- United States

- /

- Specialty Stores

- /

- NYSE:AZO

AutoZone (AZO) Announces Executive Leadership Changes as Key Officers Prepare to Retire

Reviewed by Simply Wall St

AutoZone (AZO) recently saw executive changes with the retirement announcements of Bill Hackney and Rick Smith, reaching key leadership milestones. Over the last quarter, the company's share price rose 12%, a notable performance amid the broader market ascent. This price move, potentially supported by leadership continuity efforts, contrasted with the tech sector downturn. AutoZone's strategic leadership shifts, including Eric Gould and Denise McCullough's promotions and Eric Leef's appointment, may have encouraged investor confidence, adding weight to its positive price trajectory amid an overall market uptrend. The company's momentum aligns with a period of solid market performance, reflecting broader trends.

The recent leadership changes at AutoZone, with the retirement of Bill Hackney and Rick Smith, could potentially impact future international expansion and technology investments, which form the backbone of the company's growth narrative. The elevation of key figures like Eric Gould and Denise McCullough may provide consistent strategic direction, potentially bolstering operational initiatives such as the expansion of Mega-Hub locations and the advancement of technology in distribution centers. These efforts could enhance revenue and earnings forecasts by improving inventory availability and supply chain efficiencies, offsetting some headwinds like inflation and tariffs.

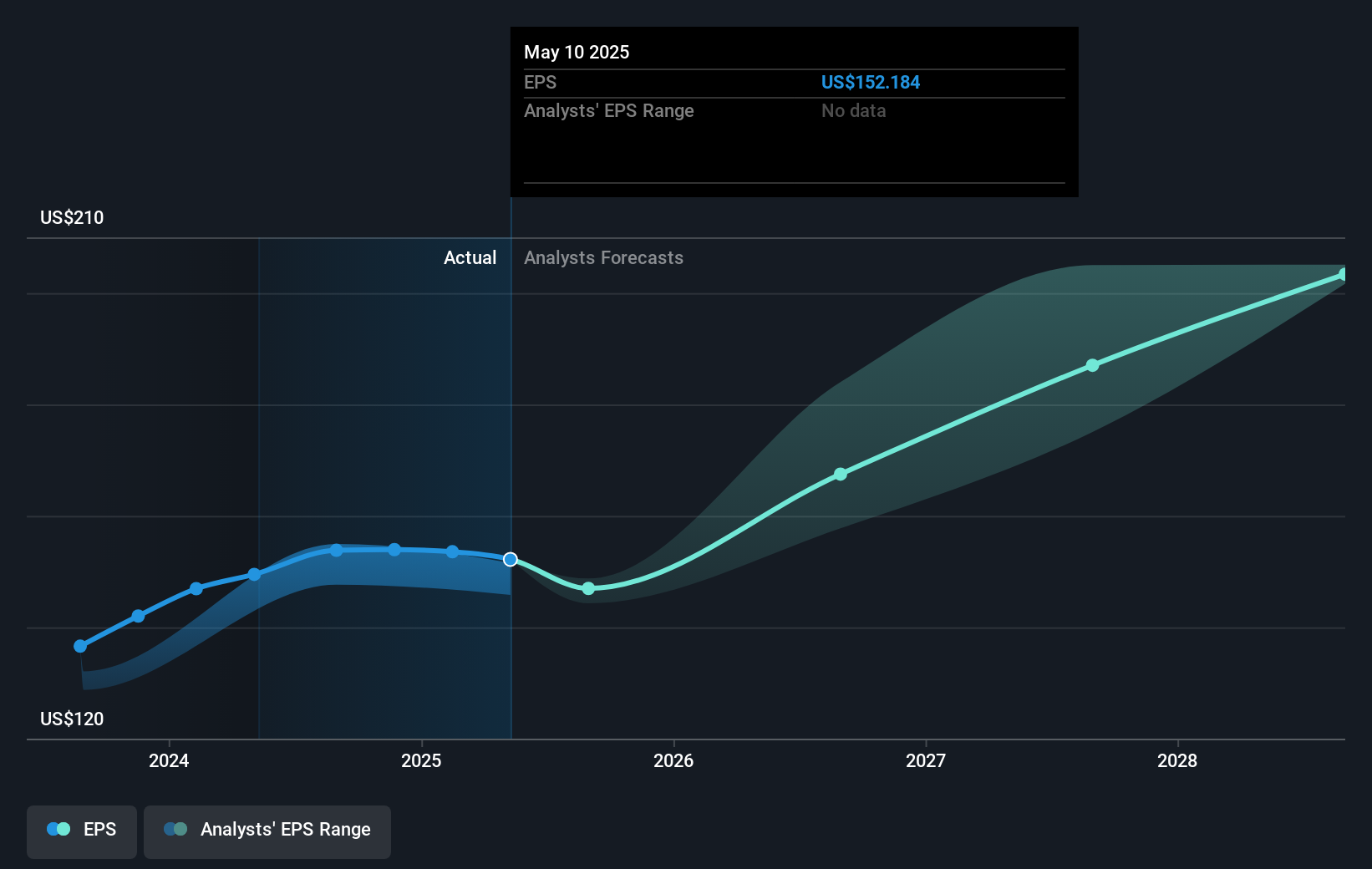

Over the past five years, AutoZone's shares have delivered a total return of 245.24%, reflecting substantial growth beyond recent quarterly improvements. While the company exceeded the US Specialty Retail industry with a past year performance, current growth prospects face challenges with inflation and foreign exchange risks. The more recent share price rise aligns with broader market trends, although it still sits slightly above the consensus analyst price target of US$4,158.83, indicating that analysts see the current pricing as fairly aligned with expected growth. As AutoZone continues focusing on store expansions and technology upgrades, the sustained performance relative to its industry peers remains an aspect to monitor.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AZO

AutoZone

AutoZone, Inc. retails and distributes automotive replacement parts and accessories in the United States, Mexico, and Brazil.

Low risk with limited growth.

Similar Companies

Market Insights

Community Narratives