- United States

- /

- Specialty Stores

- /

- NYSE:BOOT

Will Analyst Optimism Around Exclusive Brands and Margins Shift Boot Barn Holdings' (BOOT) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent days, major Wall Street analysts reaffirmed their positive outlook on Boot Barn Holdings, supported by improved earnings estimates and recognition of strong first-quarter revenue and same-store sales growth. Independent investment commentary also highlighted Boot Barn's ability to capture market opportunity through exclusive brand expansion and operational efficiencies.

- One interesting insight is the attention analysts are giving Boot Barn's shift toward higher-margin exclusive products, which is seen as a key contributor to its earnings momentum and future margin stability.

- We'll examine how this strengthened analyst confidence, especially regarding Boot Barn's earnings and margin expansion, may reshape the company's investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Boot Barn Holdings Investment Narrative Recap

To be a shareholder in Boot Barn, you need conviction in its ability to sustain growth by expanding into new markets, scaling exclusive brands, and benefiting from sector trends favoring specialty retail. The recent wave of bullish analyst updates bolsters sentiment regarding upcoming earnings, but does little to change the central near-term catalyst, gaining margin stability from exclusive product sales, while persistent risks remain around cost inflation and store expansion pace, which could impact net margins if mismanaged.

Among the latest corporate developments, Boot Barn’s Q1 2026 results stand out: revenue grew 19% to US$504 million, and same-store sales increased 9.4%. This operational momentum directly supports analyst optimism about the company’s ability to drive earnings through margin expansion, especially as exclusive brands form a larger part of the product mix.

However, investors should not overlook that, despite robust topline momentum, rising supplier costs may compress gross margins if passed on to price-sensitive customers…

Read the full narrative on Boot Barn Holdings (it's free!)

Boot Barn Holdings' outlook anticipates $2.8 billion in revenue and $264.7 million in earnings by 2028. Achieving this would require 12.5% annual revenue growth and a $69.3 million earnings increase from current earnings of $195.4 million.

Uncover how Boot Barn Holdings' forecasts yield a $213.29 fair value, a 24% upside to its current price.

Exploring Other Perspectives

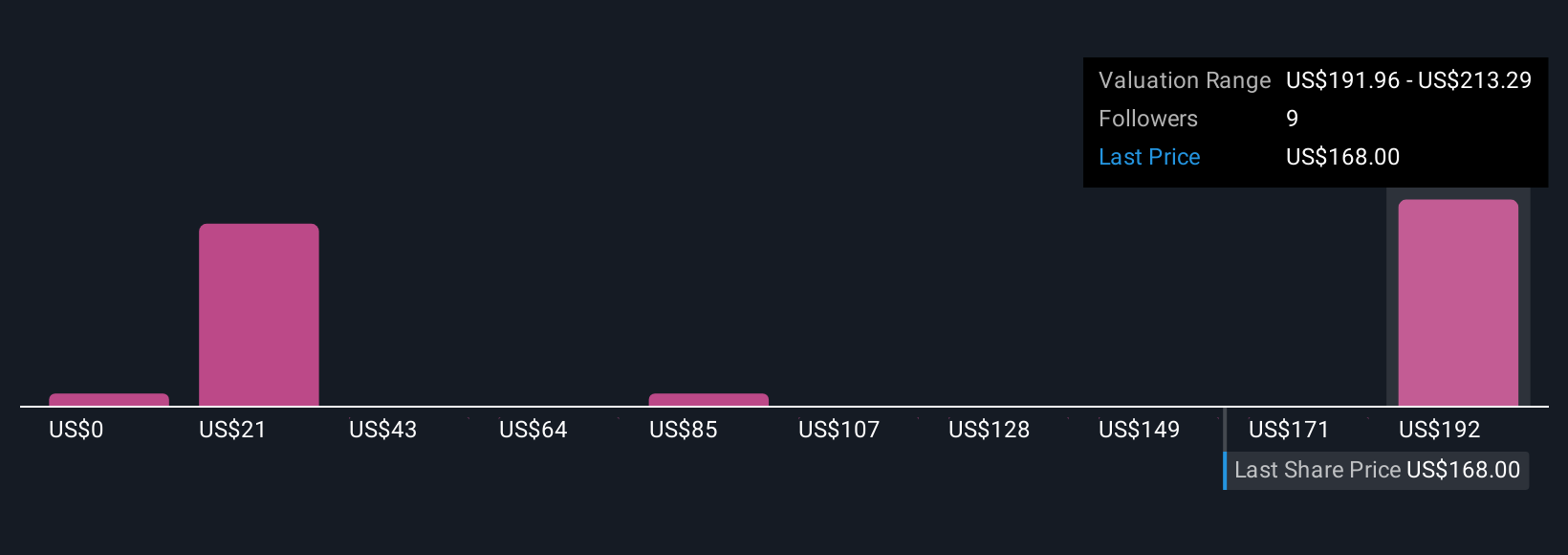

Six Simply Wall St Community members set fair value estimates for Boot Barn ranging from US$21 to US$213 per share. While this points to wide differences in outlook, many see exclusive brands as a possible driver of future margins, yet cost pressures mean you should explore alternate viewpoints on sustainability.

Explore 6 other fair value estimates on Boot Barn Holdings - why the stock might be worth as much as 24% more than the current price!

Build Your Own Boot Barn Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boot Barn Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Boot Barn Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boot Barn Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boot Barn Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOOT

Boot Barn Holdings

Operates specialty retail stores in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives