Of late the Cango (NYSE:CANG) share price has softened like an ice cream in the sun, melting a full . But plenty of shareholders will still be smiling, given that the stock is up 48% over the last quarter. The stock has been solid, longer term, gaining 16% in the last year.

All else being equal, a sharp share price increase should make a stock less attractive to potential investors. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). The implication here is that deep value investors might steer clear when expectations of a company are too high. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). Investors have optimistic expectations of companies with higher P/E ratios, compared to companies with lower P/E ratios.

View our latest analysis for Cango

Does Cango Have A Relatively High Or Low P/E For Its Industry?

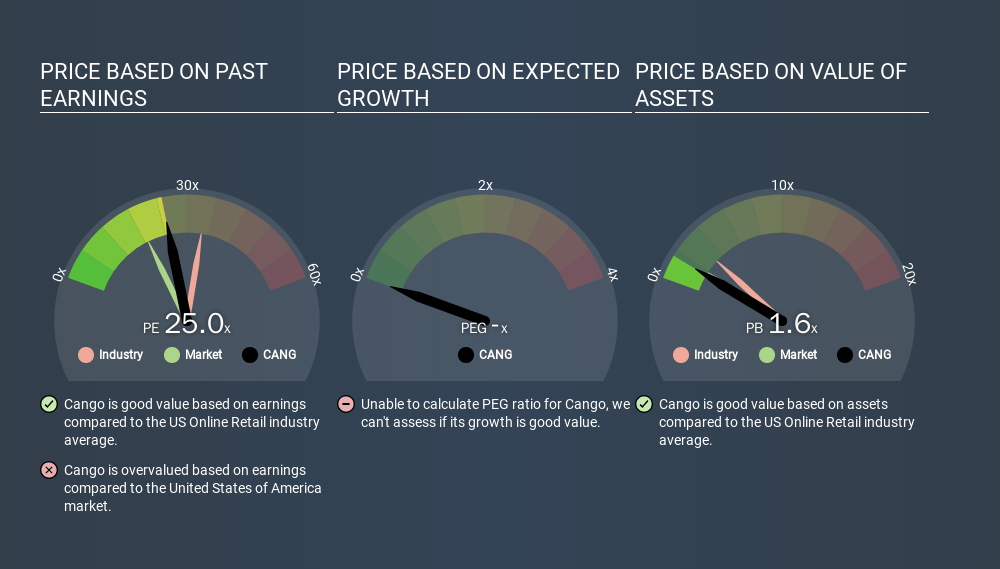

We can tell from its P/E ratio of 25.03 that sentiment around Cango isn't particularly high. If you look at the image below, you can see Cango has a lower P/E than the average (33.5) in the online retail industry classification.

This suggests that market participants think Cango will underperform other companies in its industry. Since the market seems unimpressed with Cango, it's quite possible it could surprise on the upside. It is arguably worth checking if insiders are buying shares, because that might imply they believe the stock is undervalued.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. If earnings are growing quickly, then the 'E' in the equation will increase faster than it would otherwise. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

Cango's earnings made like a rocket, taking off 135% last year. The sweetener is that the annual five year growth rate of 17% is also impressive. So I'd be surprised if the P/E ratio was not above average.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. That means it doesn't take debt or cash into account. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

Cango's Balance Sheet

The extra options and safety that comes with Cango's CN¥236m net cash position means that it deserves a higher P/E than it would if it had a lot of net debt.

The Verdict On Cango's P/E Ratio

Cango's P/E is 25.0 which is above average (18.8) in its market. Its net cash position is the cherry on top of its superb EPS growth. To us, this is the sort of company that we would expect to carry an above average price tag (relative to earnings). Given Cango's P/E ratio has declined from 25.0 to 25.0 in the last month, we know for sure that the market is less confident about the business today, than it was back then. For those who don't like to trade against momentum, that could be a warning sign, but a contrarian investor might want to take a closer look.

Investors have an opportunity when market expectations about a stock are wrong. People often underestimate remarkable growth -- so investors can make money when fast growth is not fully appreciated. So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

Of course you might be able to find a better stock than Cango. So you may wish to see this free collection of other companies that have grown earnings strongly.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:CANG

Cango

Operates an automotive transaction service platform that connects dealers, original equipment manufacturers, financial institutions, car buyers, insurance brokers, and companies in the People’s Republic of China.

Flawless balance sheet and fair value.