- United States

- /

- Specialty Stores

- /

- NYSE:BURL

Is Burlington Stores Fairly Priced After Expansion News and Stable 2.9% Gain in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Burlington Stores is a smart buy right now? Let’s dig into what’s behind the numbers, especially if you’re on the hunt for value in retail stocks.

- The stock has moved just -0.8% over the past week, with a modest 2.9% gain in the past year. This shows stability but also raises questions about what might drive bigger moves ahead.

- Recent headlines have focused on Burlington’s expansion into new markets and shifting strategies to adapt to changing consumer preferences. This has fueled speculation about its future growth. Additionally, news of broader retail trends has investors watching closely to see how Burlington positions itself among competitors.

- Digging into the numbers, Burlington Stores earns a 2 out of 6 valuation score. This suggests there’s room for optimism or caution, depending on your approach. Next, we’ll break down how that number is calculated using traditional and alternative valuation methods, and, at the end, reveal the smartest way to interpret what that means for investors.

Burlington Stores scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Burlington Stores Discounted Cash Flow (DCF) Analysis

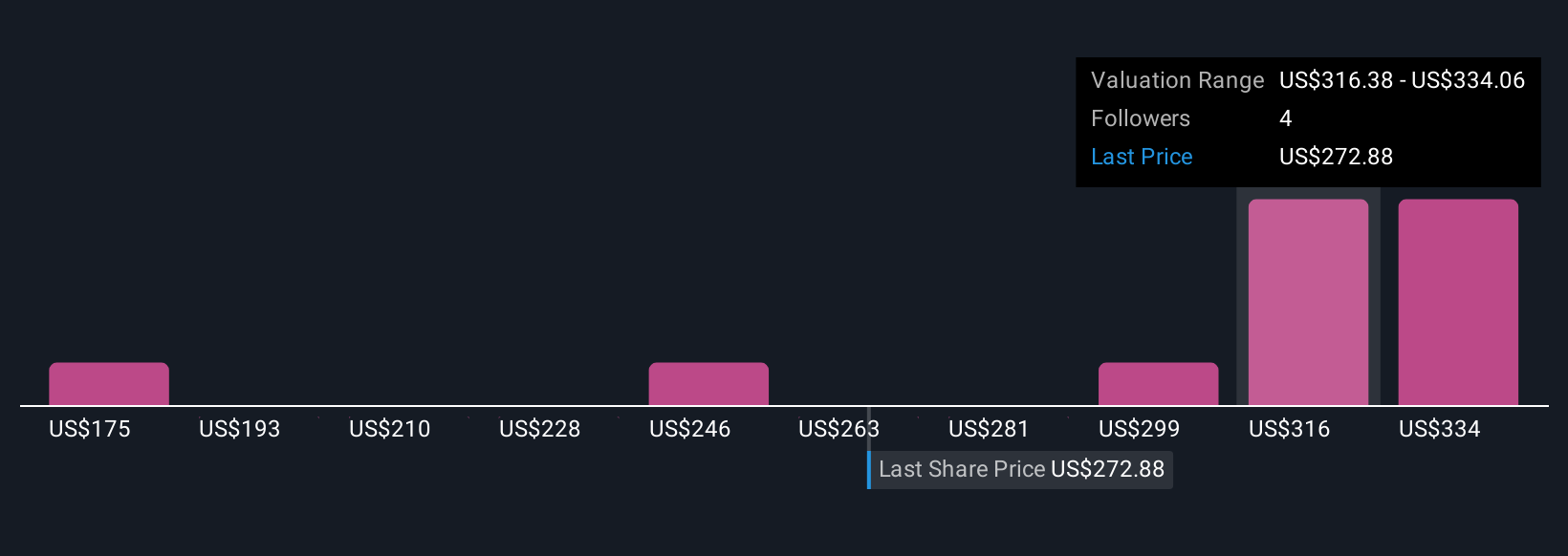

The Discounted Cash Flow (DCF) model estimates a company’s fair value by projecting its future free cash flows and discounting them to today’s dollars. This method helps investors determine if a stock is undervalued or overvalued relative to its predicted ability to generate cash.

For Burlington Stores, current Free Cash Flow stands at $6.07 million. Projections show a steep climb, with analysts estimating the company could generate $976 million in Free Cash Flow by 2030. Analysts provide detailed estimates for the next five years, and future years are extrapolated from historical patterns and industry expectations.

The DCF model applied here uses a 2 Stage Free Cash Flow to Equity method, reflecting both nearer-term analyst predictions and longer-term trend assumptions. Based on this, the estimated fair value per share is $328.31. Compared to its current price, this suggests the stock is trading at a 14.8% discount, indicating potential undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Burlington Stores is undervalued by 14.8%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

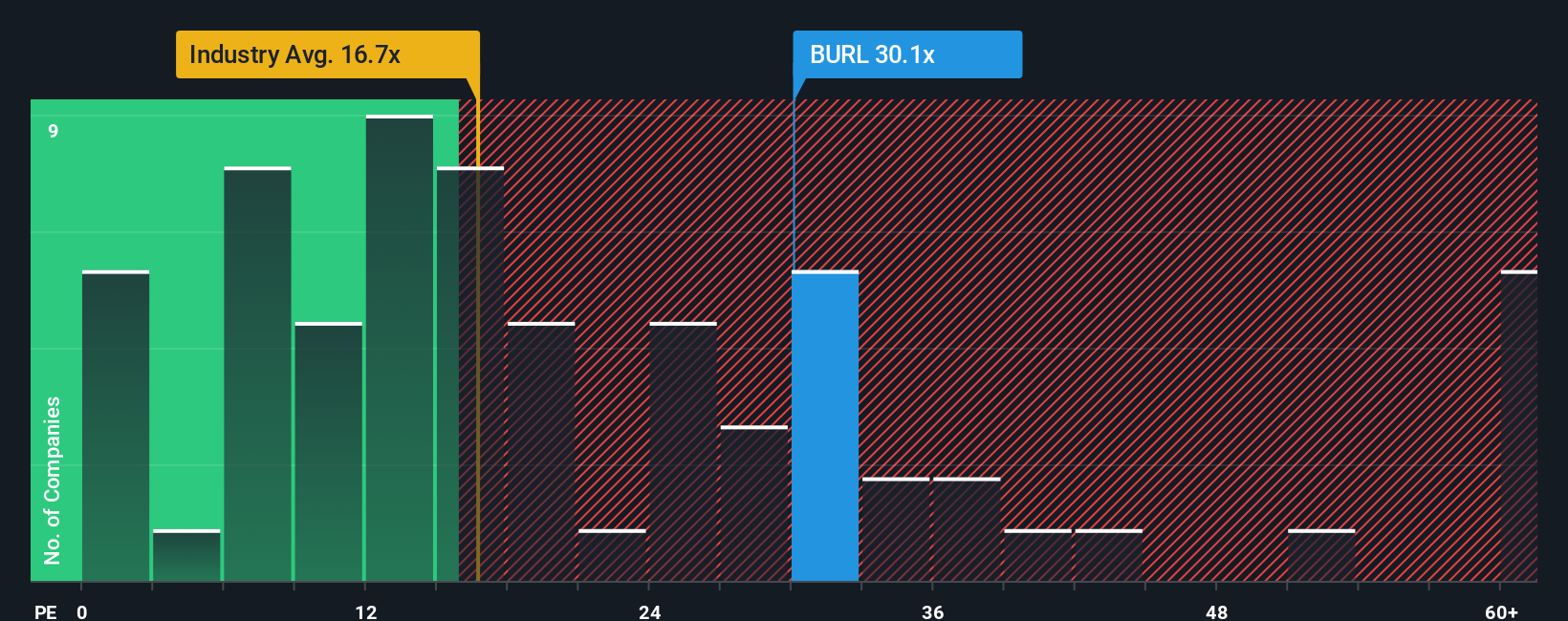

Approach 2: Burlington Stores Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies, like Burlington Stores, because it directly relates a company’s share price to its earnings. This makes it easy for investors to gauge how much they are paying for a dollar of earnings, making it especially useful when a company has a solid history of profitability.

What’s considered a “normal” or “fair” PE ratio depends on factors like expected earnings growth and the level of risk. Companies with higher growth prospects can generally support higher PE ratios, while more stable or riskier businesses often trade at a discount due to future uncertainties.

Burlington Stores currently trades at a PE ratio of 31.89x. This is well above both the specialty retail industry average of 17.04x and the typical peer group at 18.08x. To get a more nuanced view, Simply Wall St calculates a "Fair Ratio," which in this case is 23.09x. Unlike comparisons to the industry or peers, this proprietary benchmark incorporates the company’s specific earnings growth, risk profile, profit margins, industry characteristics, and market cap. As a result, the Fair Ratio gives a more personalized benchmark for what Burlington’s valuation multiple should be.

Comparing the Fair Ratio of 23.09x to the current multiple of 31.89x, Burlington looks overvalued on a PE basis, trading at a substantial premium to what would be justified by its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1413 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Burlington Stores Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives, a simple tool that lets you craft your own story about a company and see how your expectations shape its fair value.

A Narrative ties together your perspective on Burlington Stores’ future, such as revenue, earnings, and margins, with a clear financial forecast and an estimated fair value. This helps bridge the gap between numbers and real-world business stories.

On Simply Wall St’s Community page, millions of investors use Narratives to outline not just where they think the company is headed, but why. This allows you to see and compare different investment viewpoints.

This tool makes it easy to decide when to buy or sell, since you can directly compare your calculated Fair Value with the current market Price and adjust your strategy as new information emerges. Narratives update automatically whenever major news, earnings, or forecasts change.

For example, some investors are optimistic about Burlington’s Sun Belt expansion and strong margin improvements, supporting price targets over $430. Others worry about risks like digital underinvestment or macroeconomic pressures and see a fair value closer to $328. Your Narrative might align anywhere between these, driven by your own expectations.

Do you think there's more to the story for Burlington Stores? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burlington Stores might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BURL

Burlington Stores

Operates as a retailer of branded merchandise in the United States and Puerto Rico.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives