- United States

- /

- Specialty Stores

- /

- NYSE:CVNA

Should Carvana's (CVNA) Strong Q3 and Stanford Deal Offset Near-Term Growth Concerns?

Reviewed by Sasha Jovanovic

- Carvana reported strong third-quarter 2025 results with sales reaching US$474 million and revenue at US$5.65 billion, while also announcing a multi-year partnership with Stanford Athletics to enhance campus engagement as the official auto retailer.

- While the company delivered record quarterly earnings, management's forecast of a potential sequential decline in fourth-quarter retail unit sales raised questions about near-term growth momentum despite longer-term industry tailwinds.

- We'll explore how Carvana’s conservative fourth-quarter outlook, despite its Stanford Athletics partnership, might influence its future investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Carvana Investment Narrative Recap

To own Carvana stock, you'd likely need to believe in the sustained shift toward online vehicle retailing and Carvana's ability to maintain operational efficiency as it scales. While the new Stanford Athletics partnership could boost brand recognition, management's warning of a possible sequential decline in fourth-quarter retail unit sales remains the most important short-term catalyst, and the biggest near-term risk, overshadowing the partnership's effect on immediate performance.

Among Carvana's recent expansions, the launch of same-day delivery in major metropolitan areas stands out due to its direct impact on customer experience and sales volume potential. This operational enhancement aligns with the core catalysts of scaling logistics and infrastructure, which are central to addressing near-term growth bottlenecks and supporting Carvana's ambitious unit growth targets.

Yet, despite these growth initiatives, investors should especially watch for signs that reconditioning and logistics capacity are ...

Read the full narrative on Carvana (it's free!)

Carvana's outlook suggests revenues will reach $33.2 billion and earnings will rise to $2.2 billion by 2028. This is based on an annual revenue growth rate of 26.8% and an increase in earnings of $1.6 billion from the current $563.0 million.

Uncover how Carvana's forecasts yield a $423.90 fair value, a 39% upside to its current price.

Exploring Other Perspectives

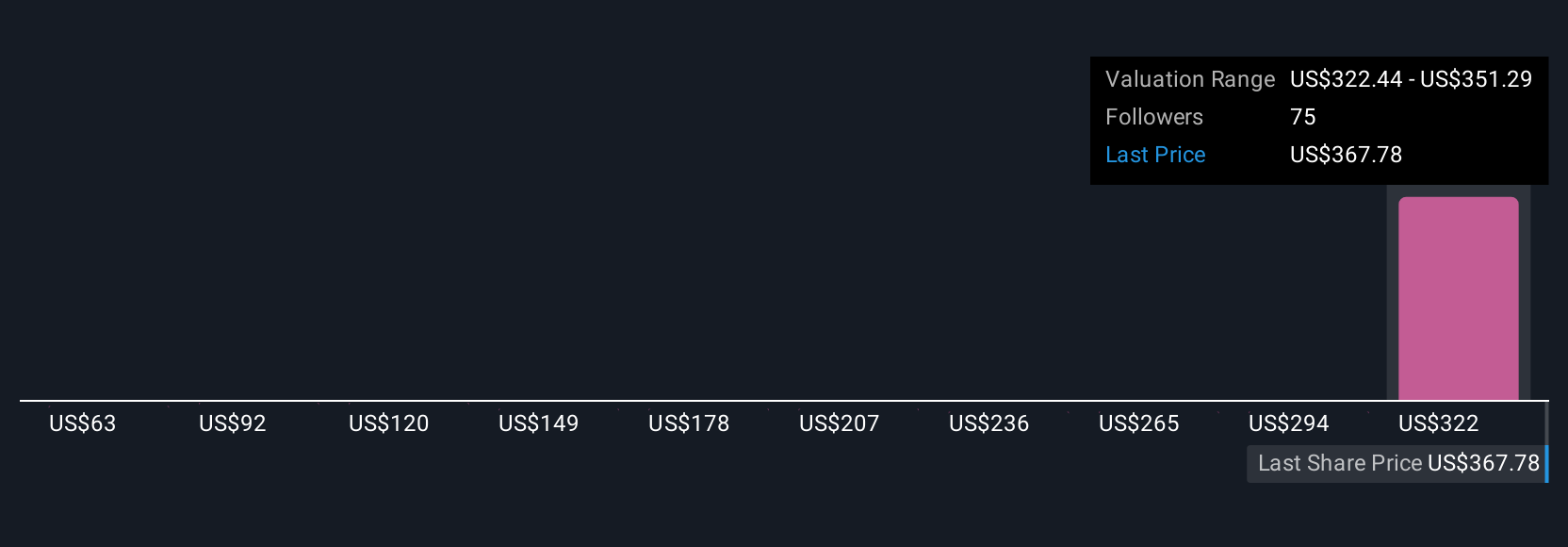

Seventeen individual fair value estimates from the Simply Wall St Community fall between US$62.76 and US$500 per share. While you might see broad disagreement among community members, keep in mind that operational growing pains such as cost overruns and margin pressure could weigh on performance, making it wise to examine multiple viewpoints.

Explore 17 other fair value estimates on Carvana - why the stock might be worth less than half the current price!

Build Your Own Carvana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carvana research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Carvana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carvana's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVNA

Carvana

Operates an e-commerce platform for buying and selling used cars in the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives