- United States

- /

- Specialty Stores

- /

- NYSE:BBW

Build-A-Bear (BBW) Q3 2026: 11.3% Net Margin Strengthens Bullish Valuation Narrative

Reviewed by Simply Wall St

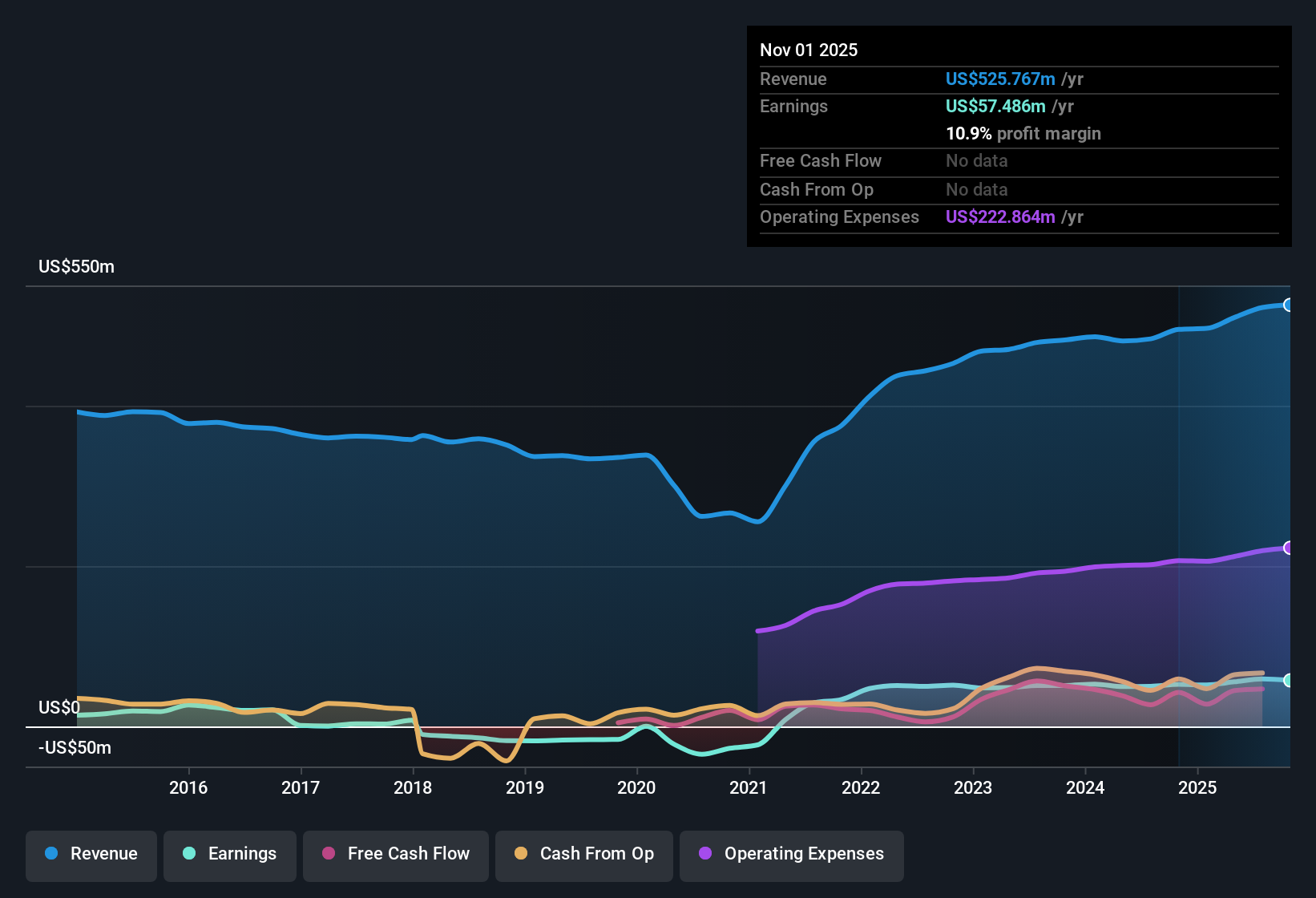

Build-A-Bear Workshop (BBW) has reported another busy stretch, with Q2 2026 revenue of about $124 million and basic EPS of $0.94, following Q1 2026 revenue of roughly $128 million and basic EPS of $1.17 as the company continues to cycle strong results from late 2025, when Q4 revenue was around $150 million and EPS reached $1.63. Over the last year, trailing twelve month revenue has climbed from approximately $480 million to $523 million and EPS has moved from $3.49 to $4.48. This sets up the latest release against a backdrop of expanding profitability and tighter margins discipline that investors will be watching closely.

See our full analysis for Build-A-Bear Workshop.With the headline numbers on the table, the next step is to see how this earnings trajectory lines up with the most widely held narratives around Build-A-Bear's growth, profitability, and long term story.

See what the community is saying about Build-A-Bear Workshop

Margins Hold Above 11.3 Percent

- Trailing twelve month net income of about $59.2 million on $522.5 million of revenue translates into an 11.3 percent net margin, up from 10.4 percent a year earlier.

- Bulls point to this margin strength as proof that the experiential model can absorb cost pressures. However, the consensus narrative also flags rising tariffs and labor costs as headwinds, which means:

- The recent 18.3 percent earnings growth over the last year supports the idea that pricing and mix are still working, even as those costs start to bite.

- At the same time, analysts expect profit margins to ease back to around 10.6 percent in three years, so the bullish case assumes the brand and format stay compelling enough to keep margins from sliding faster.

Growth Slows From 27.9 Percent Pace

- Earnings have grown 18.3 percent over the last year, which is solid but noticeably below the 27.9 percent per year growth rate seen over the past five years.

- Bears argue this deceleration plus modest forecasts of about 5.9 percent annual earnings growth and 4.0 percent annual revenue growth show the business is maturing. The consensus narrative also adds several structural risks that could limit a reacceleration:

- Heavy dependence on mall and tourist traffic, along with the long term shift toward digital entertainment, makes it harder to repeat the last five years of 27.9 percent annual earnings growth.

- Expected tariff and labor headwinds, including cited impacts in 2025, could keep earnings growth closer to that mid single digit forecast even if new products and international partners perform well.

Valuation Screens Cheap Versus DCF

- With the stock at $48.48 and a DCF fair value estimate of about $75.73, shares trade roughly 36 percent below that DCF fair value and at a 10.5 times trailing P E, compared with about 18.5 times for the US specialty retail industry and 62.9 times for peers.

- Supporters highlight this discount plus analysts’ view of continued, if slower, growth as a valuation driven opportunity, while the consensus narrative still warns that slower 4.0 percent revenue and 5.9 percent earnings growth versus the broader US market could limit how quickly that gap closes:

- The low P E multiple gives room for re rating if the company can keep net margins near the current 11.3 percent rather than drifting down toward the projected 10.6 percent.

- However, because forecast growth trails wider market expectations, any move toward the DCF fair value of $75.73 may depend more on steady execution than on a sudden growth surprise.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Build-A-Bear Workshop on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle and want your view reflected in the story? Shape your own narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Build-A-Bear Workshop.

See What Else Is Out There

Build A Bear’s slowing earnings and revenue growth, combined with forecast margin compression, suggest its strongest expansion years may be behind it for now.

If that deceleration makes you uneasy, use our stable growth stocks screener (2078 results) to quickly focus on businesses delivering steadier revenue and earnings progress across cycles, so your portfolio feels more predictable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Build-A-Bear Workshop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBW

Build-A-Bear Workshop

Operates as a multi-channel retailer of plush animals and related products in the United States, Canada, the United Kingdom, Ireland, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026