How Investors Are Reacting To Alibaba (BABA) Surpassing 10 Million Qwen AI App Downloads in One Week

Reviewed by Sasha Jovanovic

- In the past week, Alibaba Group Holding reported its second quarter and half-year earnings, alongside unveiling the rapid adoption of its newly revamped Qwen AI app, which surpassed 10 million downloads within its first week of public beta launch.

- This swift uptake of Qwen highlights Alibaba's efforts to unify and advance its AI offerings, signaling a broader intention to strengthen its position in China's competitive artificial intelligence sector.

- We'll explore how the rapid user growth of Alibaba's Qwen app may reshape the company's medium-term AI-driven growth narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Alibaba Group Holding Investment Narrative Recap

Owning Alibaba Group Holding requires confidence that its large investments in AI and cloud will ultimately drive higher revenue and restored margins, despite near-term earnings volatility. The recent surge in Qwen AI app downloads highlights strong execution in AI rollout, but ongoing margin pressure from heavy spending remains the key short-term overhang. This catalyst is unlikely to materially change the company’s exposure to earnings risk if rapid user adoption does not translate into sustainable profits.

The recent board meeting to consider Alibaba’s unaudited quarterly and half-year results is closely tied to the Qwen AI launch, as investors assess whether top-line growth from new AI products can offset compressing margins and deliver an inflection point for profitability. Both announcements underscore how closely short-term results are being watched for early indicators that Alibaba’s cloud and AI strategy may begin to address ongoing concerns about net margin recovery.

In contrast, regulatory scrutiny and fresh legal challenges could bring new uncertainties that investors should be aware of...

Read the full narrative on Alibaba Group Holding (it's free!)

Alibaba Group Holding's outlook anticipates CN¥1,260.3 billion in revenue and CN¥171.1 billion in earnings by 2028. This implies an 8.0% annual revenue growth rate and a CN¥22.8 billion increase in earnings from the current CN¥148.3 billion.

Uncover how Alibaba Group Holding's forecasts yield a $196.83 fair value, a 22% upside to its current price.

Exploring Other Perspectives

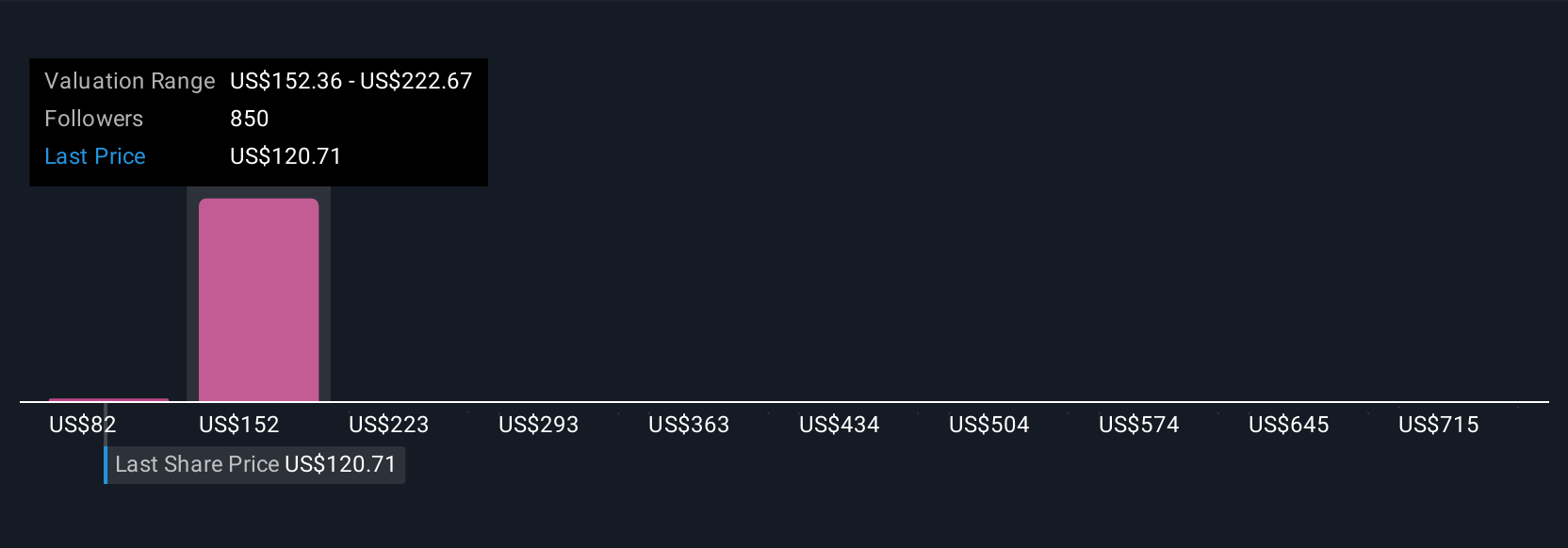

Sixty-nine members of the Simply Wall St Community estimate Alibaba’s fair value between US$107.09 and US$262.36 per share. The company’s recent focus on scaling AI solutions could create significant shifts in market sentiment, highlighting the value of reviewing a range of views before making decisions.

Explore 69 other fair value estimates on Alibaba Group Holding - why the stock might be worth 33% less than the current price!

Build Your Own Alibaba Group Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alibaba Group Holding research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Alibaba Group Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alibaba Group Holding's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success