Is the Launch of Quark AI Glasses Reframing the Investment Case for Alibaba Group (BABA)?

Reviewed by Sasha Jovanovic

- In late November 2025, Alibaba Group launched its Quark AI Glasses across major e-commerce platforms and optical stores in China, pairing the devices with its advanced Qwen AI model for real-time voice and vision-powered assistance integrated throughout the Alibaba ecosystem.

- This move highlights Alibaba’s ambition to expand its consumer AI footprint, bringing artificial intelligence directly into everyday life across shopping, productivity, and content services.

- We'll explore how the launch of Alibaba’s AI-powered Quark Glasses could reshape its investment narrative, especially regarding consumer AI expansion.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Alibaba Group Holding Investment Narrative Recap

To be an Alibaba shareholder today, you need confidence in the company’s ability to translate its heavy AI and ecosystem investments into sustainable growth, while managing margin pressures from quick commerce and new ventures. The Quark AI Glasses launch adds another layer to Alibaba’s consumer AI strategy, but its short-term impact on overall profitability remains limited, the most important catalyst continues to be Alibaba’s execution in scaling cloud and AI, while the main risk is ongoing margin compression from aggressive investments.

Among the recent announcements, Alibaba’s fiscal second-quarter earnings report stands out: despite strong sales growth, net income dipped year-over-year, largely due to continued heavy investment in quick commerce and AI initiatives. This underscores how new launches like the Quark AI Glasses fit into a broader push for user engagement and ecosystem expansion, which, while promising, still place near-term strain on margins and earnings growth.

However, investors should be aware that prolonged losses and uncertain breakeven timelines in the quick commerce segment could...

Read the full narrative on Alibaba Group Holding (it's free!)

Alibaba Group Holding's narrative projects CN¥1,260.3 billion in revenue and CN¥171.1 billion in earnings by 2028. This requires 8.0% yearly revenue growth and a CN¥22.8 billion earnings increase from the current earnings of CN¥148.3 billion.

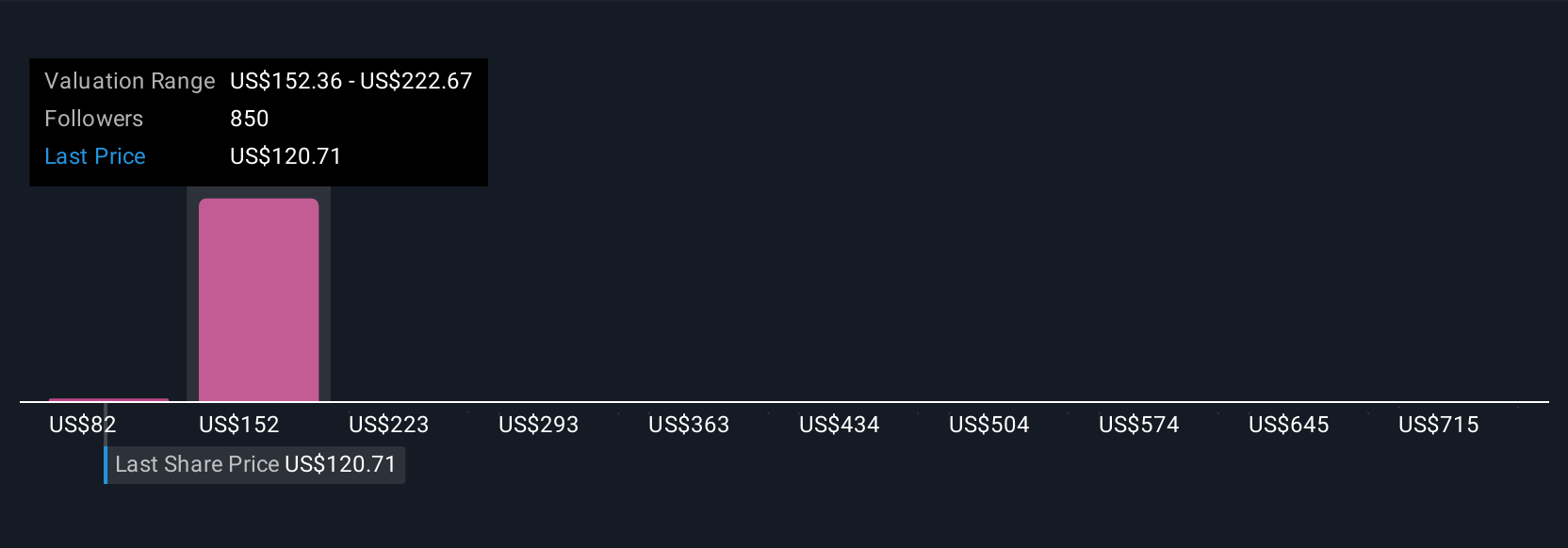

Uncover how Alibaba Group Holding's forecasts yield a $196.83 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Seventy one individual fair value estimates from the Simply Wall St Community range from CN¥107.09 to CN¥265.10 per share, reflecting widely differing perspectives. With margin pressures highlighted by recent earnings, you can compare these opinions to see how others weigh Alibaba’s aggressive investments against future growth prospects.

Explore 71 other fair value estimates on Alibaba Group Holding - why the stock might be worth 35% less than the current price!

Build Your Own Alibaba Group Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alibaba Group Holding research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Alibaba Group Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alibaba Group Holding's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026