Alibaba (NYSE:BABA): Valuation in Focus After Cloud Intelligence and AI Growth Spurs Analyst Upgrades

Reviewed by Kshitija Bhandaru

Alibaba Group Holding (NYSE:BABA) just posted a major win for its Cloud Intelligence division, delivering 26% revenue growth alongside a streak of triple-digit gains in AI-related products. That kind of momentum is hard to ignore, especially when news keeps surfacing about the company’s escalating focus on advanced technology. As if to underscore growing confidence, several market-watchers recently upgraded their outlooks on Alibaba, prompting some investors to look again at just how much upside or risk might be hiding in the current share price.

The excitement around AI and cloud services has added a fresh spark to Alibaba's performance, but it’s not just hype. Over the past year, the stock has soared 87%, a far cry from its muted showing in recent years. With Alibaba’s cloud business accelerating and sustained revenue and net income growth, momentum now appears firmly on the upswing, even as the firm continues fielding hefty investments and attention at key industry events. Taken together, these shifts frame the stock’s recent climb as more than just a short-term bounce.

So the question for anyone watching from the sidelines is whether Alibaba’s value proposition is still attractive after this rally, or if the market has already factored in its next stages of growth.

Most Popular Narrative: 52% Overvalued

According to the most widely followed narrative, Alibaba's shares are currently trading significantly above what is considered their fair value. The narrative points to robust operational performance, yet suggests the current valuation incorporates most near-term growth potential.

Alibaba delivered solid FY2025 results with revenue growing 6% to RMB 996.3 billion ($137.3B). Key highlights include core e-commerce (Taobao/Tmall) customer management revenue growing 12%, Cloud Intelligence revenue accelerating to 18% growth, and AI-related products achieving triple-digit growth for the seventh consecutive quarter.

What is really driving this bold price target? The narrative points to a detailed valuation based on strong profit and revenue forecasts, together with future growth rates that could exceed expectations. However, the full list of assumptions behind this valuation might surprise even seasoned investors. Interested in which factors set this fair value apart from others? The calculations are ambitious and challenge conventional wisdom about Alibaba's true worth.

Result: Fair Value of $107.09 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks like escalating US-China trade tensions and regulatory pressures remain significant factors that could quickly reshape the outlook for Alibaba’s shares.

Find out about the key risks to this Alibaba Group Holding narrative.Another View: How Do the Numbers Stack Up?

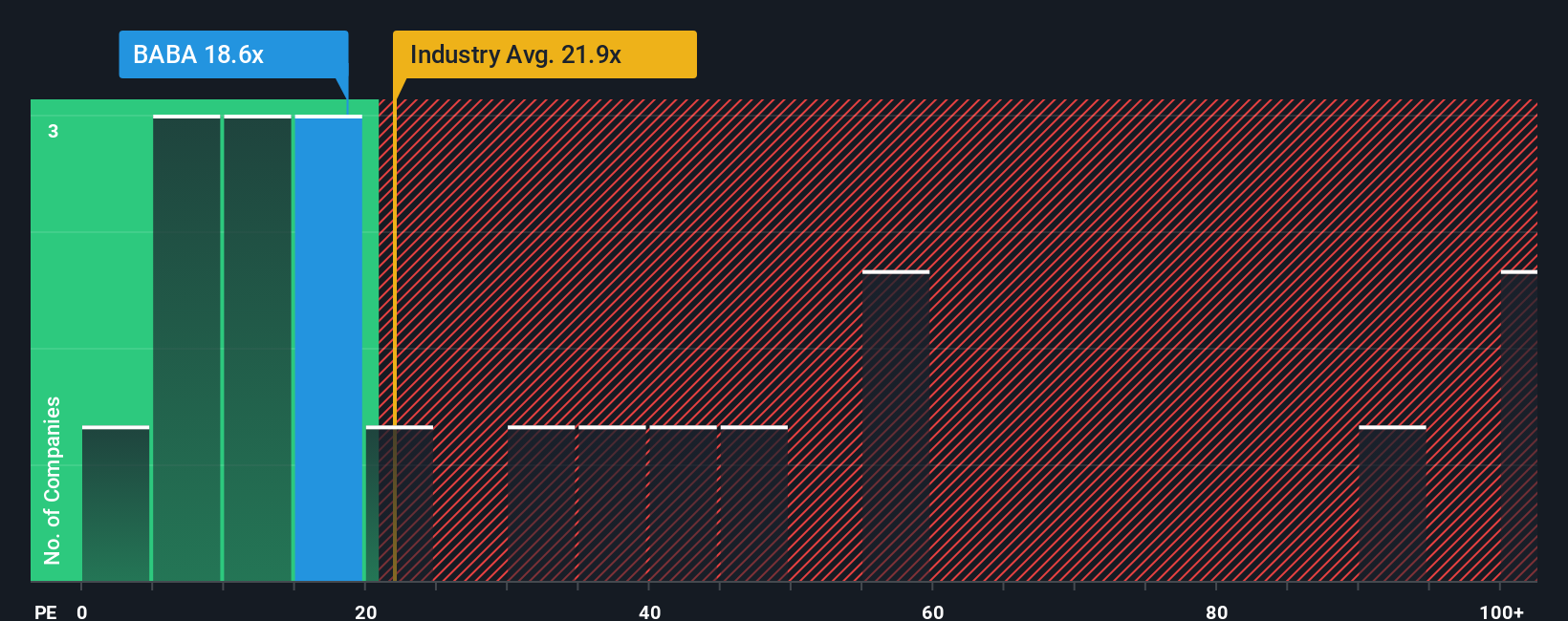

Switching gears, let’s consider how Alibaba looks through its earnings multiple versus the overall retail industry. On this measure, Alibaba actually comes through as good value compared to the industry standard, despite the overvaluation flagged by other approaches. So, is the market missing something or are these numbers hiding bigger risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alibaba Group Holding Narrative

If you think the story deserves a different angle or want to dig into the data on your own terms, it only takes a few minutes to shape your own view. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Alibaba Group Holding.

Ready for Your Next Investing Move?

Don’t stop at Alibaba. Broaden your portfolio and be first to spot high-potential stocks. Act now to access research and ideas you won’t want to miss.

- Uncover overlooked bargains by scanning for undervalued stocks based on cash flows that could offer compelling upside based on strong cash flows.

- Tap into market momentum by following AI penny stocks leading breakthroughs in artificial intelligence and next-generation tech.

- Embrace digital disruption by tracking cryptocurrency and blockchain stocks at the intersection of cryptocurrency and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success