- United States

- /

- Specialty Stores

- /

- NYSE:BKE

Why Buckle (BKE) Is Up 5.5% After Strong Quarterly Results Led by Women’s Denim Growth

Reviewed by Sasha Jovanovic

- The Buckle, Inc. recently reported its third quarter 2025 results, showing quarterly net sales of US$320.84 million and net income of US$48.7 million, both higher than the same period last year.

- The quarterly performance was driven by strong growth in the women's merchandise segment, with women's denim sales increasing by about 19%, as well as ongoing store openings and remodels.

- We'll take a look at how robust growth in women's merchandise, particularly denim, may influence Buckle's broader investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Buckle Investment Narrative Recap

To be a shareholder in Buckle, Inc., you need to believe that the brand’s niche in specialty apparel, supported by strong core markets and resilient same-store sales, is durable despite shifts in US retail. The latest quarterly report, highlighting robust net sales and net income growth, signals momentum in women’s merchandise and denim, but does not materially change the key short-term catalyst of merchandise performance or the persistent risk tied to the company’s heavy reliance on mall locations and brick-and-mortar traffic.

Among recent announcements, Buckle’s store expansion and remodel activity directly connects to the themes in the third quarter earnings release. With two new stores opened and six remodels completed this quarter, these investments continue to be central to driving store productivity and supporting sales growth, potentially reinforcing the company’s strategy to mitigate pressure from shifts in consumer shopping preferences.

But for investors, keep in mind that despite these positives, there is still the ongoing risk associated with Buckle’s exposure to declining mall foot traffic and rising occupancy costs...

Read the full narrative on Buckle (it's free!)

Buckle's outlook expects $1.4 billion in revenue and $226.1 million in earnings by 2028. Achieving these figures assumes a 4.0% annual revenue growth and a $24.5 million increase in earnings from the current $201.6 million.

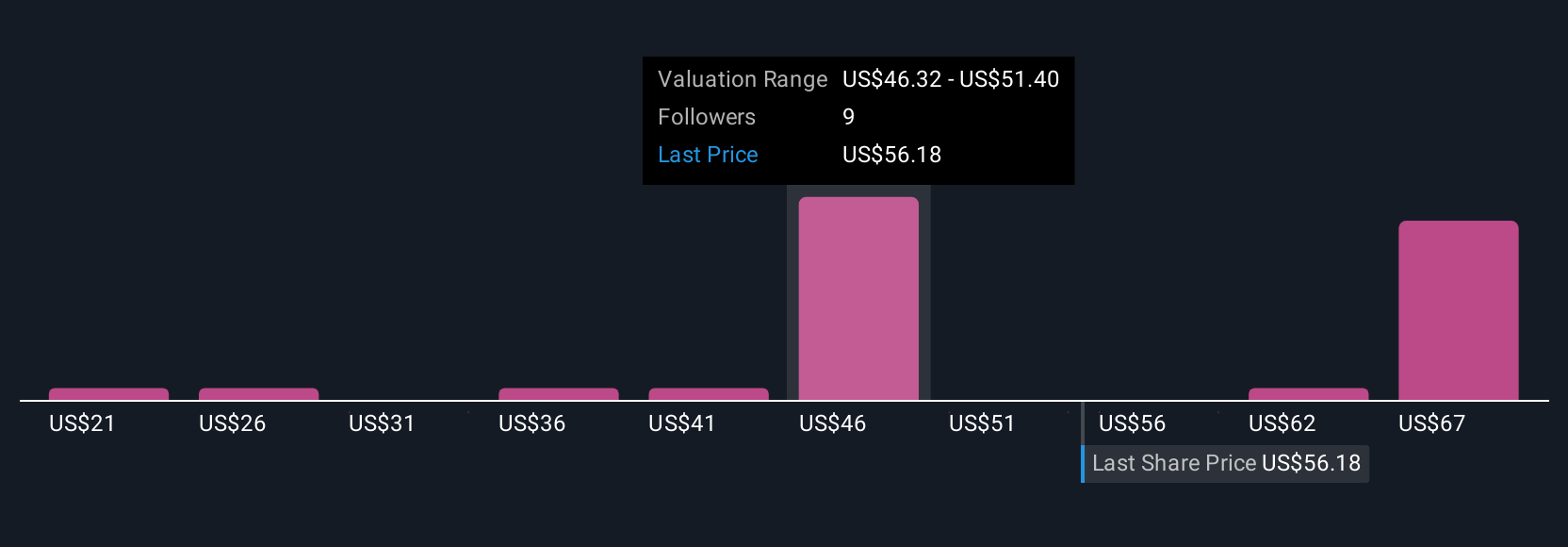

Uncover how Buckle's forecasts yield a $54.00 fair value, a 6% downside to its current price.

Exploring Other Perspectives

Fair value opinions from eight members of the Simply Wall St Community span from US$20.90 to US$88.73, highlighting a wide gap in expectations. Many participants see merchandise momentum as a key driver, but risks tied to brick-and-mortar exposure remain a point of debate for the company’s outlook.

Explore 8 other fair value estimates on Buckle - why the stock might be worth less than half the current price!

Build Your Own Buckle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Buckle research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Buckle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Buckle's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Buckle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKE

Buckle

Operates as a retailer of casual apparel, footwear, and accessories for men, women, and kids under the Buckle and Buckle Youth brands in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.