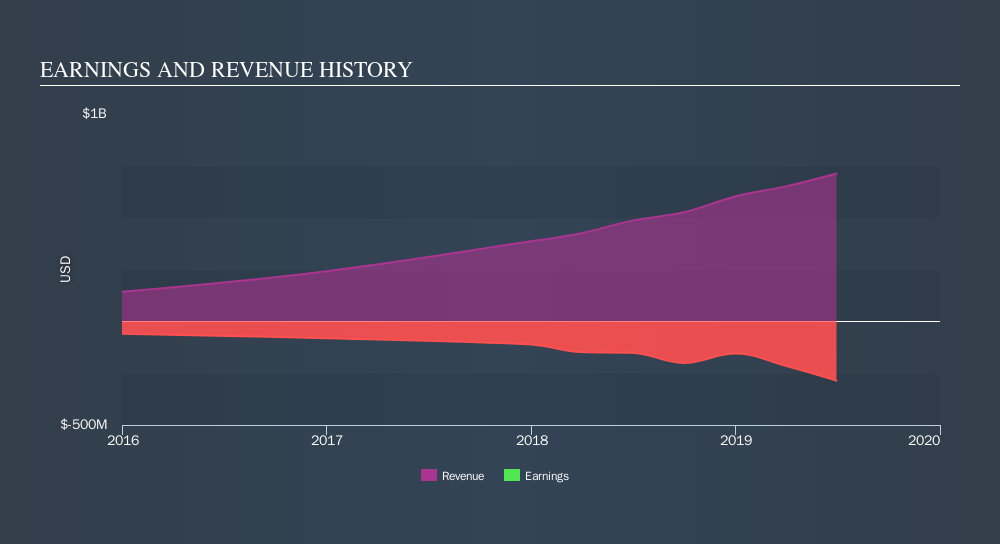

In the last year Farfetch saw its revenue grow by 47%. That's well above most other pre-profit companies. Meanwhile, the share price slid 60%. Typically a growth stock like this will be volatile, with some shareholders concerned about the red ink on the bottom line (that is, the losses). We'd definitely consider it a positive if the company is trending towards profitability. If you can see that happening, then perhaps consider adding this stock to your watchlist.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Farfetch is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Farfetch stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Given that the market gained 13% in the last year, Farfetch shareholders might be miffed that they lost 60%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Notably, the loss over the last year isn't as bad as the 64% drop in the last three months. So it seems like some holders have been dumping the stock of late - and that's not bullish. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OTCPK:FTCH.Q

Farfetch

Operates a platform for the luxury fashion industry in the United States, the United Kingdom, and internationally.

Low with weak fundamentals.

Similar Companies

Market Insights

Community Narratives