- United States

- /

- Specialty Stores

- /

- NYSE:FND

Why Floor & Decor Holdings (FND) Is Up 13.5% After Announcing New Stores Across Three States

Reviewed by Sasha Jovanovic

- In November 2025, Floor & Decor Holdings announced the opening of several new warehouse stores across Washington, South Carolina, and Idaho, each with dedicated leadership and teams in place to serve local markets.

- These expansions highlight Floor & Decor's ongoing commitment to professional customers, offering networking events and tailored services aimed at growing its share of the nationwide flooring and renovation market.

- We'll examine how this accelerated pace of store openings could influence Floor & Decor's investment narrative and long-term growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Floor & Decor Holdings Investment Narrative Recap

For those considering Floor & Decor Holdings, the central investment premise hinges on the company’s nationwide expansion strategy and ability to capture increasing renovation and flooring demand, especially as residential housing activity evolves. The recent wave of store openings across Washington, South Carolina, and Idaho adds scale but is not expected to change the immediate risk that aggressive expansion into subdued housing markets could pressure margins and returns if consumer demand remains slow.

The November 20, 2025 grand opening of the Mount Pleasant, SC location, with a full design center and robust team, is particularly relevant for those watching the pace and operational execution of Floor & Decor's expansion. This new store, like the others launched this month, is equipped to support local pros and highlights the company's ongoing efforts to strengthen its relationships with professional customers, one of the business’s key growth catalysts.

However, despite these openings, investors should also pay close attention to the potential downside of...

Read the full narrative on Floor & Decor Holdings (it's free!)

Floor & Decor Holdings' outlook anticipates $6.0 billion in revenue and $296.9 million in earnings by 2028. This is based on a 9.0% annual revenue growth rate and a $85.7 million increase in earnings from the current level of $211.2 million.

Uncover how Floor & Decor Holdings' forecasts yield a $78.91 fair value, a 22% upside to its current price.

Exploring Other Perspectives

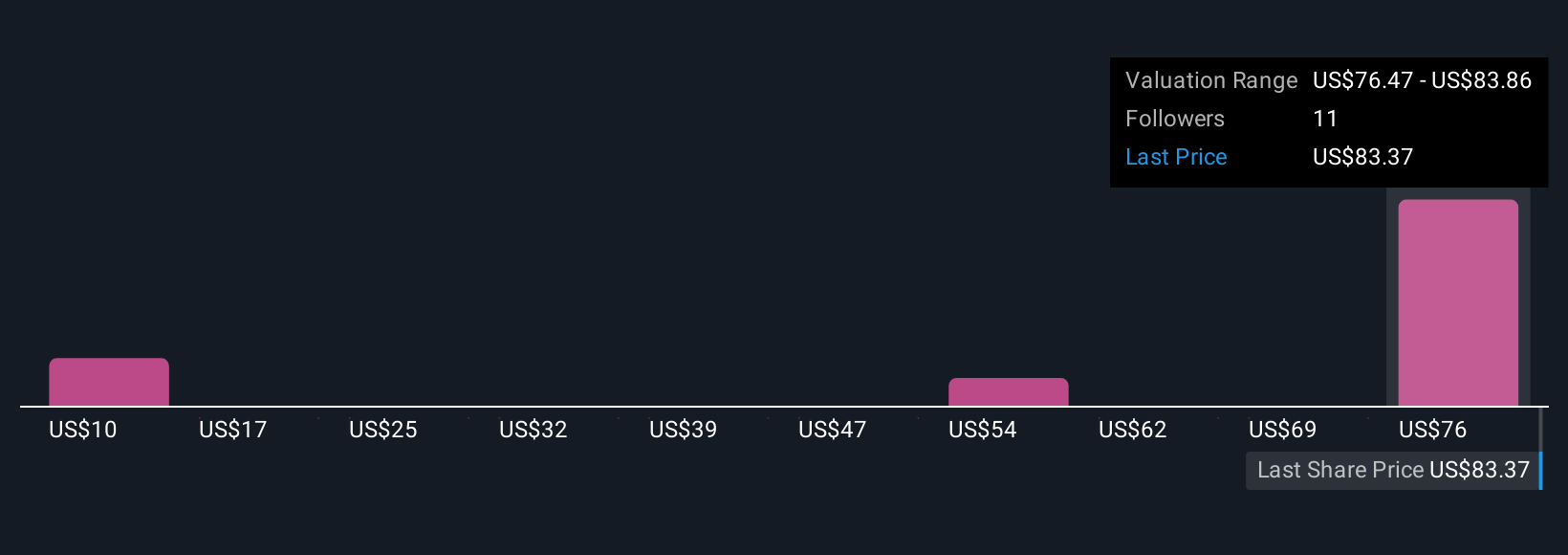

Five community fair value estimates for Floor & Decor range from US$24.72 to US$78.91 per share, underlining a wide spectrum of expectations. Amid this diversity, the risk of margin compression from rapid expansion is a factor you’ll want to weigh as you compare these viewpoints.

Explore 5 other fair value estimates on Floor & Decor Holdings - why the stock might be worth less than half the current price!

Build Your Own Floor & Decor Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Floor & Decor Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Floor & Decor Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Floor & Decor Holdings' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FND

Floor & Decor Holdings

Operates as a multi-channel specialty retailer of hard surface flooring and related accessories, and commercial surfaces seller in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success