Coupang (NYSE:CPNG) Valuation in Focus Following Strong Q3 Results and Upbeat Margin Improvements

Reviewed by Simply Wall St

Coupang (NYSE:CPNG) just reported its third-quarter earnings, topping forecasts on both revenue and net income. Year-over-year growth remained solid, and profit margins showed improvement in the company’s main business.

See our latest analysis for Coupang.

Despite a recent dip following third-quarter earnings, Coupang’s 2025 story remains compelling. After a strong first nine months, highlighted by revenue and earnings beats, a share buyback, and the Farfetch acquisition, the 30.1% year-to-date share price return shows momentum is still in play, even as near-term volatility reflects shifting growth expectations and somewhat elevated valuation. Overall, the three-year total shareholder return of 45.2% underlines the long-term appeal for investors, though short-term sentiment has become more cautious on slowing customer growth and margin pressures.

If strong earnings and ambitious global moves inspire your next stock idea, it’s a great moment to broaden your search and uncover fast growing stocks with high insider ownership

With shares still sitting nearly 23% below analysts’ target price and Coupang trading at a 36% discount to some intrinsic value estimates, the question is whether this creates a genuine buying opportunity or if the market is already factoring in all future growth.

Most Popular Narrative: 18.9% Undervalued

Coupang’s current share price of $29 sits noticeably below the most-followed fair value estimate of $35.75. This sizable gap underscores the market’s skepticism, even as the prevailing narrative outlines an ambitious path for future growth and profitability.

Ongoing investments in automation, AI, and logistics technology are already driving major improvements in operational efficiency and gross margins. Management sees significant further upside as these technologies are scaled. Over time, this is likely to result in continued margin expansion and growth in earnings.

Want to know the real story powering these lofty valuations? Insiders believe Coupang is poised for dramatic gains if certain key drivers play out. The profit assumptions underpinning this fair value are bigger than many expect. Curious what future milestones the narrative counts on? Read on for the full framework behind the optimism.

Result: Fair Value of $35.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent scaling inefficiencies in new markets or elevated operating expenses could hinder Coupang’s growth trajectory and pose challenges to the optimistic outlook.

Find out about the key risks to this Coupang narrative.

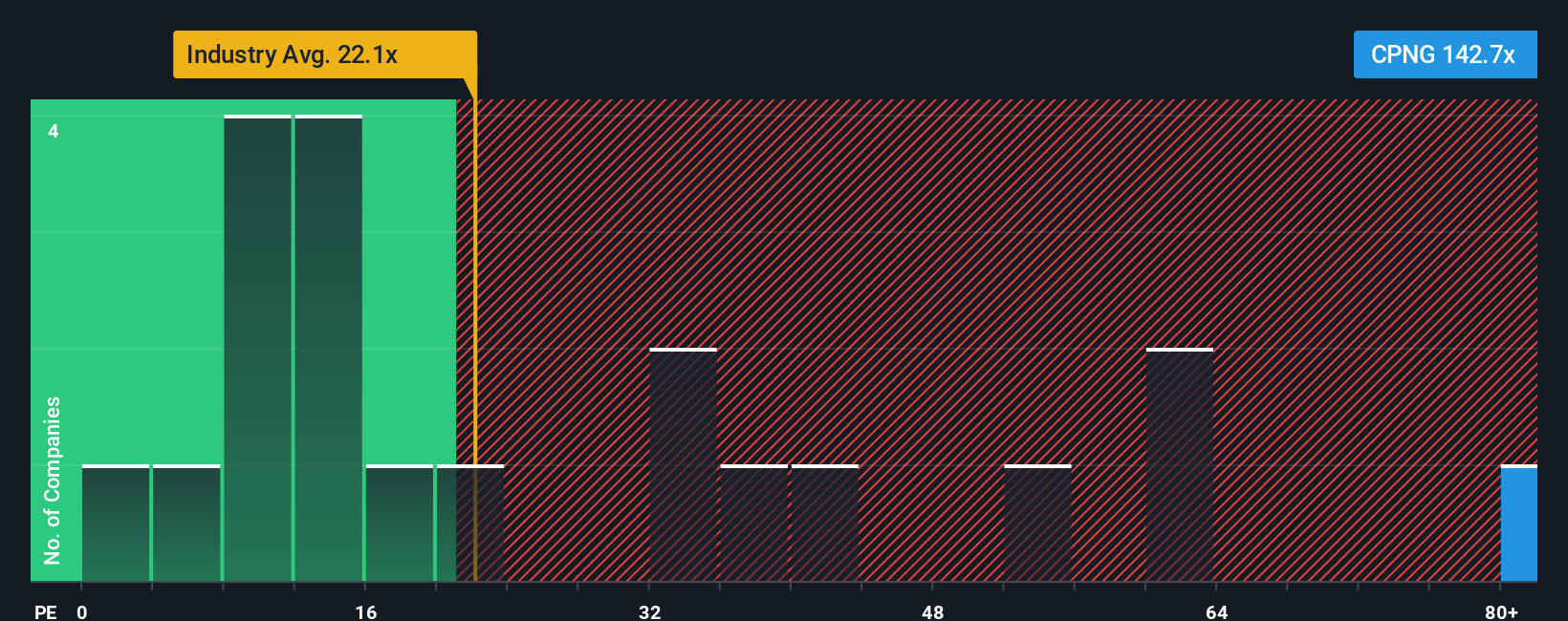

Another View: A Look Through Multiples

While many investors focus on future earnings to estimate Coupang’s potential, traditional valuation ratios paint a much less rosy picture. Coupang’s current price-to-earnings ratio is 135.8 times earnings, which is significantly higher than the industry average of 19.9 and its peer group’s 38.3. Even compared to its fair ratio of 38.5, Coupang looks expensive. That is a big gap and could mean more valuation risk than opportunity. For now, is the market simply pricing in too much optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coupang Narrative

If you have a different perspective or enjoy digging into the numbers on your own, crafting your own narrative takes just a few minutes. Do it your way

A great starting point for your Coupang research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your portfolio by seeking out unique opportunities many investors overlook. Check out these handpicked lists that could help you spot your next outlier:

- Capture upside by targeting these 861 undervalued stocks based on cash flows before the market recognises their true potential.

- Unlock growth in emerging medical innovation with these 32 healthcare AI stocks, which is shaping the future of healthcare technology.

- Boost your income strategy by investigating these 17 dividend stocks with yields > 3%, offering robust yields and steady performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPNG

Coupang

Owns and operates retail business through its mobile applications and internet websites in South Korea and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives