- United States

- /

- Specialty Stores

- /

- NYSE:CURV

Optimistic Investors Push Torrid Holdings Inc. (NYSE:CURV) Shares Up 36% But Growth Is Lacking

Those holding Torrid Holdings Inc. (NYSE:CURV) shares would be relieved that the share price has rebounded 36% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Taking a wider view, although not as strong as the last month, the full year gain of 22% is also fairly reasonable.

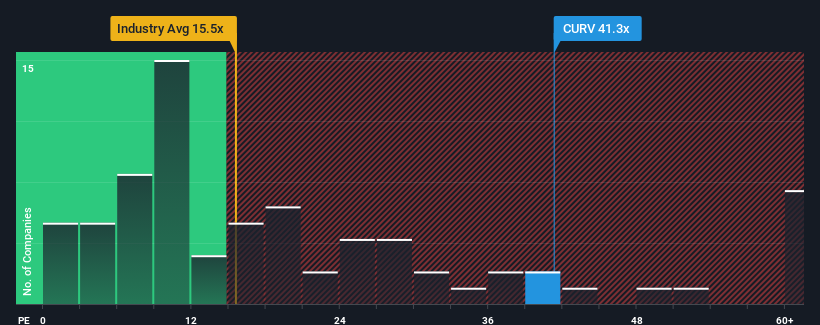

Following the firm bounce in price, Torrid Holdings may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 41.3x, since almost half of all companies in the United States have P/E ratios under 17x and even P/E's lower than 10x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

We've discovered 3 warning signs about Torrid Holdings. View them for free.Recent times have been advantageous for Torrid Holdings as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Torrid Holdings

Is There Enough Growth For Torrid Holdings?

In order to justify its P/E ratio, Torrid Holdings would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 40% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 3.9% as estimated by the six analysts watching the company. With the market predicted to deliver 13% growth , that's a disappointing outcome.

With this information, we find it concerning that Torrid Holdings is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh heavily on the share price eventually.

The Final Word

Shares in Torrid Holdings have built up some good momentum lately, which has really inflated its P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Torrid Holdings currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Torrid Holdings (at least 2 which are concerning), and understanding these should be part of your investment process.

If you're unsure about the strength of Torrid Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Torrid Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CURV

Torrid Holdings

Provides apparel, intimates, and accessories for curvy women in North America.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026