- United States

- /

- Food

- /

- NasdaqGS:SFD

Best Dividend Stocks For November 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of mixed performance, with major indices like the S&P 500 and Nasdaq showing slight gains while others face pressure from AI-related valuation concerns, investors are keenly observing upcoming earnings reports and economic data releases. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for those looking to balance growth with reliable returns amidst market fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 5.33% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.79% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.61% | ★★★★★★ |

| Interpublic Group of Companies (IPG) | 5.24% | ★★★★★★ |

| Heritage Commerce (HTBK) | 5.08% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 6.27% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.29% | ★★★★★★ |

| Ennis (EBF) | 6.01% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.58% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.74% | ★★★★★★ |

Click here to see the full list of 137 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

Smithfield Foods (SFD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Smithfield Foods, Inc. is a producer of packaged meats and fresh pork operating in the United States and internationally, with a market cap of $8.48 billion.

Operations: Smithfield Foods, Inc.'s revenue segments include Fresh Pork at $8.30 billion, Hog Production at $3.37 billion, and Packaged Meats at $8.65 billion.

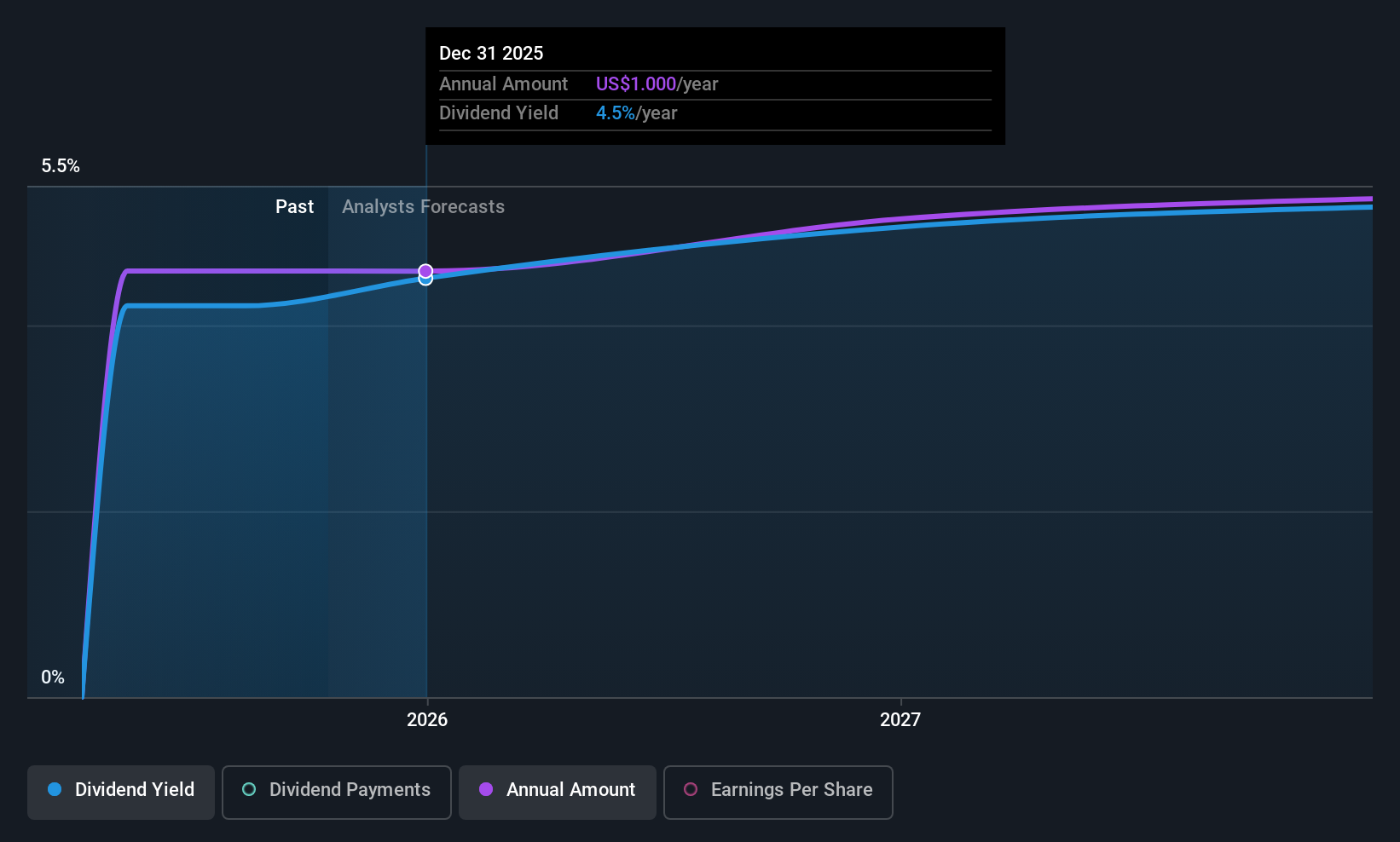

Dividend Yield: 4.6%

Smithfield Foods offers a dividend yield of 4.64%, placing it in the top 25% of US dividend payers. The dividend is well-covered by earnings, with a payout ratio of 33.6%, though cash flow coverage is tighter at 84.4%. Recent earnings show growth, with Q3 sales rising to US$3.75 billion from US$3.33 billion year-over-year, despite net income declining slightly to US$248 million from US$291 million.

- Get an in-depth perspective on Smithfield Foods' performance by reading our dividend report here.

- The valuation report we've compiled suggests that Smithfield Foods' current price could be quite moderate.

Buckle (BKE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Buckle, Inc. is a U.S.-based retailer specializing in casual apparel, footwear, and accessories for men, women, and kids under the Buckle and Buckle Youth brands with a market cap of approximately $2.78 billion.

Operations: Buckle's revenue primarily comes from its casual apparel, footwear, and accessories segment, which generated $1.25 billion.

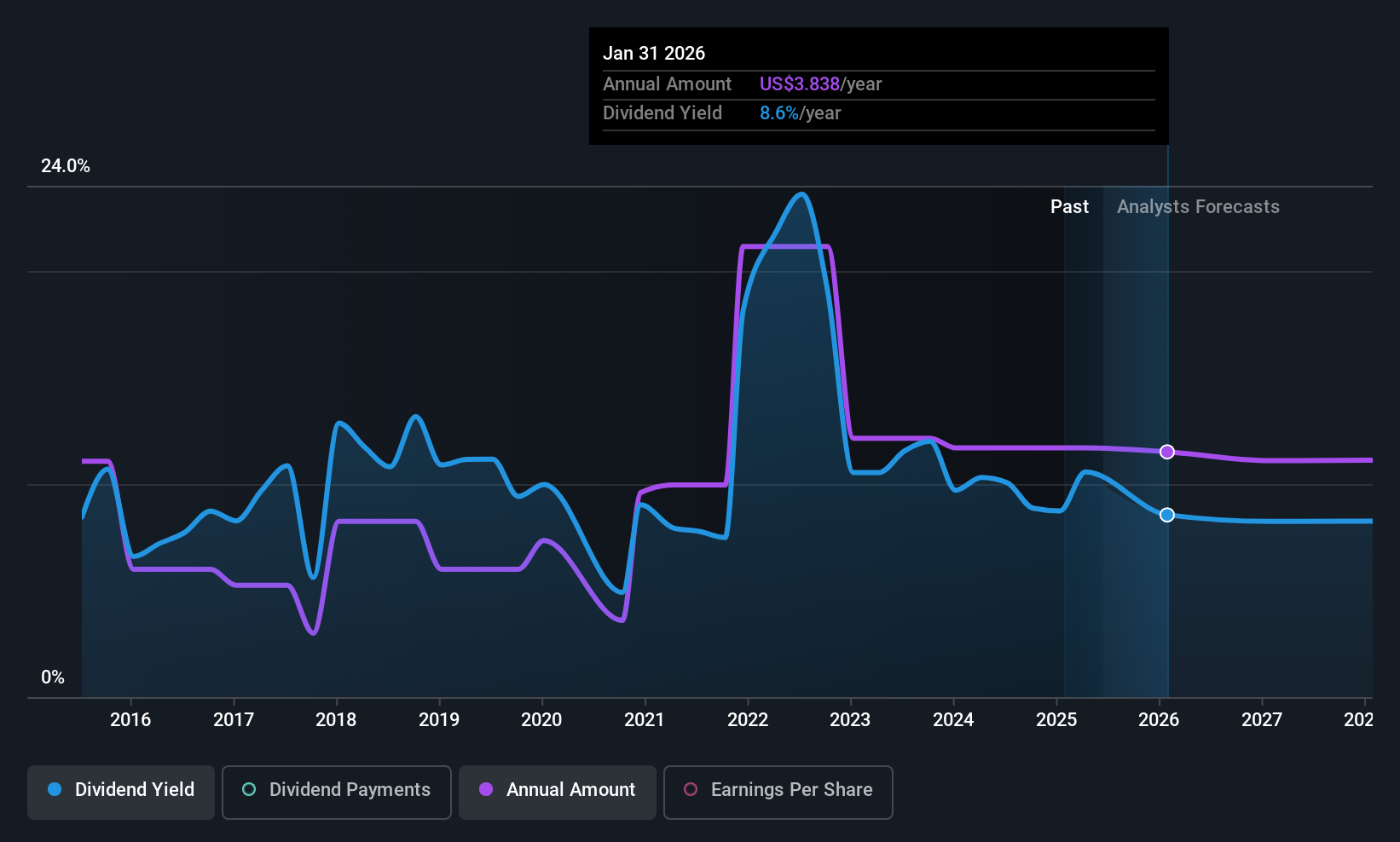

Dividend Yield: 7.0%

Buckle's dividend yield of 7.01% ranks in the top 25% of US payers, yet its sustainability is questionable due to a high cash payout ratio of 93%. Despite recent sales growth, with Q3 net sales rising to US$320.8 million from US$293.6 million year-over-year, dividends have been volatile and not consistently covered by earnings or cash flows. Significant insider selling further complicates the outlook for stability in dividend payments.

- Click to explore a detailed breakdown of our findings in Buckle's dividend report.

- Our expertly prepared valuation report Buckle implies its share price may be lower than expected.

HNI (HNI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HNI Corporation, with a market cap of $1.75 billion, manufactures, sells, and markets workplace furnishings and residential building products primarily in the United States and Canada.

Operations: HNI Corporation generates revenue from two main segments: Workplace Furnishings, which accounts for $1.94 billion, and Residential Building Products, contributing $656.30 million.

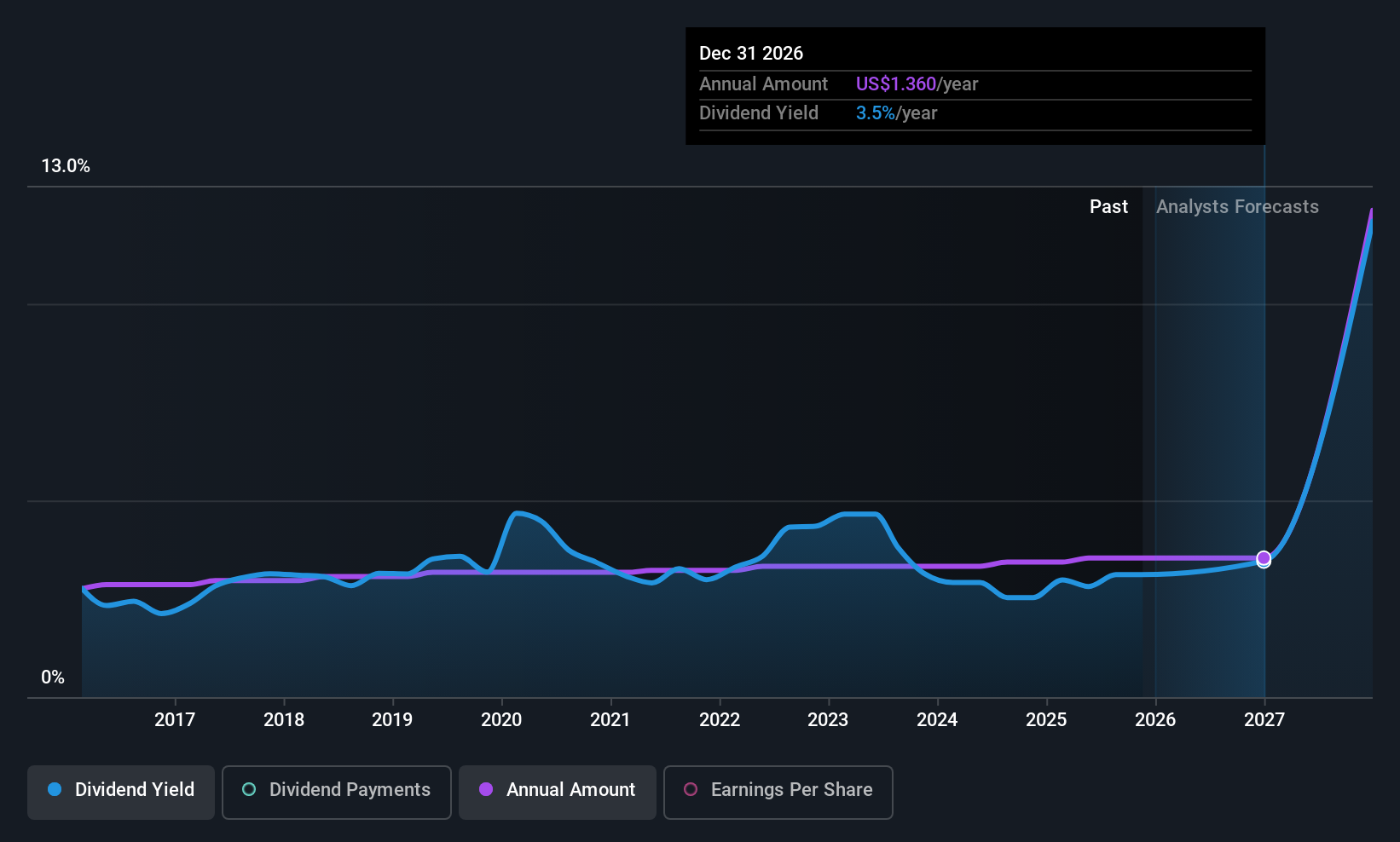

Dividend Yield: 3.5%

HNI's dividend payments have been reliable and stable over the past decade, with a recent quarterly dividend of US$0.34 per share declared. The company's dividends are well covered by both earnings and cash flows, with payout ratios of 44.1% and 32.9%, respectively. Despite a lower yield of 3.48% compared to top-tier US payers, HNI trades at an attractive value relative to its peers, supported by consistent earnings growth and strategic financial management initiatives like recent debt financing activities.

- Click here to discover the nuances of HNI with our detailed analytical dividend report.

- Our valuation report unveils the possibility HNI's shares may be trading at a discount.

Taking Advantage

- Investigate our full lineup of 137 Top US Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SFD

Smithfield Foods

Produces packaged meats and fresh pork in the United States and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives