- United States

- /

- Specialty Stores

- /

- NYSE:ANF

Will NFL Collaborations and Influencer Discounts Shift Abercrombie & Fitch's (ANF) Brand Momentum?

Reviewed by Sasha Jovanovic

- In early October 2025, Abercrombie & Fitch launched and promoted a new NFL apparel collection and a fresh loungewear line, featuring significant discounts and collaborations with football stars such as Christian McCaffrey and Brittany Mahomes. These initiatives aimed to attract both sports fans and trend-conscious shoppers, driving heightened brand visibility through limited-time offers and influencer partnerships.

- The ability to stack influencer discounts with the new product lines, along with quickly selling out popular colorways, reveals Abercrombie & Fitch's use of digital engagement and timely marketing to boost customer excitement and demand.

- We'll now assess how the NFL collection and enhanced promotions may affect Abercrombie & Fitch's long-term brand momentum and investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Abercrombie & Fitch Investment Narrative Recap

To be a shareholder in Abercrombie & Fitch, you need to believe in its ability to drive brand relevance and sustainable revenue through digital engagement, partnerships, and targeted product launches. The latest NFL apparel collection and influencer-driven promotions may build near-term excitement, but their impact on the company’s most pressing issue, restoring core brand momentum after recent year-over-year sales declines, remains limited. The biggest short-term risk continues to be sustained weakness in Abercrombie brand sales and the challenge of reestablishing pricing power.

One recent and highly relevant announcement is Abercrombie & Fitch's multi-year partnership with the Dallas Cowboys as their Official Fashion Partner, extending licensed NFL merchandise into high-visibility markets. This collaboration ties into the current promotional push and may support the company’s effort to widen its reach among sports fans and address comparable sales softness in key product categories.

However, investors should also be mindful that even strong collaborations may not offset the underlying risk of ongoing brand sales declines and...

Read the full narrative on Abercrombie & Fitch (it's free!)

Abercrombie & Fitch's outlook points to $5.8 billion in revenue and $489.4 million in earnings by 2028. This assumes a 4.3% annual revenue growth rate but a decrease in earnings of $51.6 million from the current $541.0 million.

Uncover how Abercrombie & Fitch's forecasts yield a $114.62 fair value, a 36% upside to its current price.

Exploring Other Perspectives

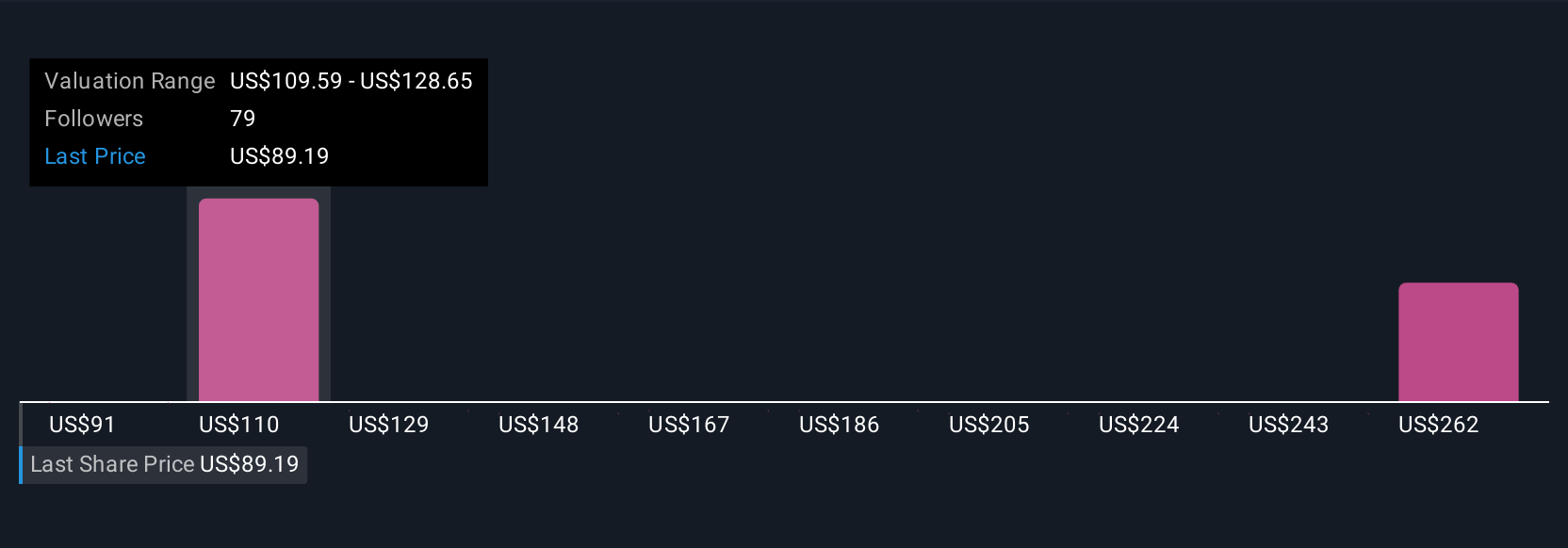

Fourteen individual fair value estimates from the Simply Wall St Community for Abercrombie & Fitch range widely from US$83.08 to US$164.27 per share. While opinions differ, the challenge to restore brand momentum after recent core sales weakness is a theme many are watching closely with larger implications for future returns.

Explore 14 other fair value estimates on Abercrombie & Fitch - why the stock might be worth as much as 94% more than the current price!

Build Your Own Abercrombie & Fitch Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Abercrombie & Fitch research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Abercrombie & Fitch research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Abercrombie & Fitch's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANF

Abercrombie & Fitch

Through its subsidiaries, operates as an omnichannel retailer in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives