Alibaba (BABA) Is Up 9.4% After Nvidia AI Partnership to Boost Robotics and Cloud Initiatives – What's Changed

Reviewed by Sasha Jovanovic

- Alibaba announced a major collaboration in artificial intelligence technology with Nvidia, aiming to accelerate its development of humanoid robotics and expand its AI initiatives across cloud and local services.

- This partnership comes at a time when Alibaba is significantly increasing its artificial intelligence spending and navigating U.S. restrictions on advanced AI hardware exports to China, highlighting both technological ambition and external challenges.

- We will assess how Alibaba’s expanded AI collaboration with Nvidia could reshape its investment narrative and outlook for cloud-driven growth.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Alibaba Group Holding Investment Narrative Recap

To be a shareholder in Alibaba today, you need to believe in its ability to monetize large-scale investments in AI and cloud infrastructure while maintaining competitiveness across e-commerce and local services. The latest Nvidia partnership may support cloud-driven growth and headline AI ambitions, but it does not eliminate the key short-term risk: that heavy AI and quick commerce spending still threaten near-term profitability if revenue growth does not keep pace. The most relevant recent announcement is Alibaba's extraordinary commitment to boost AI investment beyond its prior RMB 380 billion target, signaling both scale and urgency. This development pairs with the Nvidia collaboration and positions Alibaba to potentially capture enterprise cloud demand and next-generation digital services, but also intensifies the stakes for delivering adequate returns as margin pressures persist. By contrast, investors should be aware that even as optimism rises, Alibaba’s aggressive AI spending could ...

Read the full narrative on Alibaba Group Holding (it's free!)

Alibaba Group Holding's narrative projects CN¥1,260.3 billion in revenue and CN¥171.1 billion in earnings by 2028. This requires 8.0% yearly revenue growth and a CN¥22.8 billion earnings increase from current earnings of CN¥148.3 billion.

Uncover how Alibaba Group Holding's forecasts yield a $179.82 fair value, a 4% downside to its current price.

Exploring Other Perspectives

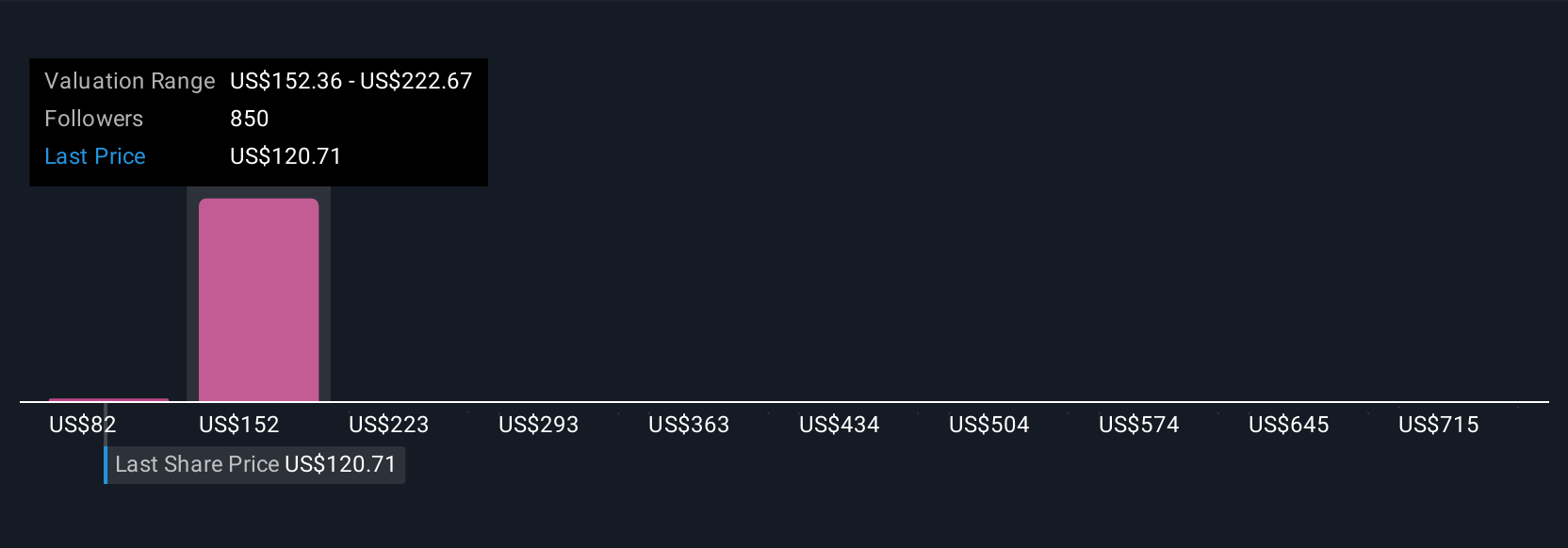

Fair value estimates for Alibaba from 82 members of the Simply Wall St Community span from CN¥107 to CN¥785, with many clustering between CN¥174 and CN¥242. While this wide range reflects sharply differing views, it is clear that the company’s escalating investments in AI and cloud are a key factor shaping expectations and could play a central role in its future returns.

Explore 82 other fair value estimates on Alibaba Group Holding - why the stock might be worth 43% less than the current price!

Build Your Own Alibaba Group Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alibaba Group Holding research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Alibaba Group Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alibaba Group Holding's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives