- United States

- /

- Specialty Stores

- /

- NYSE:AN

Can AutoNation’s (AN) Used-Car Lending Approach Redefine Affordability for the Aging Vehicle Market?

Reviewed by Sasha Jovanovic

- AutoNation recently addressed the used vehicle financing landscape, highlighting that high loan-to-value ratios on older models are less problematic than widely assumed and that customers can still secure financing despite elevated prices due to dealership reconditioning.

- This perspective, echoed by Lithia Motors, suggests continued consumer access to credit for "value" used vehicles, which may support ongoing demand and ease prior concerns about affordability in the aging vehicle segment.

- We'll explore how AutoNation’s positive stance on accessible used-vehicle financing may influence its long-term growth expectations and business outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

AutoNation Investment Narrative Recap

To be a shareholder in AutoNation, you need to believe that its dealership network, focus on after-sales, and efforts in used vehicle sourcing and financing can offset disruption from digital competitors and shifts in consumer vehicle preferences. The recent update around used car financing should alleviate some immediate fears about demand or margin pressure, but it does not materially change the primary catalysts or the core risks linked to margin compression due to rising digital competition. Of recent announcements, the $700 million asset-backed securitization deal completed this May stands out as most relevant. This transaction, which supports AutoNation’s automobile loan portfolio, reinforces the company's commitment to making used vehicle financing accessible, aligning closely with its optimistic stance on credit availability for “value” models in the current market. However, in contrast to improving access to used car credit, investors should be aware of how rising digital retail competition could still impact…

Read the full narrative on AutoNation (it's free!)

AutoNation's narrative projects $29.9 billion in revenue and $871.6 million in earnings by 2028. This requires 2.9% yearly revenue growth and a $237.8 million increase in earnings from $633.8 million today.

Uncover how AutoNation's forecasts yield a $233.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

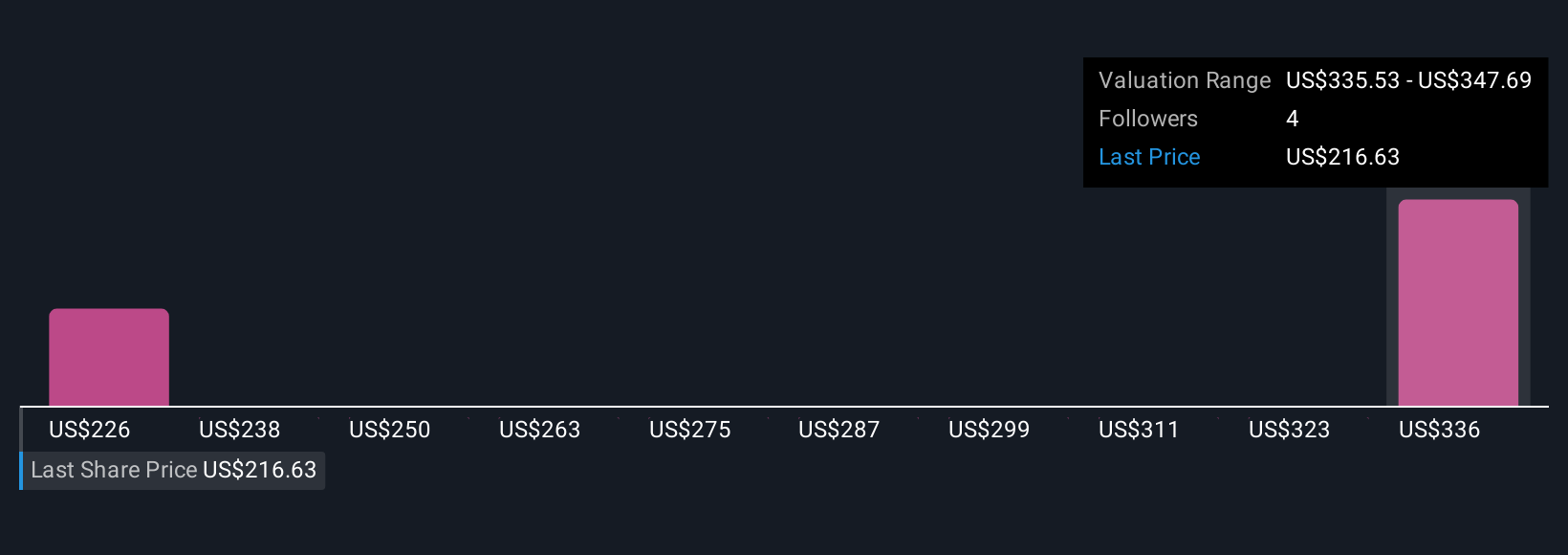

The Simply Wall St Community fair value estimates for AutoNation, ranging from US$233 to US$347.85 across two contributors, highlight varying views on company prospects. While opinions differ significantly, margin pressure from digital-first competitors remains a persistent theme, consider how this could influence longer-term industry profitability as you review the data.

Explore 2 other fair value estimates on AutoNation - why the stock might be worth as much as 62% more than the current price!

Build Your Own AutoNation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AutoNation research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AutoNation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AutoNation's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AN

AutoNation

Through its subsidiaries, operates as an automotive retailer in the United States.

Good value with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success