- United States

- /

- Specialty Stores

- /

- NYSE:DKS

How Analyst Upgrades and Earnings Anticipation at DICK'S Sporting Goods (DKS) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In recent days, analyst sentiment toward DICK'S Sporting Goods improved, with several upward earnings estimate revisions and anticipation building around its upcoming earnings report.

- This analyst optimism has coincided with increased attention to the stock, reflecting expectations for strong performance in the retail sector.

- We'll examine how this wave of analyst upgrades and earnings anticipation shapes the broader investment narrative for DICK'S Sporting Goods.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

DICK'S Sporting Goods Investment Narrative Recap

To own shares of DICK’S Sporting Goods, you need to believe in Americans’ ongoing enthusiasm for sports and an active lifestyle, as well as the retailer’s ability to expand both in stores and online. The recent surge in analyst optimism, combined with heightened attention to upcoming earnings, further highlights near-term expectations, but does not fundamentally change the major short-term catalyst, which is successful integration of Foot Locker, nor does it reduce the risk surrounding real estate expansion and in-store traffic trends.

Among recent announcements, the company’s raised 2025 earnings guidance stands out, with DICK’S forecasting comparable sales growth between 2.0% and 3.5% and full-year diluted EPS of US$13.90 to US$14.50. This raises the stakes for the next earnings report as investors focus on execution against these higher targets alongside the pending Foot Locker deal.

Yet, in contrast to the market’s optimism, investors should be aware of the risk that heightened capital investments and exposure to physical retail could become a headwind if consumer behavior...

Read the full narrative on DICK'S Sporting Goods (it's free!)

DICK'S Sporting Goods' outlook anticipates $15.0 billion in revenue and $1.3 billion in earnings by 2028. This is based on an annual revenue growth rate of 2.9% and a $0.1 billion increase in earnings from the current $1.2 billion.

Uncover how DICK'S Sporting Goods' forecasts yield a $240.33 fair value, a 6% upside to its current price.

Exploring Other Perspectives

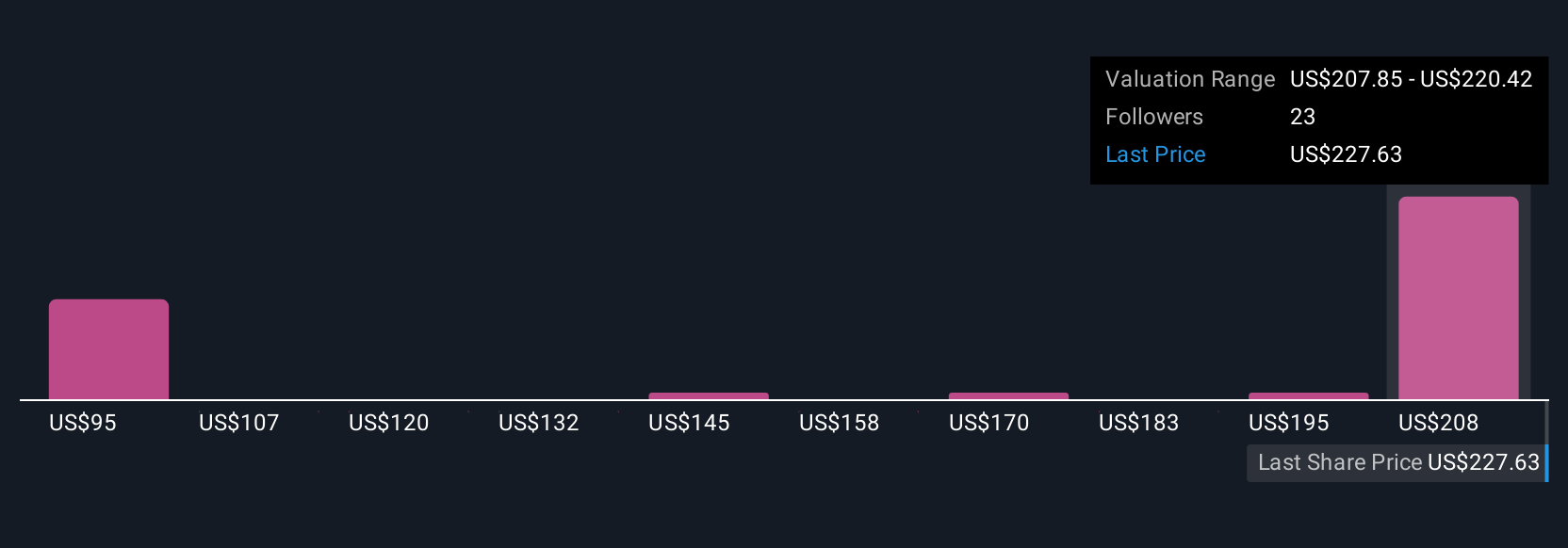

Seven different fair value estimates from the Simply Wall St Community range from US$153.36 to US$550.20 per share. While many see growth catalysts, concerns about execution risks tied to the Foot Locker acquisition also weigh on wider sentiment, reflecting just how much opinions on DICK’S future can differ.

Explore 7 other fair value estimates on DICK'S Sporting Goods - why the stock might be worth over 2x more than the current price!

Build Your Own DICK'S Sporting Goods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DICK'S Sporting Goods research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DICK'S Sporting Goods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DICK'S Sporting Goods' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DKS

DICK'S Sporting Goods

Operates as an omni-channel sporting goods retailer primarily in the United States.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives