Etsy (ETSY): Reassessing Valuation Following Recent 25% Share Price Climb

Reviewed by Simply Wall St

Etsy (ETSY) stock has caught the attention of investors following a steady climb over the past few months. With shares rising about 25% in the past 3 months, many are re-examining the company’s performance and potential from this point forward.

See our latest analysis for Etsy.

Looking beyond the recent rally, Etsy's one-year total shareholder return now sits just shy of 55%. This is a sharp contrast to its longer-term record, which remains in the red over both three and five years. After a tough stretch, momentum is clearly building once again as investor sentiment shifts on renewed growth prospects and lighter risk concerns.

If you want to see what other stocks are gaining strong momentum in today's market, it's a great moment to broaden your search and discover fast growing stocks with high insider ownership

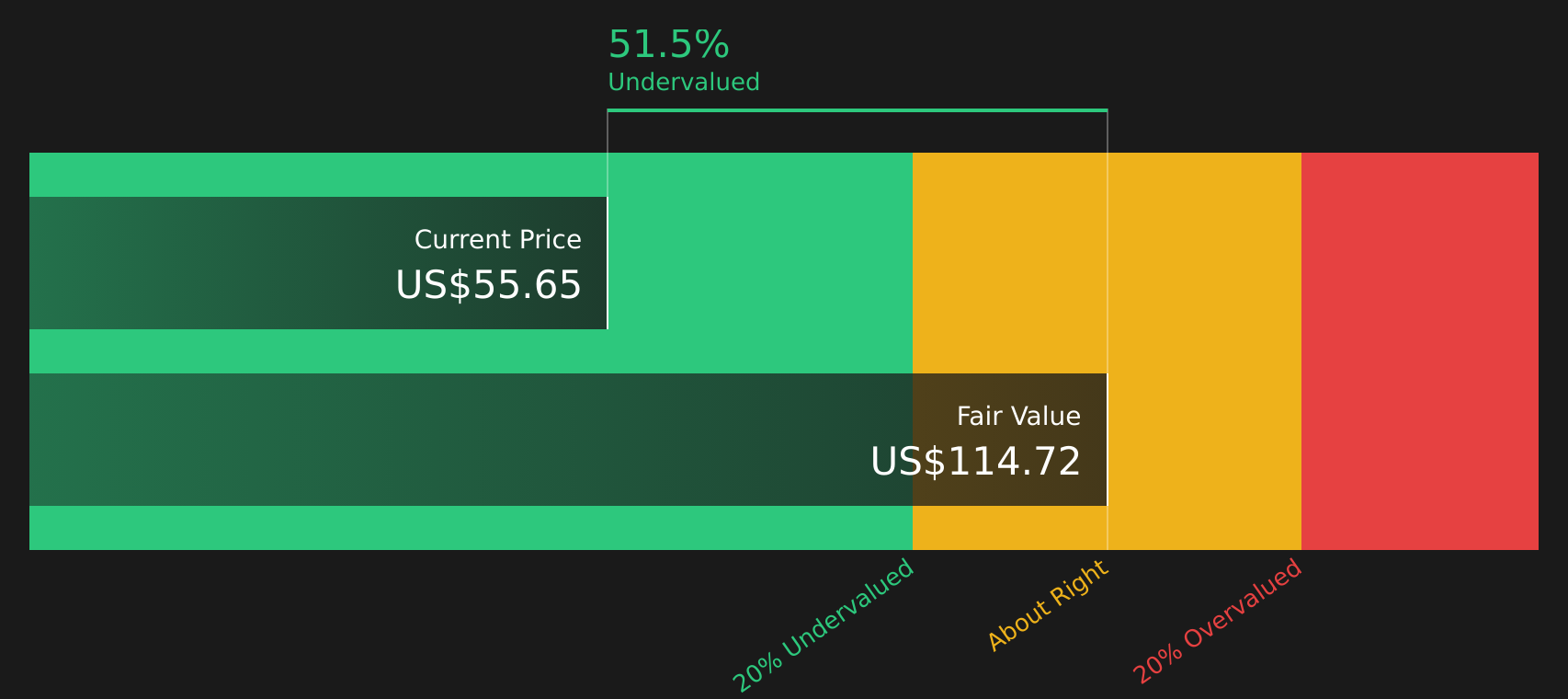

But after this impressive rebound, investors are left wondering whether Etsy's recent surge is a sign that the stock remains undervalued or if the market is already pricing in expectations for future growth and leaving little room for upside.

Most Popular Narrative: 11% Overvalued

The most widely followed narrative suggests Etsy's fair value sits well below its recent closing price of $75.56, pointing to fading upside even after a strong rally. With the discount rate at 9.3%, the issue is whether incremental growth drivers are enough to defend the current valuation premium.

Expansion of direct marketing and app-based engagement, with the Etsy app now accounting for nearly 45% of total GMS and providing a higher customer LTV, is an operational pivot expected to increase buyer retention, loyalty, and overall platform stickiness. These factors are viewed as fueling longer-term revenue and margin expansion.

Curious what key financial levers drive the loftier valuation? The narrative focuses on shifts in engagement and profitability, but there is a catch most investors do not see. Shifting buyer habits, future margin moves, and bold assumptions keep the value debate unresolved. Ready for the details that frame this upside case?

Result: Fair Value of $68.19 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in active buyers or rising customer acquisition costs could quickly challenge the upbeat valuation narrative and stall Etsy's growth momentum.

Find out about the key risks to this Etsy narrative.

Another View: DCF Points to Significant Undervaluation

While analysts see Etsy as overvalued relative to their price targets, our SWS DCF model suggests a different story. The model estimates Etsy’s fair value at $122.24 per share, which is much higher than the latest market price. Could the market be overlooking deeper value drivers embedded in future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Etsy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Etsy Narrative

If you are inclined to dig deeper and reach your own conclusions, it only takes a few minutes to put together your personal take on Etsy’s outlook. Do it your way

A great starting point for your Etsy research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step confidently into your next opportunity and access stocks with big upside potential, breakthrough trends, or resilient dividend power, all just a click away on Simply Wall Street.

- Gain early-mover advantage and spot overlooked potential by reviewing these 3566 penny stocks with strong financials before the next surge leaves you behind.

- Enhance your portfolio’s innovation edge with these 27 AI penny stocks that are shaping tomorrow’s world with artificial intelligence.

- Increase your income focus by targeting reliable returns from these 19 dividend stocks with yields > 3% offering robust yields and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Etsy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETSY

Etsy

Operates two-sided online marketplaces that connect buyers and sellers worldwide.

Moderate risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives