Due to Regulatory Risks Alibaba Group Holding Limited (NYSE:BABA) is Trading at a Discount

The latest government crackdowns show that China remains a regulatory risk. Yet, as the Chinese market keeps its trajectory, its siren's song is irresistible for growth investors.

The latest market decline brought the valuations down; therefore, it is worth examining large stocks like Alibaba Group Holding Limited (NYSE:BABA).

It is no secret that regulatory pressures weigh heavily on Alibaba, as the stock declined almost 40% from the highs achieved in October 2020. These include blocking the Ant Group's IPO, a US$2.75b fine, and potential access to customer data to implement in CCP's credit scoring system.

Still, Fred Hu, a former Goldman Sachs chairman and a member of the board of directors of the Ant Group remains upbeat on the eventual IPO relaunch.

Even the latest crackdown on the for-profit tutoring sector that doesn't directly impact the company brought the shares down by 13%. The market has temporarily bottomed, but from the technical perspective, it is hard to speculate on the bullishness of the stock until it closes above $240.

Let's take a look at Alibaba Group Holding's outlook and value based on the most recent financial data to see if there are any catalysts for a price change.

Check out our latest analysis for Alibaba Group Holding

What is Alibaba Group Holding worth?

According to our valuation, the intrinsic value for the stock is $273.02, which is above what the market is valuing the company at the moment. This indicates an opportunity to buy low.

Alibaba Group Holding's share price also seems relatively stable compared to the rest of the market, as indicated by its low beta. If you believe the share price should eventually reach its true value, a low beta could suggest it is unlikely to do so anytime soon, and once it's there, it may be hard to fall back down into an attractive buying range. Monthly Beta is 0.80, meaning that the stock moves 20% less than the market.

What kind of growth will Alibaba Group Holding generate?

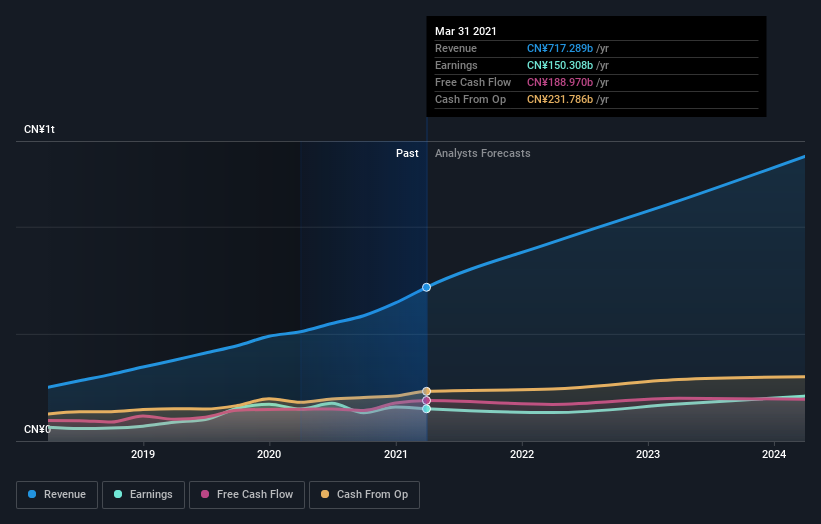

Investors looking for growth in their portfolio may want to consider a company's prospects before buying its shares. Buying a great company with a robust outlook at a low price is always a good investment, so let's also look at the company's future expectations. Alibaba Group Holding's earnings over the next few years are expected to increase by 39%, indicating a highly optimistic future ahead. This should lead to more robust cash flows, feeding into a higher share value.

What this means for you:

Are you a shareholder? Since BABA is currently undervalued, it may be a great time to increase your holdings in the stock. With an optimistic outlook on the horizon, it seems like this growth has not yet been fully factored into the share price. However, there are also other factors such as capital structure to consider, which could explain the current undervaluation.

Are you a potential investor? If you've been keeping an eye on BABA for a while, now might be the time to enter the stock. Its buoyant future outlook isn't fully reflected in the current share price yet, which means it's not too late to buy BABA. But before you make any investment decisions, consider other factors such as the strength of its balance sheet to make a well-informed buy.

While anyone can guess what the government could be next, Alibaba's sheer size is one thing to account for. The company is soon due to publish the quarterly report, expecting the annual revenue in the ballpark of US$130b. Meanwhile, the stock trades around the levels from 2 years ago when the revenue was less than half.

Diving deeper into the forecasts for Alibaba Group Holding mentioned earlier will help you understand how analysts view the stock in the future. So feel free to check out our free graph representing analyst forecasts.

If you are no longer interested in Alibaba Group Holding, you can use our free platform to see our list of over 50 other stocks with high growth potential.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives