- United States

- /

- Specialty Stores

- /

- NYSE:CWH

Camping World (CWH): Deep Discount to Fair Value Reinforces Bullish Narrative Despite Worsening Losses

Reviewed by Simply Wall St

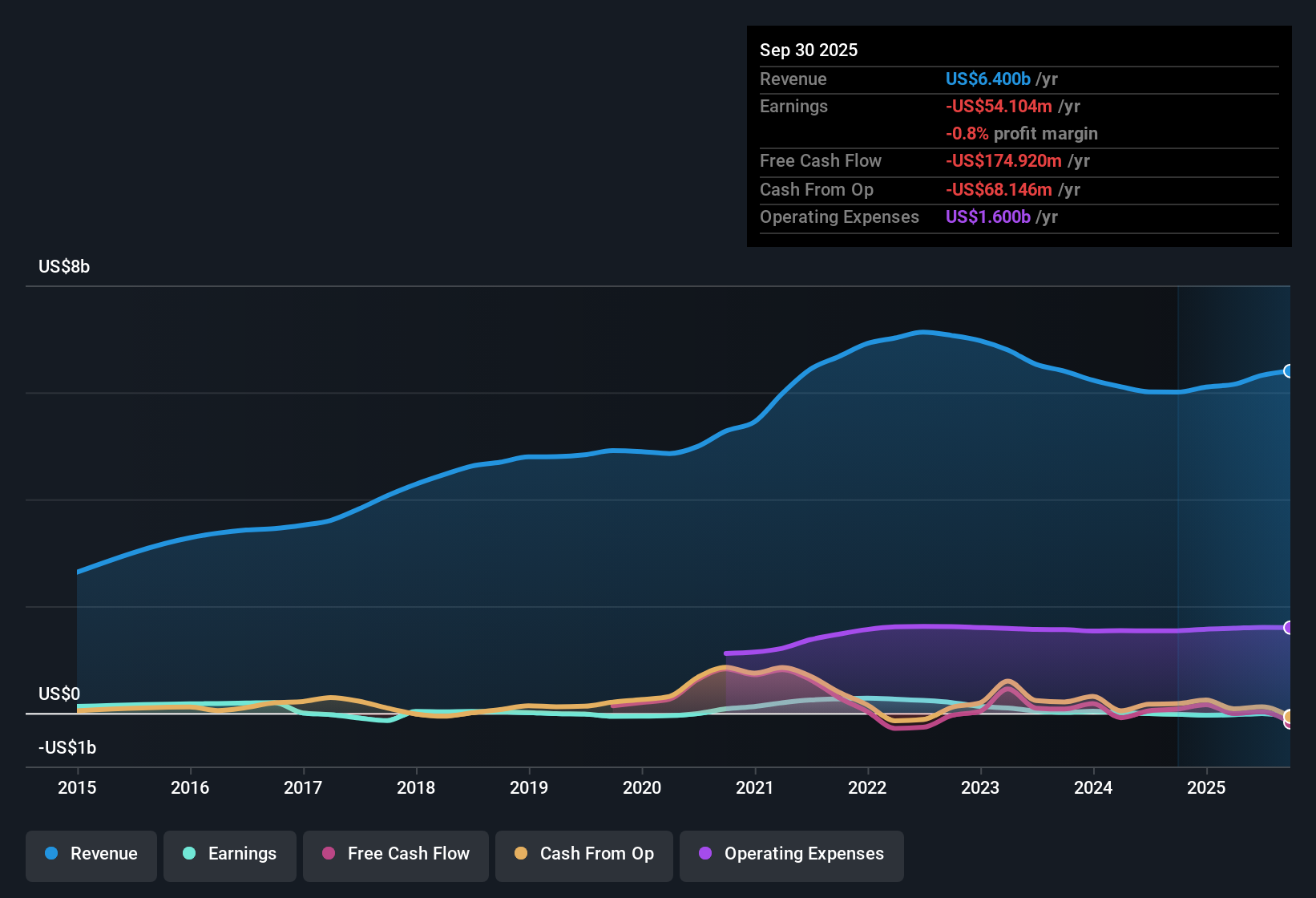

Camping World Holdings (CWH) remains unprofitable, with losses compounding at a rapid 53.3% per year over the last five years. Looking ahead, analysts see a sharp turnaround, forecasting earnings to grow at an exceptional 187.51% annually and shifting the company into profitability within three years. This is happening even as revenue growth of 5.7% per year trails the wider US market's 10.2% pace. The stock is currently trading at $12.65, well beneath its estimated fair value of $28.50, and features a Price-To-Sales Ratio of just 0.1x, highlighting a potentially attractive valuation for investors willing to weigh the short-term risks against robust profit growth estimates and apparent discount pricing.

See our full analysis for Camping World Holdings.Now that we have the key numbers on the table, let's see how these results compare to the prevailing market narratives and whether any expectations might need adjusting.

See what the community is saying about Camping World Holdings

Margins Set to Climb from -0.1% to 5.5%

- Analysts expect profit margins to expand from the current -0.1% to 5.5% over the next three years, reflecting optimism for a swift turnaround in operational efficiency and profitability that exceeds typical industry recovery timelines.

- According to the analysts' consensus view, operational improvements and targeted digital investments are cited as key drivers. These factors support the expectation of higher margins and stable demand.

- Increased store productivity from cost reductions and consolidation is anticipated to unlock operating leverage even while industry trends remain pressured.

- Stable demand from long-term demographic shifts, such as a growing population of outdoor-oriented retirees, is expected to underpin durable store traffic and recurring revenue streams.

- To see how margin recovery shapes the broader company outlook, dive into the full consensus narrative for Camping World Holdings. 📊 Read the full Camping World Holdings Consensus Narrative.

Peer-Relative Valuation: 0.1x P/S Versus 0.5x Industry

- Camping World trades at a Price-To-Sales Ratio of just 0.1x, dramatically below both the US Specialty Retail industry average of 0.5x and its peer average of 0.6x. This raises the prospect of a valuation discount for new investors.

- Consensus narrative highlights how this discount may attract buyers who believe in Camping World’s turnaround, while also acknowledging that ongoing unprofitability and slower revenue growth versus industry averages remain key hurdles.

- The current share price of $12.65 sits well below the DCF fair value of $28.50, suggesting clear upside if management executes and margin expansion is realized.

- However, weak financial position and unsustainable dividends caution against overestimating the relevance of the valuation gap without considering near-term risks.

Analysts Forecast 7% Share Dilution Annually

- The number of shares outstanding is projected to grow by 7.0% annually over the next three years, which could offset some per-share earnings growth for existing shareholders.

- Consensus narrative maintains that, despite dilution, the combination of strong earnings forecasts and recurring customer revenue should provide a path to sustainable growth if operational risks and inventory management are kept in check.

- Forecasted earnings of $392.7 million by 2028 (up from negative territory) anchor the bullish part of the consensus outlook, yet much depends on execution rather than purely on share count or revenue targets.

- Inventory risk, particularly around higher levels of used RV stock, is cited as a variable that could hinder the upside narrative if not managed prudently.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Camping World Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the data? Bring your insights to life and shape your own view in just a few minutes. Do it your way

A great starting point for your Camping World Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

While Camping World Holdings appears undervalued, its weak financial position, recurring losses, and risk of dilution pose significant threats to a sustained turnaround.

If you want companies with less debt and stronger financial footing, our solid balance sheet and fundamentals stocks screener (1981 results) helps you quickly spot businesses built for resilience and long-term stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWH

Camping World Holdings

Together its subsidiaries, retails recreational vehicles (RVs), and related products and services in the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives