- United States

- /

- Specialty Stores

- /

- NYSE:AZO

AutoZone (AZO): Assessing Valuation After Analyst Upgrade and Renewed Institutional Interest

Reviewed by Simply Wall St

AutoZone (AZO) shares are in focus after receiving an upgrade from a Goldman Sachs analyst, moving from a Neutral to a Buy rating. This shift comes at a time when institutional investors are showing renewed bullish sentiment in the options market.

See our latest analysis for AutoZone.

AutoZone’s stock has been riding a wave of renewed optimism, with momentum picking up lately as investors shrug off a recent lackluster quarter and focus on the company’s long-term growth narrative. Even after a dip last month, the stock’s 18.7% year-to-date share price return and robust 24.1% total shareholder return over the past year highlight strong performance and persistent investor confidence through recent ups and downs.

If AutoZone’s upswing has you thinking about where else momentum could be building, now is an excellent chance to see who is leading the way among top auto manufacturers: See the full list for free.

With a major analyst upgrade and strengthening investor enthusiasm, the question now is whether AutoZone stock remains undervalued or if the market has already factored in its future growth prospects. Could this be a buying opportunity, or is optimism already priced in?

Most Popular Narrative: 15.6% Undervalued

AutoZone’s fair value estimate sits well above its last close, suggesting meaningful upside if current expectations play out as analysts anticipate.

The expansion of Mega-Hub locations, with an aim to open at least 19 more in the next two quarters, is expected to enhance inventory availability and support both retail and Commercial growth. This could help improve sales and operating margins.

Want to know which ambitious moves are fueling this valuation? The narrative centers on bold expansions, strategic bets, and a future profit outlook that surprises. See what’s driving the forecast and how these financial targets could influence AutoZone’s path. You’ll want to know what stands behind these bullish numbers.

Result: Fair Value of $4,569.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, factors such as persistent inflation and ongoing foreign exchange headwinds could challenge AutoZone’s sales momentum and put pressure on profit margins in the near term.

Find out about the key risks to this AutoZone narrative.

Another View: What Do The Multiples Say?

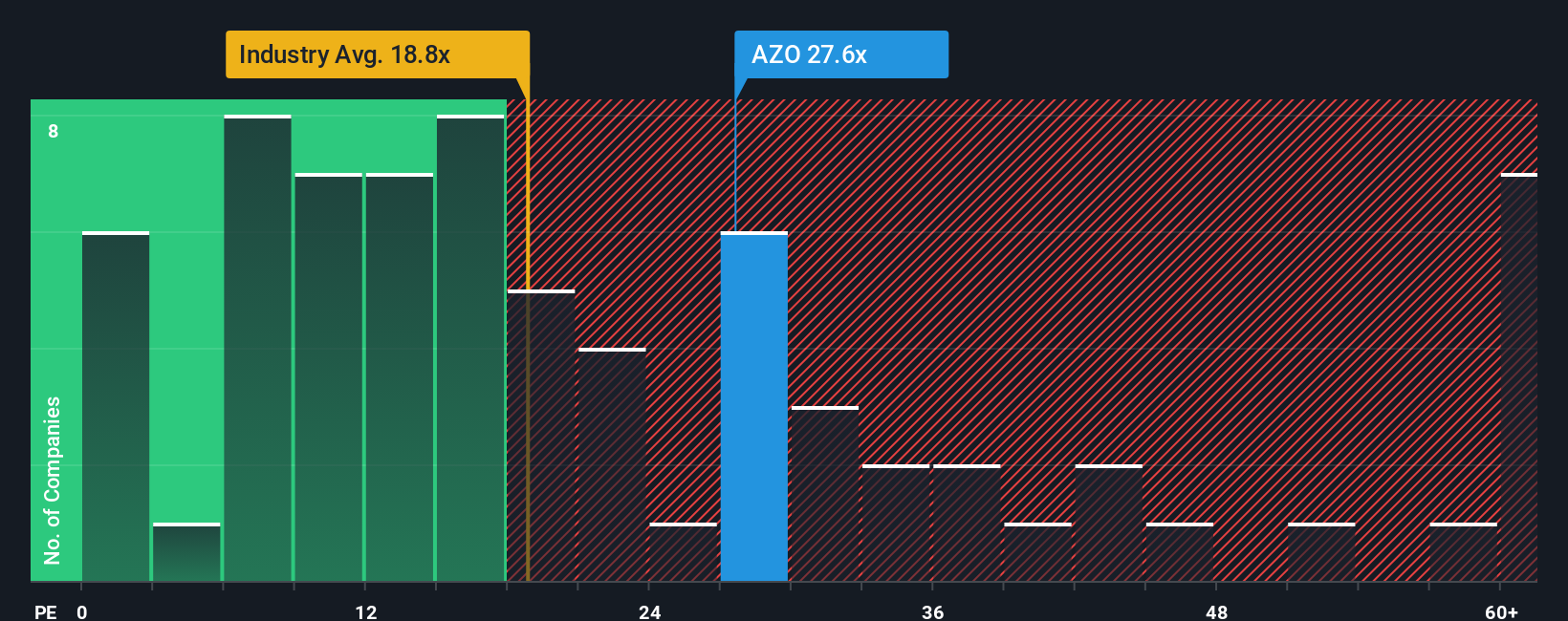

Looking at AutoZone through the lens of price-to-earnings, its valuation sits well above the industry average. AutoZone trades at 25.7 times earnings, compared to 17.6 times for the broader US specialty retail sector and a fair ratio of 19 times. This higher valuation signals the market’s strong confidence in AutoZone’s prospects, but it also raises the stakes. Investors pay a premium for future growth that must materialize. Will AutoZone deliver enough to justify the price tag?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AutoZone Narrative

If you see the numbers differently or want to craft your own story, exploring the data firsthand and shaping your version takes just a few minutes, so why not Do it your way

A great starting point for your AutoZone research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit their search to one opportunity. Make your next move with confidence by exploring unique stock ideas tailored to different themes and growth trends.

- Tap into future-shaping breakthroughs by checking out these 25 AI penny stocks, which are transforming industries with artificial intelligence innovations.

- Unlock resilient potential with steady income by considering these 16 dividend stocks with yields > 3% among companies offering attractive yields above 3%.

- Seize opportunities in rapidly evolving tech with these 26 quantum computing stocks as companies harness the latest advances in quantum computing for tomorrow's growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AZO

AutoZone

Operates as a retailer and distributor of automotive replacement parts and accessories in the United States, Mexico, and Brazil.

Limited growth with questionable track record.

Similar Companies

Market Insights

Community Narratives