- United States

- /

- Specialty Stores

- /

- NYSE:BURL

Burlington Stores (BURL): Examining Valuation After Recent Slowdown in Share Price Momentum

Reviewed by Simply Wall St

Burlington Stores (BURL) shares have shown slight movement lately, prompting some investors to revisit the retailer’s performance. The company’s stock has experienced mixed returns over the past month and continues to draw attention in the retail sector.

See our latest analysis for Burlington Stores.

While Burlington Stores’ share price return has been fairly muted recently, the bigger story is that momentum has slowed after a strong multi-year run. The company’s total shareholder return of 77% over three years stands out, even as short-term moves have been less decisive. This suggests investors are weighing fresh opportunities against the stock’s elevated level.

If you’re curious about what else is attracting attention in retail and beyond, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares near recent highs and a solid track record behind it, investors are left to wonder: is Burlington Stores trading at a bargain price, or has the market already accounted for all its growth prospects?

Most Popular Narrative: 20.5% Undervalued

Burlington Stores’ fair value, according to the most widely followed narrative, sits noticeably above its last close. Despite recent share price highs, debate intensifies around what’s driving that bullish target and whether current momentum is justified.

“Ongoing investments in automation (such as the new West Coast distribution center) and enhanced inventory management through reserve buying and supply chain initiatives allow Burlington to improve merchandise margins and achieve operating leverage, supporting long-term earnings growth. The ongoing upgrades to merchandising and store operations (‘Burlington 2.0’ initiatives), including modernized layouts and improved associate engagement, have produced measurable improvements in sales productivity and margin control, indicating potential for further net margin expansion as these initiatives scale across the chain.”

What’s quietly supercharging this fair value target? A ramp-up in margins, accelerated revenue growth, and a bullish expectations reset. There is also a profit multiple that dares to rival industry heavyweights. Want to know the key financial assumptions? See what’s driving this narrative’s bold projection.

Result: Fair Value of $351.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain if tariff pressures persist or if Burlington’s aggressive store expansion reduces profitability and exposes the company to volatile consumer demand.

Find out about the key risks to this Burlington Stores narrative.

Another View: Is the Multiple Telling a Different Story?

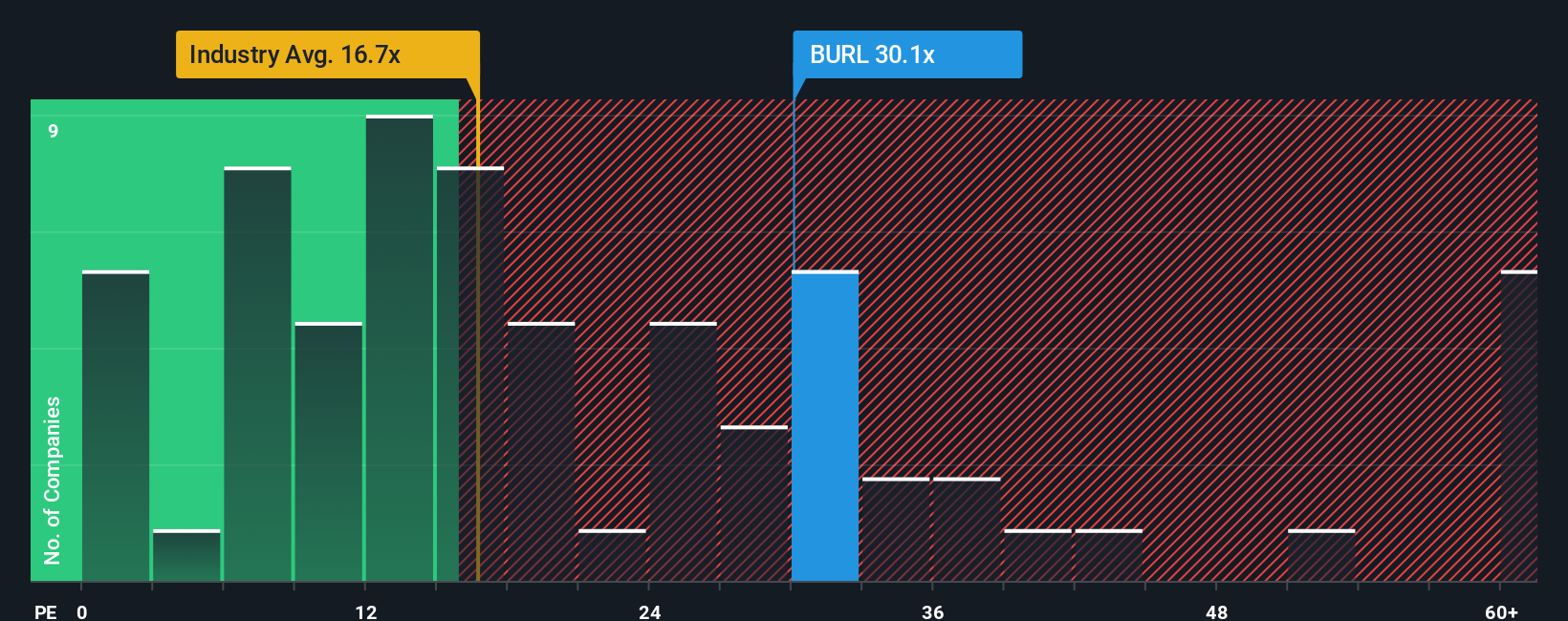

Looking beyond fair value estimates, Burlington Stores’ current price-to-earnings ratio is 31.9x. That is noticeably higher than both the US Specialty Retail industry average of 17.6x, the peer average of 18.1x, and our calculated fair ratio of 23.1x. This premium suggests investors expect robust growth, but it also raises the risk that any slowdown could trigger a sharp valuation reset. Is the market being too optimistic, or will Burlington continue to justify this high valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Burlington Stores Narrative

If you want to challenge these perspectives or dig deeper for yourself, you can quickly shape your own take in minutes. Do it your way

A great starting point for your Burlington Stores research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t just watch from the sidelines. Now is your chance to spot the next big winner and take control of your investing journey on your terms.

- Uncover high-growth opportunities with market leaders by checking these 25 AI penny stocks making breakthroughs in artificial intelligence and automation.

- Boost your income potential and stability by targeting these 16 dividend stocks with yields > 3% delivering yields above 3% to strengthen your portfolio’s foundation.

- Seize first-mover advantage in blockchain innovation by monitoring these 82 cryptocurrency and blockchain stocks driving the evolution of digital assets and financial technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burlington Stores might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BURL

Burlington Stores

Operates as a retailer of branded merchandise in the United States and Puerto Rico.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives