- United States

- /

- Specialty Stores

- /

- NYSE:CHWY

Chewy (CHWY): Exploring Whether Shares Are Undervalued After Recent Volatility

Reviewed by Simply Wall St

Chewy (CHWY) shares have been moving against the broader retail sector’s trend lately. This has prompted investors to re-examine what could be next for the company. Recent trading sessions have seen swings that call for a closer look at Chewy’s business outlook.

See our latest analysis for Chewy.

Chewy’s share price has been on a choppy ride this year, most recently closing at $33.54, with a 7-day decline of 2.8 percent and a 90-day drop of 17 percent. Despite some positive trading days, momentum has generally been fading, as reflected in its 1-year total shareholder return of -1.5 percent and a disappointing total return of -55 percent over five years.

If you’re curious about which other companies are catching investors' attention, why not broaden your search and discover fast growing stocks with high insider ownership

With shares trading well below analysts' targets despite recent earnings growth, the big question is whether Chewy is undervalued at current levels or if the market has already factored in all future gains.

Most Popular Narrative: 26% Undervalued

Chewy’s most widely followed narrative puts its fair value at $45.45 per share, a substantial premium over its recent closing price of $33.54. This sets the stage for a debate about whether Chewy’s fundamentals can deliver the growth implied in this target.

Chewy's strategic expansions, such as opening new Chewy Vet Care Clinics, are expected to further penetrate the $25 billion vet services market. This is likely to increase revenue and active customer engagement in 2025 and beyond. The migration to a 1P ad platform allows for enhanced advertising capabilities, including off-site ads and new content formats like video. This could grow the sponsored ads business up to 3% of total enterprise net sales, positively impacting gross margins.

Want the full inside scoop on what powers this high fair value? The assumptions behind this price hint at bold top-line ambitions and profit dynamics rarely seen outside tech disruptors. Only by unpacking the future projections for growth and margins will you understand the math guiding this sharp premium for Chewy.

Result: Fair Value of $45.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a heavy reliance on Autoship subscriptions and slow customer growth could threaten Chewy’s expected revenue expansion and long-term market share ambitions.

Find out about the key risks to this Chewy narrative.

Another View: Are the Multiples Sending a Different Signal?

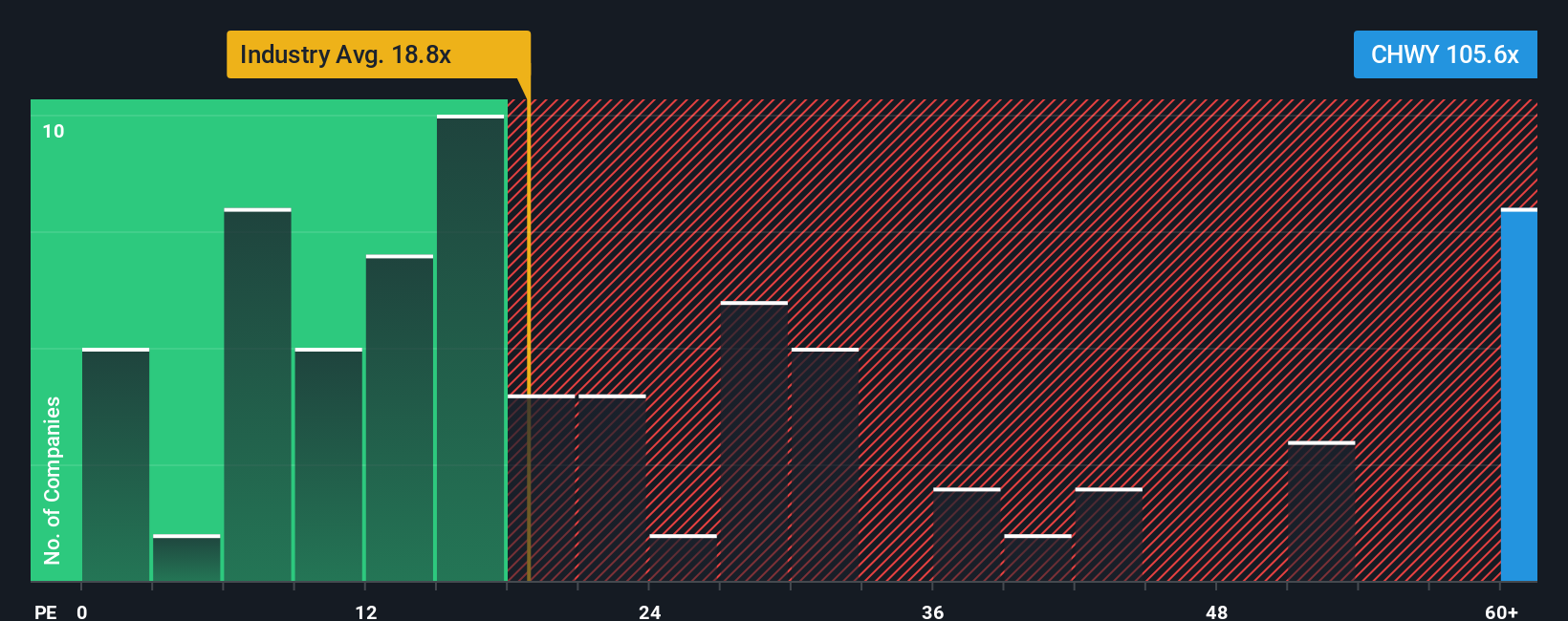

While consensus sees Chewy as undervalued, its current price-to-earnings ratio stands at 92.1 times, which is dramatically higher than the US Specialty Retail industry average of 18.9 and its fair ratio of 26.6. This industry gap suggests investors are paying a significant premium. Is the market too optimistic or simply betting on long-term outperformance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chewy Narrative

If you have a different take or want to dig into the numbers firsthand, you can quickly craft your own perspective using our tools in just minutes, so why not Do it your way

A great starting point for your Chewy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Fresh Opportunities?

Smart investors never stop looking for their next strong move. With the Simply Wall Street Screener, you can quickly spot stocks that match your goals and get ahead of the market’s twists.

- Earn more from your portfolio when you check out these 14 dividend stocks with yields > 3% with the potential for yields above 3 percent.

- Snap up undervalued companies trading far beneath their true worth by checking out these 924 undervalued stocks based on cash flows before others catch on.

- Ride the most exciting trends in tech by tapping into these 26 AI penny stocks as artificial intelligence transforms entire industries and creates new winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHWY

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success