Alibaba (NYSE:BABA) Valuation in Focus After Recent Shareholder Gains and Pullback

Reviewed by Simply Wall St

See our latest analysis for Alibaba Group Holding.

After a strong rally this year, Alibaba’s share price momentum has cooled in the past month with a 12.5% pullback. The stock still boasts an impressive 81.7% total shareholder return over the past year, setting it apart from many peers. This recent volatility may reflect shifting expectations about growth and risk, but long-term investors have seen substantial gains.

If you’re watching how big tech is performing, now is the perfect moment to widen your perspective and discover See the full list for free.

With Alibaba still trading below many analysts’ price targets and its fundamentals looking solid, investors are left to wonder: Is the market underestimating its future growth prospects, or already pricing in what comes next?

Most Popular Narrative: 43% Overvalued

The leading narrative from StefanoF puts Alibaba’s fair value much lower than the current share price, raising questions about growth assumptions and market risks. This sets the stage for a deeper look at the numbers driving such a bold valuation call.

“While Alibaba shows strong operational momentum, particularly in AI and cloud services, the current stock price appears to fully reflect near-term growth prospects given macro headwinds and geopolitical risks. Just in the end I put my doubt, why has Michael Burry sold all ?”

Curious what goes into this sharply lower fair value? There is a blend of optimism about tech expansion and tough macro headwinds. The real shock is in the projected growth rates and margin assumptions. Find out what numbers are driving this contrarian perspective before you make your next move.

Result: Fair Value of $107.09 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected regulatory shifts or the easing of US-China trade tensions could quickly challenge this overvaluation view and shift market expectations again.

Find out about the key risks to this Alibaba Group Holding narrative.

Another View: By the Numbers

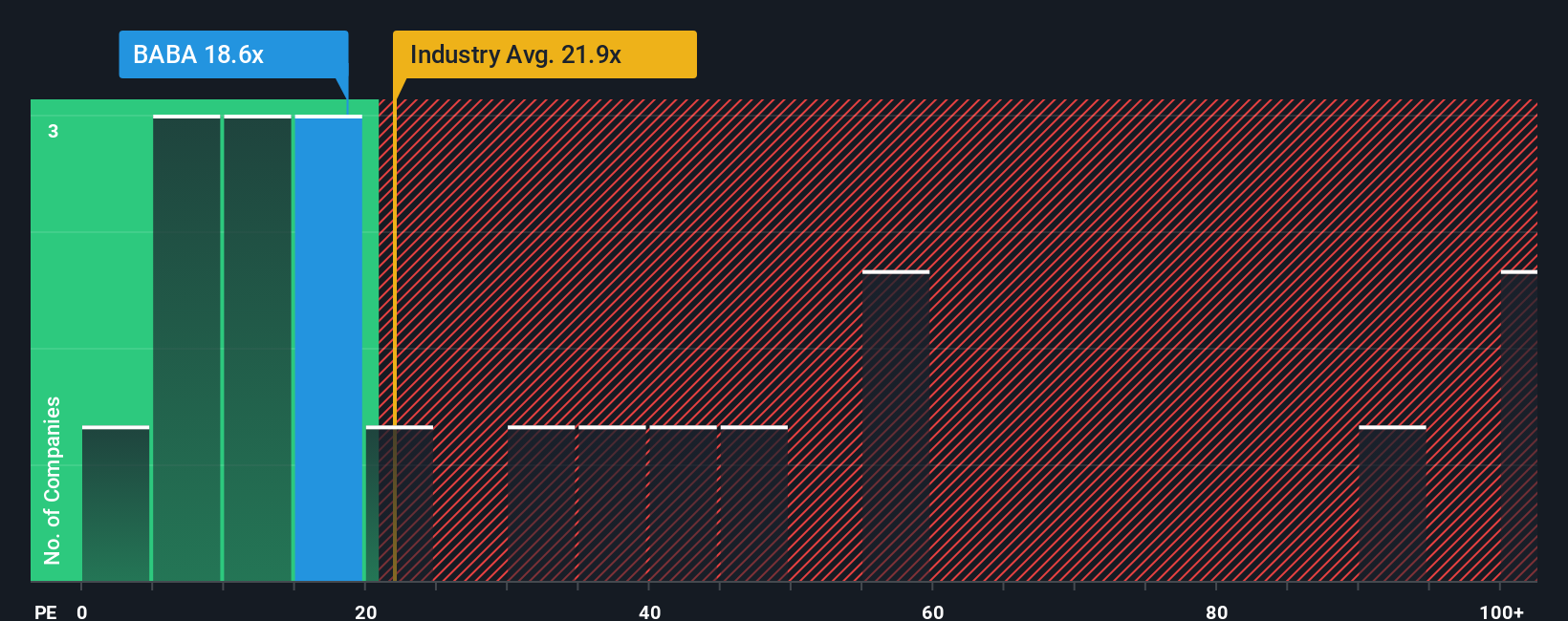

Stepping away from the discounted cash flow angle, our lens shifts to earnings multiples. Alibaba’s current price-to-earnings ratio of 16.4 is less than half the peer average of 36.1 and sits comfortably below the industry average of 19. Even compared to its own fair ratio of 27.2, there is a wide margin, suggesting investors may be overlooking potential upside or are cautious about lingering risks.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alibaba Group Holding Narrative

If you see the story differently or want to dig into the numbers yourself, crafting your own perspective takes just a few minutes. So why not Do it your way?

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Alibaba Group Holding.

Looking for more investment ideas?

Broaden your investment horizons by acting today. You could miss out on opportunities if you don’t check out other exciting sectors reshaping the market right now.

- Boost your portfolio’s income potential by checking out these 15 dividend stocks with yields > 3%, which features high-yielding companies with strong financials and consistent payout records.

- Tap into the future of medicine through these 30 healthcare AI stocks, where artificial intelligence is powering the next generation of healthcare solutions.

- Ride the momentum of cutting-edge innovation by exploring these 26 AI penny stocks, focusing on disruptive leaders harnessing artificial intelligence and automation to transform industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives