- United States

- /

- Specialty Stores

- /

- NYSE:ANF

Abercrombie & Fitch (NYSE:ANF) Sees 12% Increase In Share Price Over The Past Month

Reviewed by Simply Wall St

Abercrombie & Fitch (NYSE:ANF) recently experienced a notable 12% increase in its share price over the past month. This price movement aligns somewhat with broader market trends, where tech and crypto-related stocks have seen gains, though the S&P 500 and Nasdaq saw fluctuations due to trade talks and labor market data. While the company’s rise can be partly attributed to general positive market conditions, there were no specific events directly impacting ANF during this period. Investors are likely keeping an eye on both global economic indicators and sector performance as they assess potential impacts on retail stocks.

You should learn about the 1 warning sign we've spotted with Abercrombie & Fitch.

The recent 12% rise in Abercrombie & Fitch's share price aligns with a broader market upswing, though the company's strong five-year total return of over 756% shows a very large appreciation beyond short-term movements. This long-term performance reflects the benefits of its international expansion and focus on digital shopping enhancements, which have driven revenue and margin improvements. However, over the past year, ANF underperformed both the US market, which returned 13.9%, and the US Specialty Retail industry, which grew by 11.1%.

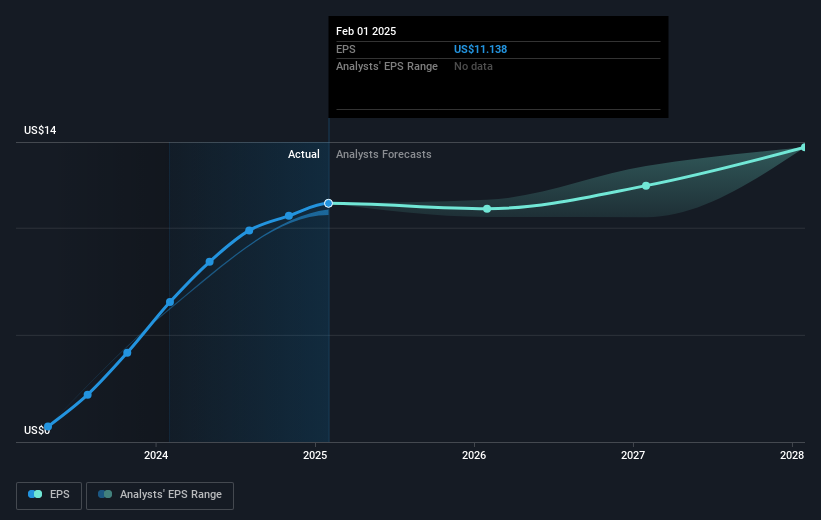

While there are no specific recent events to explain the price boost, potential impacts on future revenue and earnings can't be dismissed. Positive market conditions might enhance consumer sentiment, potentially translating to increased sales revenue, especially as ANF ventures further into online retail. However, analysts anticipate modest revenue growth of 3.1% annually over the next three years, with some margin compression from 11.4% to 10.3%.

The share price of US$69.59 positions ANF at a significant discount to the US$121.47 analyst price target, suggesting market skepticism about achieving forecast earnings of US$559 million by May 2028. With expectations of trading at a 11.3x price-to-earnings ratio in 2028, the attractiveness of the current valuation may hinge on operational success and strategic execution in line with their digital and international aspirations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANF

Abercrombie & Fitch

Through its subsidiaries, operates as an omnichannel retailer in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives