- United States

- /

- Specialty Stores

- /

- NYSE:BBY

Did In-Store XR Glasses Trials Just Shift Best Buy’s (BBY) Experiential Retail Investment Narrative?

Reviewed by Sasha Jovanovic

- VITURE announced the rollout of its XR Glasses in 200 Best Buy stores across the United States, enabling consumers to try and purchase full-display XR eyewear in person at a major U.S. electronics retailer for the first time.

- This milestone positions Best Buy as an early leader in immersive spatial computing retail, expanding its experiential tech offerings just ahead of the holiday season.

- We'll explore how Best Buy's launch of in-store XR eyewear experiences adds a fresh growth angle to its broader investment case.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Best Buy Investment Narrative Recap

Shareholders in Best Buy are buying into a story centered on the company’s ability to strengthen its in-store experiential edge and capitalize on cycles of new tech adoption, all while defending margins against an increasingly promo-driven, competitive marketplace. The arrival of VITURE XR Glasses in 200 stores shows Best Buy building on its tech-experience leadership, but the short-term impact on the most important catalyst, renewed demand for PCs and smart home devices, remains limited as this category is still niche. The principal risk, as ever, is a further shift towards lower-margin sales categories and escalating online competition, which could pressure margins and offset innovation-driven gains.

Among recent announcements, the September expansion of Best Buy’s holiday product assortment, adding ten times more items online, stands out as a significant move. While the VITURE rollout boosts in-store experiences, scaling digital selection supports the core catalyst around the expected computing refresh cycle, supporting both online and in-person sales opportunities.

On the other hand, investors should keep in mind the risk that growing e-commerce and marketplace competition could erode Best Buy’s store advantage and profitability over time...

Read the full narrative on Best Buy (it's free!)

Best Buy's narrative projects $44.5 billion revenue and $1.5 billion earnings by 2028. This requires 2.3% yearly revenue growth and a $722 million earnings increase from the current $778 million.

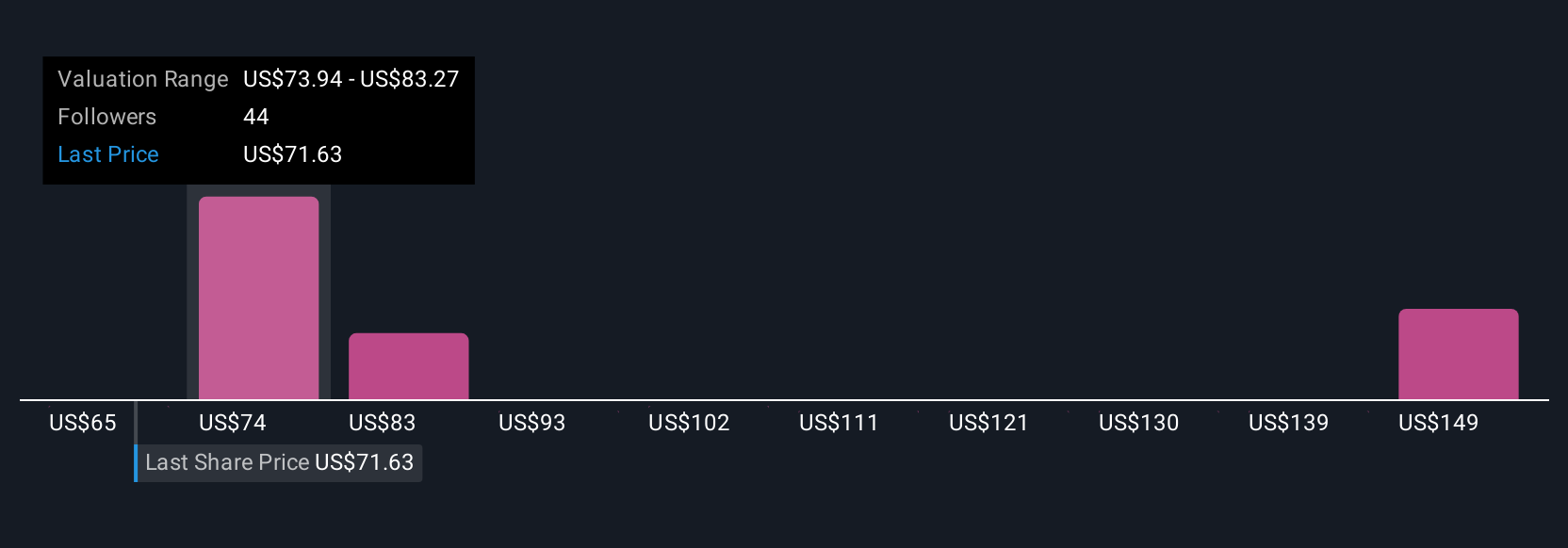

Uncover how Best Buy's forecasts yield a $80.71 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Best Buy range from US$64.62 to US$176.89 based on five independent perspectives, reflecting a wide gap in investor outlooks. With ongoing margin pressure and the potential for recurring shifts in sales mix or consumer behavior, examining several viewpoints can reveal important factors influencing performance.

Explore 5 other fair value estimates on Best Buy - why the stock might be worth 23% less than the current price!

Build Your Own Best Buy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Best Buy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Best Buy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Best Buy's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Best Buy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBY

Best Buy

Offers technology products and solutions in the United States, Canada, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives