- United States

- /

- Specialty Stores

- /

- NYSE:BKE

A Fresh Look at Buckle (BKE) Valuation Following Strong Year-Over-Year Sales Growth

Reviewed by Simply Wall St

Buckle (BKE) released its latest sales update, showing that both comparable store net sales and total net sales increased for the five and thirty-five week periods ending October 4. The numbers highlight stronger consumer demand compared to last year.

See our latest analysis for Buckle.

This upbeat sales news has added momentum to Buckle’s recent run, with the share price climbing over 10% in the past 90 days and sitting at $55.36. Investors with a longer view have enjoyed an impressive 39.77% total shareholder return over the last year. This underscores Buckle’s consistent performance in both the short and long term.

If Buckle’s strong run has you searching for new opportunities, now’s a great chance to broaden your investment ideas and discover fast growing stocks with high insider ownership

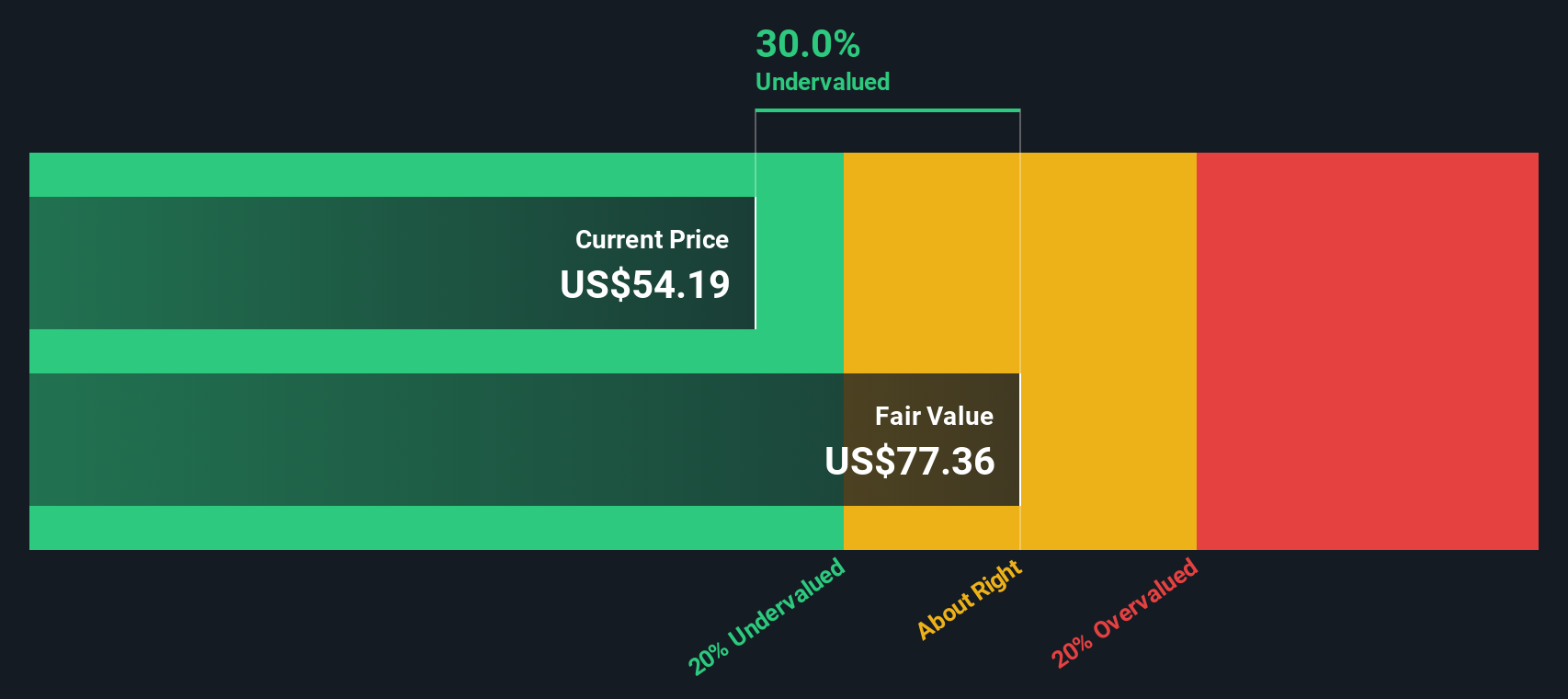

But with shares rallying and recent gains outpacing analyst targets, the big question now is whether Buckle is still undervalued or if all the upside is already built in. Investors are left to wonder if there is truly a buying opportunity or if the market has already priced in future growth.

Most Popular Narrative: 2.5% Overvalued

The narrative’s fair value of $54.00 is slightly below Buckle’s last close of $55.36, pointing to a market price just above consensus calculations. This provides an opportunity to examine the key factors influencing the valuation.

Remodeling activity and relocation from mall locations to better-performing outdoor centers, as part of ongoing store investments, are expected to drive higher store productivity, supporting same-store sales growth and improved rent leverage over time, thereby aiding revenue and profitability.

What drives this controversial view? The narrative is based on a specific, quantified plan for future growth, margins, and profit multiples, which is unusual for a specialty retailer. To understand which assumptions underlie this projection and how they compare to industry standards, reading the full narrative is essential.

Result: Fair Value of $54.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing mall concentration and rising inventory levels could threaten Buckle’s growth if consumer habits or demand trends shift unexpectedly.

Find out about the key risks to this Buckle narrative.

Another View: DCF Model Paints a Different Picture

Taking a look through our SWS DCF model, Buckle’s shares appear to be undervalued by a notable margin. The calculated fair value is $78 compared to the current price of $55.36. This suggests an upside that stands in contrast to the consensus price target. Could the market be missing hidden value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Buckle for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Buckle Narrative

If you have a different perspective or want to dive into the numbers yourself, it’s easy to put together your own narrative in just a few minutes. Do it your way

A great starting point for your Buckle research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let today’s momentum slip by. Use the Simply Wall Street Screener to find untapped opportunities and stay ahead of fast-moving trends in the market.

- Tap into standout companies making waves in healthcare innovation by using these 33 healthcare AI stocks to spot leaders transforming patient care with artificial intelligence.

- Seize potential value with these 874 undervalued stocks based on cash flows, which features companies currently out of favor and gives you a chance to benefit as the market catches up.

- Capture reliable passive income with these 17 dividend stocks with yields > 3%, offering yields above 3% and proven histories of rewarding shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Buckle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKE

Buckle

Operates as a retailer of casual apparel, footwear, and accessories for men, women, and kids under the Buckle and Buckle Youth brands in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives