- United States

- /

- Specialty Stores

- /

- NYSE:CHWY

Should Chewy's (CHWY) Chewy+ Price Hike Shift Investor Views on Its Recurring Revenue Strategy?

Reviewed by Sasha Jovanovic

- Chewy has raised its Chewy+ membership fee from US$49 to US$79, reflecting management’s confidence in the premium program’s value proposition and positioning for increased revenue potential.

- This move, paired with sustained positive analyst sentiment, highlights the company’s emphasis on recurring revenue streams and its continued momentum with both investors and customers.

- We'll examine how Chewy's increase in Chewy+ membership fee could influence the company’s growth outlook and investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Chewy Investment Narrative Recap

To be a Chewy shareholder, you have to believe in the company's ability to turn a loyal customer base and recurring revenue model into long-term, profitable growth. The recent increase in Chewy+ membership fees has the potential to strengthen recurring revenue, a key short-term catalyst, yet it does not materially resolve the biggest risk: that modest customer acquisition continues to lag, limiting top-line expansion. While pricing power is a positive sign, sustainable growth depends equally on growing the customer base.

Among Chewy’s recent announcements, the upward revision of full-year 2025 net sales guidance, now projected at US$12.5 to US$12.6 billion, stands out. This more optimistic view on sales closely relates to the positive signals around membership pricing but still rests on delivering active customer growth to support top-line momentum.

But while recurring revenue looks more secure, investors should be aware that stagnation in new customer acquisition means...

Read the full narrative on Chewy (it's free!)

Chewy’s narrative projects $15.1 billion revenue and $467.3 million earnings by 2028. This requires 7.7% yearly revenue growth and a $79.1 million earnings increase from current earnings of $388.2 million.

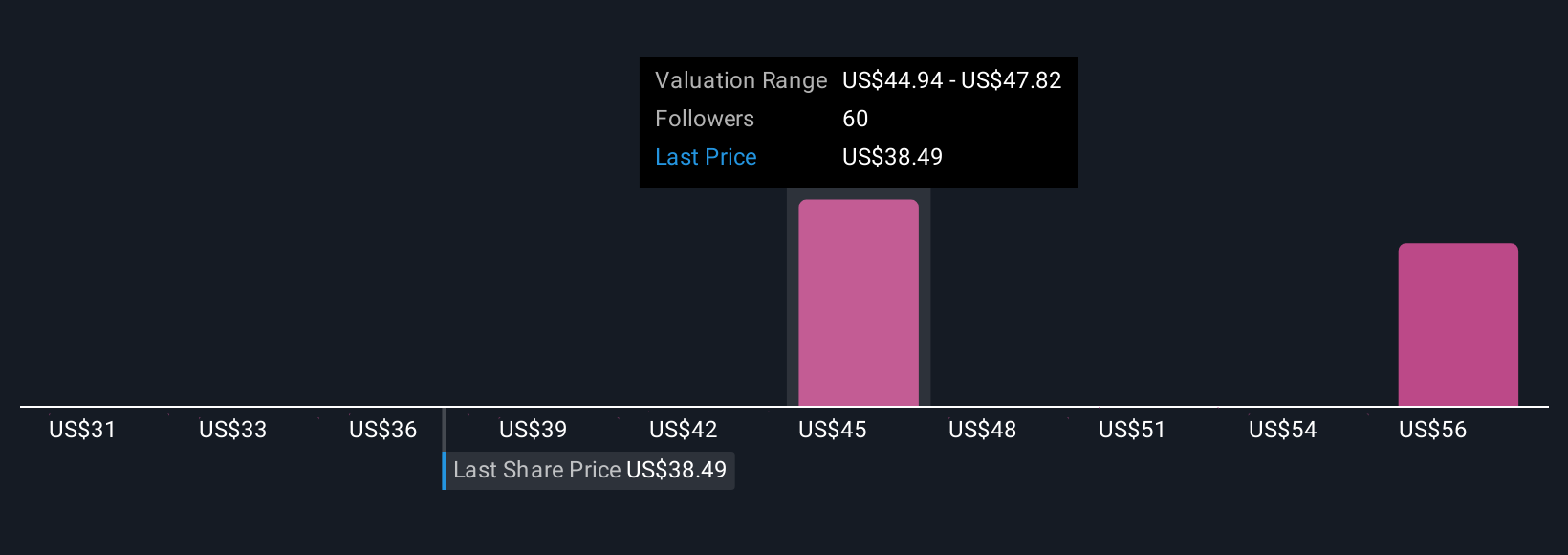

Uncover how Chewy's forecasts yield a $45.45 fair value, a 35% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community range widely from US$43.07 to US$60.41 per share. With customer acquisition growth still modest, you can see why some investors see more risks ahead, tap into these different perspectives to decide what rings true for you.

Explore 8 other fair value estimates on Chewy - why the stock might be worth just $43.07!

Build Your Own Chewy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chewy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Chewy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chewy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHWY

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives