- United States

- /

- Specialty Stores

- /

- NYSE:DKS

DICK'S Sporting Goods (DKS): Evaluating Valuation After 5% Comp Store Sales Growth and Omnichannel Expansion

Reviewed by Kshitija Bhandaru

DICK'S Sporting Goods (DKS) just delivered a second quarter update that likely turned some heads. The company reported a 5% increase in comparable store sales year over year, with management attributing this growth to strong customer engagement and shoppers spending more each visit. What stands out is how DICK'S has leaned into its omnichannel strategy, ramping up e-commerce and investing in eye-catching retail formats such as House of Sport and Field House locations. This combination of online expansion and strategic physical footprint is now showing up in real numbers, and investors are paying attention.

If you zoom out, DICK'S Sporting Goods’ stock has experienced subtle ups and downs, ending the past year with a 5% gain. Over the past three months, however, momentum has gained serious traction with a 25% rally, even as shorter-term movements have seen minor pullbacks. These market moves have unfolded while management highlights solid progress in product segments from footwear to golf, higher customer engagement across channels, and continued market share gains, keeping optimism alive as DICK'S intensifies its growth initiatives.

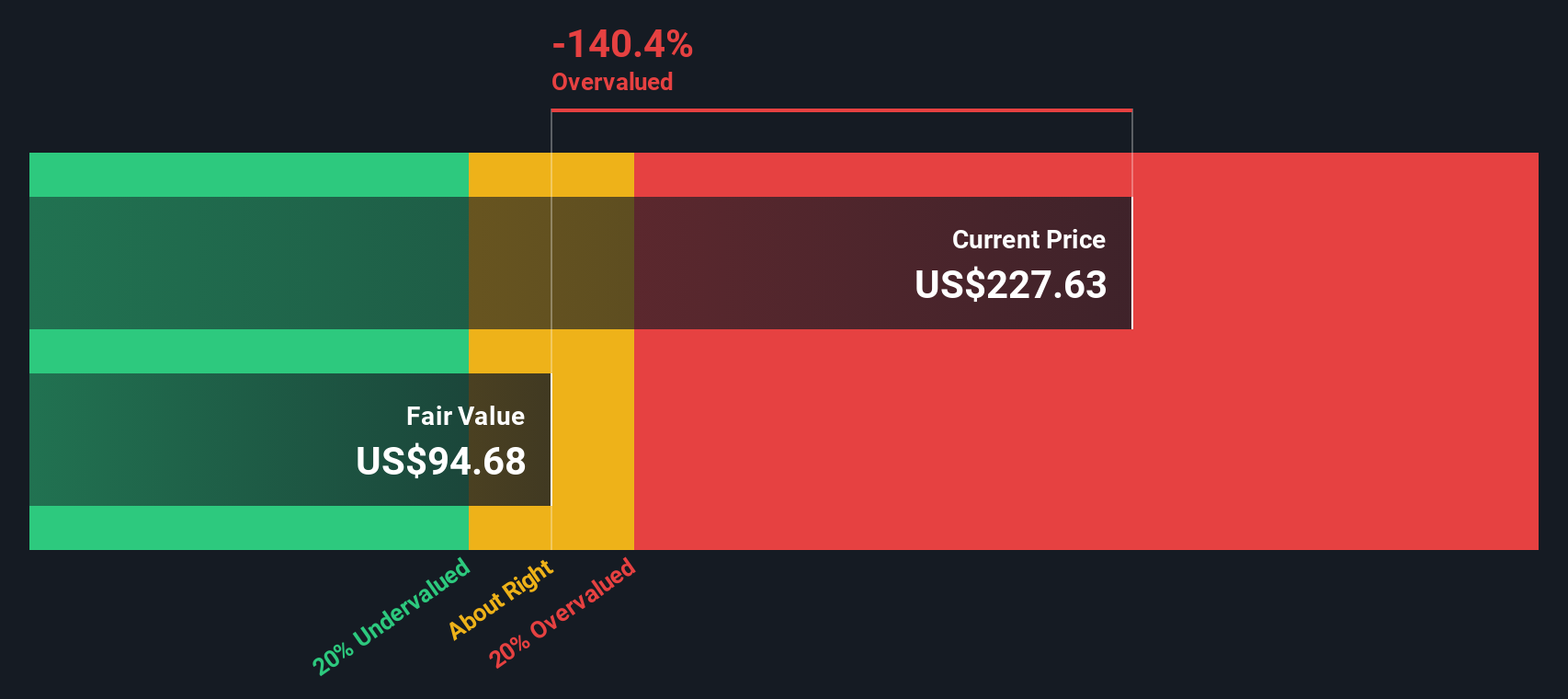

With all this fueling both the business and the stock, the key question is whether DICK'S Sporting Goods is now trading at a discount or if investors have already accounted for its potential for future growth.

Most Popular Narrative: 7.6% Undervalued

According to the most widely followed narrative, DICK'S Sporting Goods is currently undervalued by 7.6% based on future projected growth and anticipated synergies from the Foot Locker acquisition.

"Strategic investments in omnichannel capabilities, including House of Sport and Field House experiential stores, a robust e-commerce/app platform, and advanced athlete data, are boosting both online and in-store engagement. These initiatives are positioning DICK'S to increase revenue per customer and support higher average transaction values over the long term."

Want to know what is powering this bullish outlook? The narrative is built on a blend of rising sales, profitability enhancements, and a bold new acquisition. Curious which numbers are moving the needle for this fair value? Unpack the underlying assumptions and find out what could surprise the market next.

Result: Fair Value of $240.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, integration risks from the Foot Locker acquisition and increased exposure to footwear could impact DICK'S profitability if execution falters or if consumer trends shift.

Find out about the key risks to this DICK'S Sporting Goods narrative.Another View: Discounted Cash Flow Perspective

Taking a different angle, our SWS DCF model also suggests DICK'S Sporting Goods is undervalued, but by a much wider margin than the analyst consensus. Could the cash flow outlook be too bullish? Alternatively, do the numbers reveal hidden upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own DICK'S Sporting Goods Narrative

If you see things differently or want to dive into the data yourself, you can easily craft your own view in just a few minutes. Do it your way Do it your way.

A great starting point for your DICK'S Sporting Goods research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Set your sights beyond a single stock and tap into emerging investment themes with the Simply Wall Street Screener. Unique opportunities are waiting, and acting now means you stay ahead while others catch up.

- Tap into steady income streams by seeking out top picks among dividend stocks with yields > 3% for yields above 3% and reliable cash flows.

- Accelerate your portfolio’s tech edge by targeting the future of automation and innovation with leading AI penny stocks.

- Find stocks trading below their intrinsic worth by uncovering fresh value opportunities with our handpicked selection of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DKS

DICK'S Sporting Goods

Operates as an omni-channel sporting goods retailer primarily in the United States.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives