- United States

- /

- Specialty Stores

- /

- NYSE:FND

Valuation Check: Floor & Decor (FND) Expands With New Cortlandt Manor Warehouse Store Opening

Reviewed by Simply Wall St

Floor & Decor Holdings (FND) has marked its continued expansion by opening a new warehouse store and design center in Cortlandt Manor, New York. This move highlights the company’s strategy to grow its footprint and reach new customers.

See our latest analysis for Floor & Decor Holdings.

Despite the buzz around Floor & Decor’s latest store opening, momentum has been distinctly negative, with a sharp 30-day share price return of -15.3% and a total shareholder return over the past year of -41.7%. Investors appear to remain cautious, even as the business continues to expand its footprint and invest in new markets.

If this kind of retail expansion has you curious about what else is gaining attention, now is the perfect opportunity to broaden your perspective and explore fast growing stocks with high insider ownership

Given the significant expansion and strong revenue growth, yet persistent share price weakness and a meaningful discount to analyst targets, investors are left to consider whether this is a true buying opportunity or if the market is already accounting for future growth.

Most Popular Narrative: 23.9% Undervalued

With a narrative fair value of $78.91 well above the last close of $60.02, there is a notable gap between what analysts expect and where the shares sit now. This spread highlights a market disconnect and sets the stage for a closer look at the underlying drivers of value.

Floor & Decor's ongoing aggressive store expansion strategy, opening 20 new warehouse-format stores this year and at least 20 planned for next year, with the infrastructure to accelerate openings further as housing market conditions improve, positions the company to capture outsized revenue growth and future operating leverage as end-market demand returns.

Curious what growth assumptions could justify this valuation gap? The narrative hinges on bold revenue, margin, and profit forecasts. Discover what could send these shares surging if the strategy works as planned.

Result: Fair Value of $78.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged weakness in housing turnover and rising competition from lower-priced rivals could limit sales momentum and challenge optimistic recovery assumptions.

Find out about the key risks to this Floor & Decor Holdings narrative.

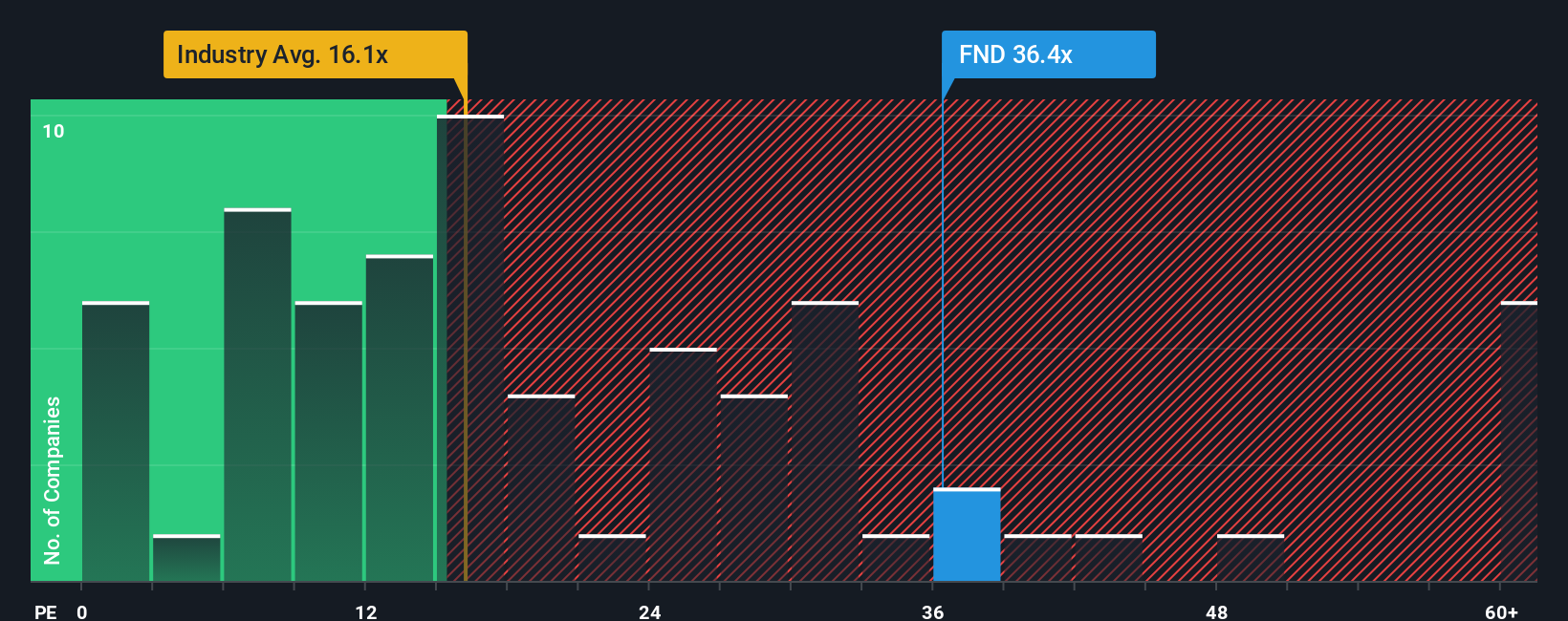

Another View: Multiples Show a Caution Flag

Looking at valuation through the lens of the price-to-earnings ratio, Floor & Decor trades at a steep 29.8x, which is far higher than both the US Specialty Retail industry’s average of 17.6x and the peer average of 12.6x. Even when compared to a fair ratio of 17.5x, the premium is significant. This suggests that the stock carries more valuation risk than upside unless growth far exceeds expectations. Does the current multiple reflect optimism, or is the market already pricing in the best-case scenario?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Floor & Decor Holdings Narrative

If you think the story could play out differently or want to dig deeper into the numbers, you can quickly build your own perspective using our tools: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Floor & Decor Holdings.

Looking for More Unique Investment Ideas?

Don’t wait and let opportunities slip past you. Tap into innovative investment trends with ease using the Simply Wall Street Screener. You’ll find potential you might have missed elsewhere.

- Target stable income in your portfolio by checking out these 16 dividend stocks with yields > 3% with yields over 3% and a history of rewarding investors.

- Unearth digital transformation leaders by scanning these 25 AI penny stocks using groundbreaking artificial intelligence to revolutionize their industries.

- Capitalize on undervalued opportunities by browsing these 879 undervalued stocks based on cash flows that are trading below their intrinsic value based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FND

Floor & Decor Holdings

Operates as a multi-channel specialty retailer of hard surface flooring and related accessories, and commercial surfaces seller in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives