- United States

- /

- Specialty Stores

- /

- NYSE:AEO

Where Does AEO Stand After Its 25% Surge and Upbeat Q1 Results?

Reviewed by Bailey Pemberton

Trying to figure out whether American Eagle Outfitters is a buy right now? You are not alone. With stocks like this one, where you see both wild swings and familiar brands, nailing down whether shares are undervalued or overhyped can really pay off. Over the past month, American Eagle’s stock has climbed an eye-catching 25.5%, even after a dip of 4.8% in just the last week. The year-to-date number is slightly negative at -1.1%, but look further back and there is a 69.6% return over three years and 25.3% for five. Clearly, there have been some bumps in the road. Shares are still down 18.7% across the past year, but momentum has picked up recently as investors factor in improving industry sentiment.

Some of this rebound ties in with bigger market shifts, including renewed optimism around consumer spending and a rotation into retail names that had lagged during economic uncertainty. It seems the risk profile is evolving, and perceptions about American Eagle’s potential are adjusting with it. But if you are trying to judge whether the move is justified, you will want to zoom in on the numbers. Our valuation score pegs American Eagle Outfitters as undervalued in 3 out of 6 key checks, giving it a value score of 3. That is not a slam dunk, but it is enough to dig deeper, especially if you are searching for discounted retail stocks with upside.

Let us break down each valuation approach individually. Stay with me until the end, because there is a smarter way to make the final call on what the stock is really worth.

Why American Eagle Outfitters is lagging behind its peers

Approach 1: American Eagle Outfitters Discounted Cash Flow (DCF) Analysis

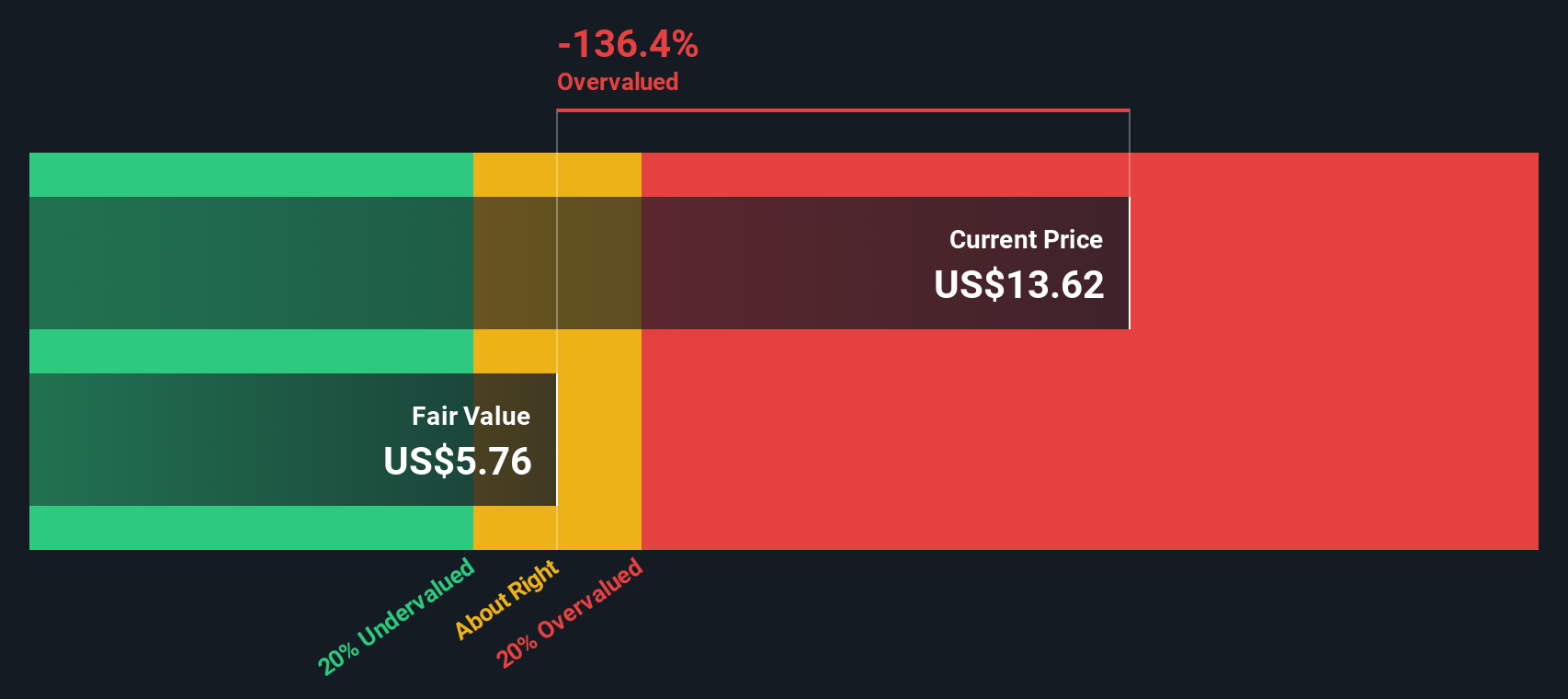

The Discounted Cash Flow (DCF) model involves projecting a company’s future cash flows and then discounting them to their present value to estimate the business’s intrinsic worth. For American Eagle Outfitters, this means evaluating current free cash generation and considering how this figure might change in the coming years.

Currently, American Eagle’s last twelve months free cash flow is $188.2 million. Analyst projections indicate this figure may decline, with free cash flow expected to reach $136 million by 2028. Simply Wall St extends these forecasts through 2035, with estimates moving from $194.8 million in 2026 down to approximately $52.8 million by 2035, after applying discount rates. All amounts are in US dollars.

According to these cash flow scenarios, the DCF model estimates American Eagle Outfitters has an intrinsic value of $9.88 per share. This is 71.6% below the current market price, suggesting the stock may be significantly overvalued when judged purely on discounted cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests American Eagle Outfitters may be overvalued by 71.6%. Find undervalued stocks or create your own screener to find better value opportunities.

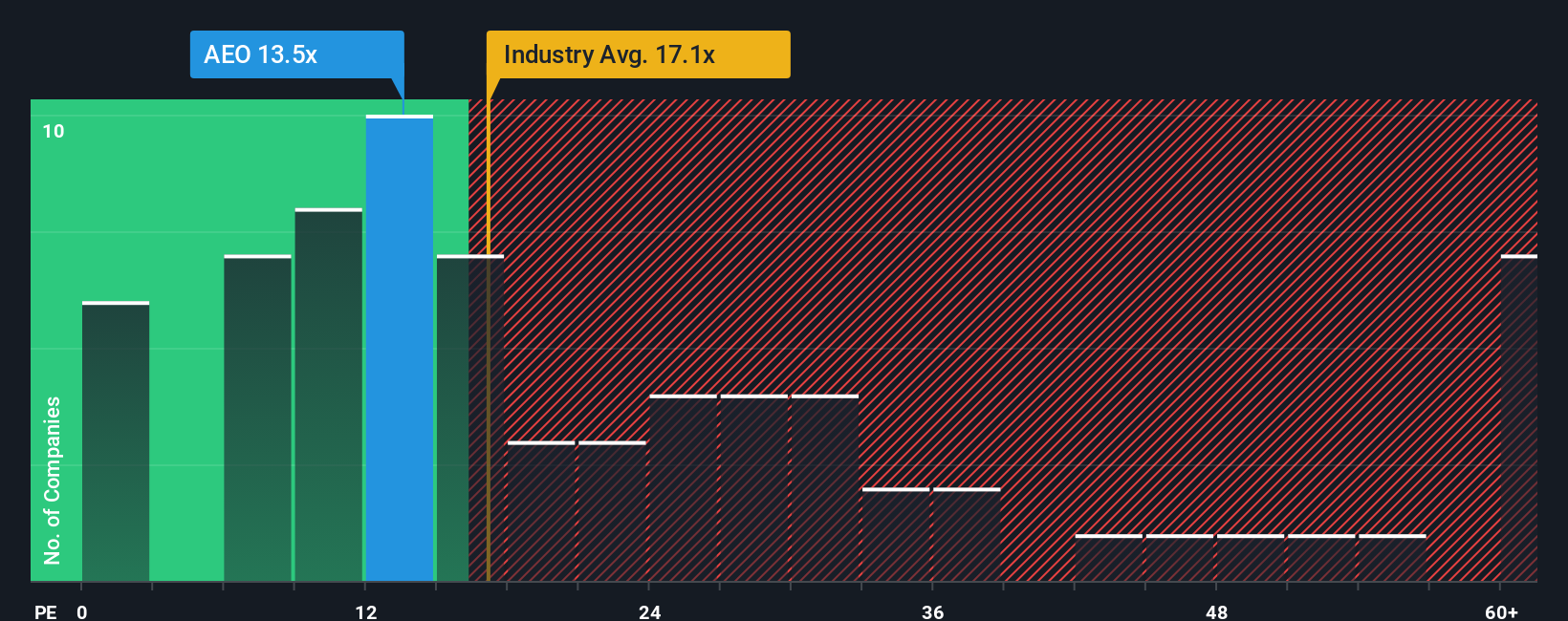

Approach 2: American Eagle Outfitters Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular valuation method for profitable companies like American Eagle Outfitters because it links the share price with the company’s earning power. A “normal” or fair PE ratio is influenced by expected earnings growth and the level of risk investors perceive. Faster growth and lower risk often justify a higher PE multiple, while slower growth or greater uncertainty typically result in a lower ratio.

American Eagle is currently trading at a PE ratio of 14.6x. For context, this is below the Specialty Retail industry average of 17.2x and also lower than the peer average of 16.0x. While being priced lower than peers may be a positive sign, it is important to remember that simple comparisons do not tell the whole story.

This is where Simply Wall St’s proprietary “Fair Ratio” is useful. The Fair Ratio, calculated at 23.2x for American Eagle, adjusts for factors such as the company’s earnings growth outlook, margins, market cap, and industry risks. By considering these additional factors, the Fair Ratio offers a more tailored benchmark for what the company could be worth at present. With a current PE of 14.6x compared to a Fair Ratio of 23.2x, American Eagle Outfitters may appear undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your American Eagle Outfitters Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce Narratives, a smarter, more dynamic method for making investment decisions that moves beyond just numbers. A Narrative is essentially your own story or viewpoint about a company, combining your assumptions about future revenue, earnings, and margins into a personalized financial forecast and resulting fair value.

Narratives link the events shaping American Eagle Outfitters’ business to your financial estimates, then tie those to what you think the shares are truly worth. Available on Simply Wall St’s Community page (used by millions of investors), Narratives make this process easy and approachable for everyone, whether you are a seasoned investor or just getting started.

With Narratives, you can instantly see whether your fair value (based on your unique assumptions) is above or below the current share price, helping you decide if now is the right time to buy or sell. They update automatically whenever fresh news or earnings data arrives, so your view is always relevant.

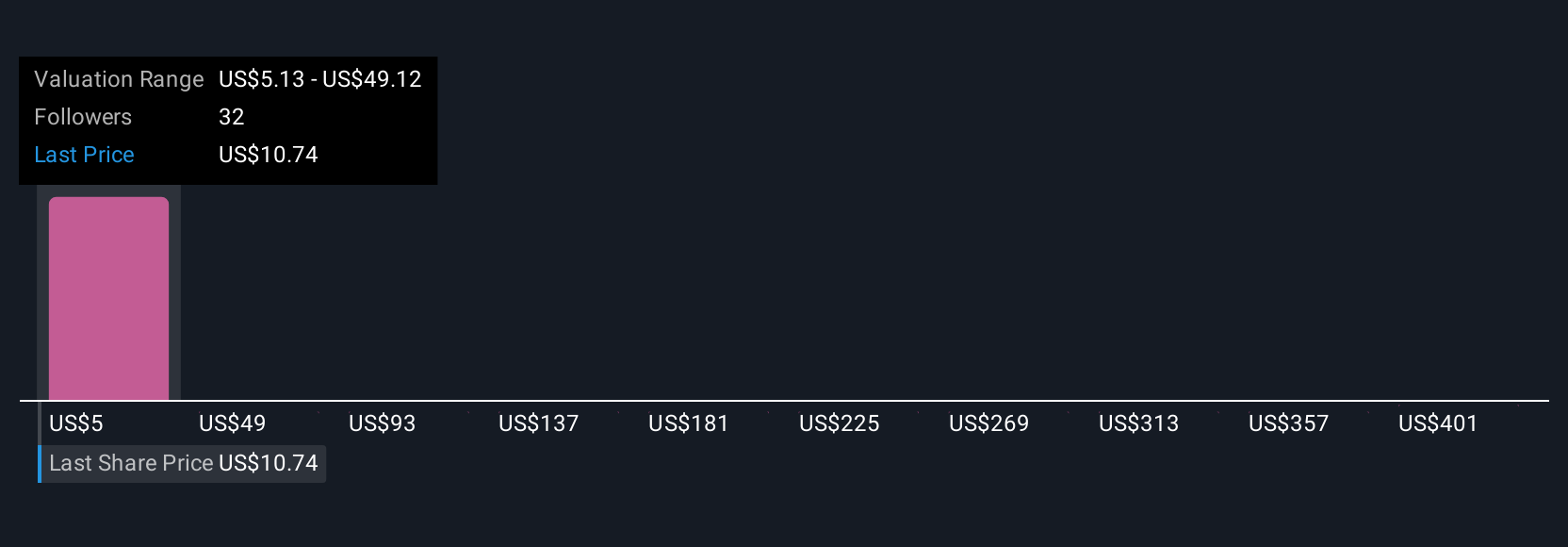

For example, on American Eagle Outfitters, some investors see strong brand momentum and project a fair value as high as $21.50, while others are more cautious due to margin pressures and set their fair value closer to $10.00. Narratives let you compare these views and easily craft your own.

Do you think there's more to the story for American Eagle Outfitters? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEO

American Eagle Outfitters

Operates as a multi-brand specialty retailer in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives