- United States

- /

- Specialty Stores

- /

- NYSE:AEO

What Do Recent Earnings Mean for the Future Value of American Eagle?

Reviewed by Bailey Pemberton

If you have ever stared at your portfolio and wondered what to do with those American Eagle Outfitters shares, you are not alone. With price swings that could make even seasoned investors do a double-take lately, figuring out the next move is the million-dollar question. Consider this: in just the past week, the stock popped up 4.5%. Yet if you zoom out, there are some sobering numbers, like a nearly 25% drop over the past month and a 26.6% slide in the past year. Still, for those who have stuck around since 2021 or even longer, American Eagle Outfitters is up 57% in three years and 17.3% in five years. This shows resilience when given enough time on the clock.

Much of this recent volatility can be traced back to shifting retail trends and a constant buzz around how brick-and-mortar brands like American Eagle are adapting to shoppers’ evolving habits. Market jitters about consumer strength and inventory levels have played a part in those short-term dips, yet the company’s longer-term gains hint that there is still belief out there in its ability to find a profitable niche.

When you stack up American Eagle Outfitters’ valuation, things get especially interesting. Out of six key checks that analysts use to sniff out undervalued stocks, AEO passes three. That gives it a value score of 3. Is that “undervalued enough” to make it a bargain, or are there warning signs hiding under the hood?

Let’s take a closer look at what those valuation numbers really mean, and by the end, we will dig into a smarter way to judge value that most investors overlook.

Why American Eagle Outfitters is lagging behind its peers

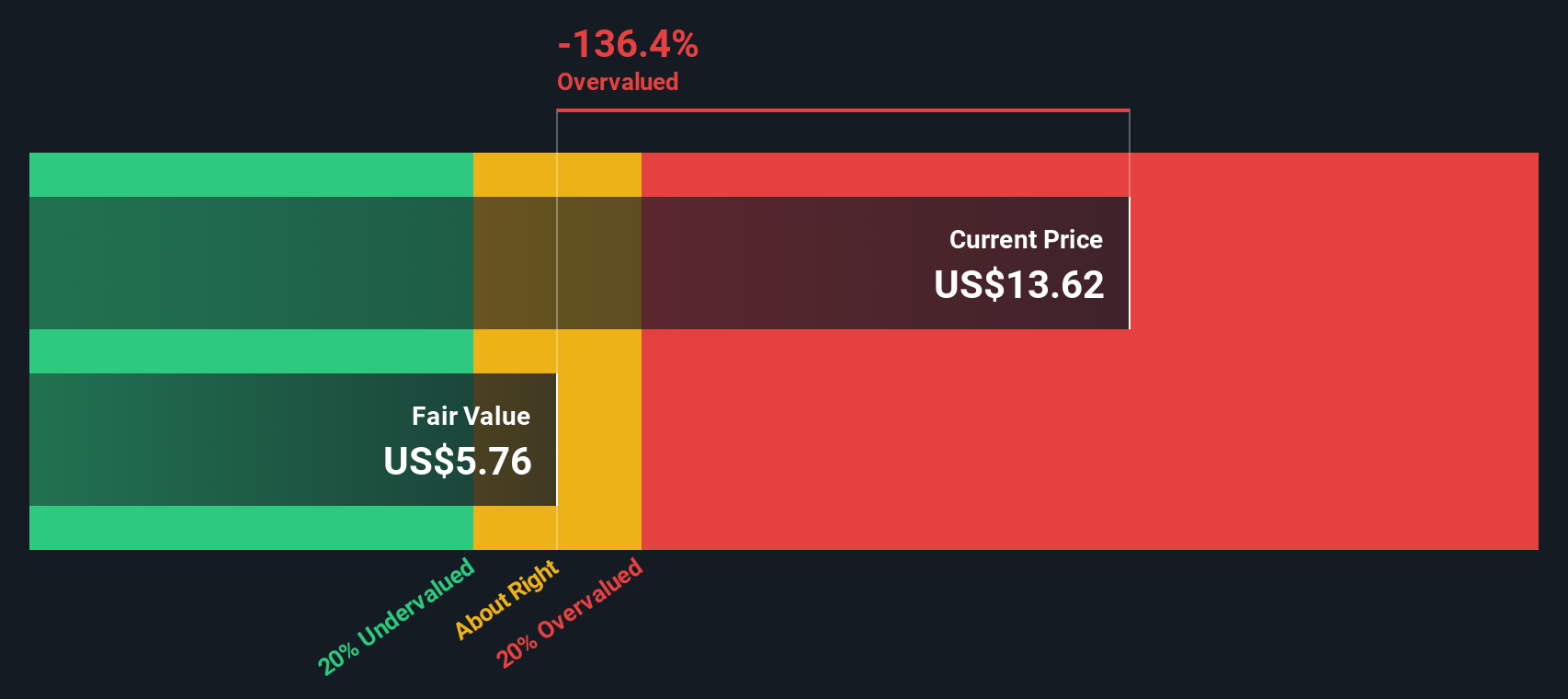

Approach 1: American Eagle Outfitters Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting those flows back to today’s dollars. This approach aims to answer what the business is really worth based on its cash-generating potential, rather than just its current market sentiment.

For American Eagle Outfitters, the latest reported Free Cash Flow stands at $188.2 million. Analysts provide estimates for the next five years, reflecting a mixed outlook, with projected Free Cash Flow expected to decrease to $157 million by 2028. Beyond this point, Simply Wall St extrapolates the numbers out to 2035, where Free Cash Flow is forecasted to hold near the same range, indicating only modest growth.

Given these projections, the DCF model arrives at an intrinsic fair value of $10.23 per share. However, compared to the recent market price, this calculation suggests American Eagle Outfitters stock is 46.1% overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests American Eagle Outfitters may be overvalued by 46.1%. Find undervalued stocks or create your own screener to find better value opportunities.

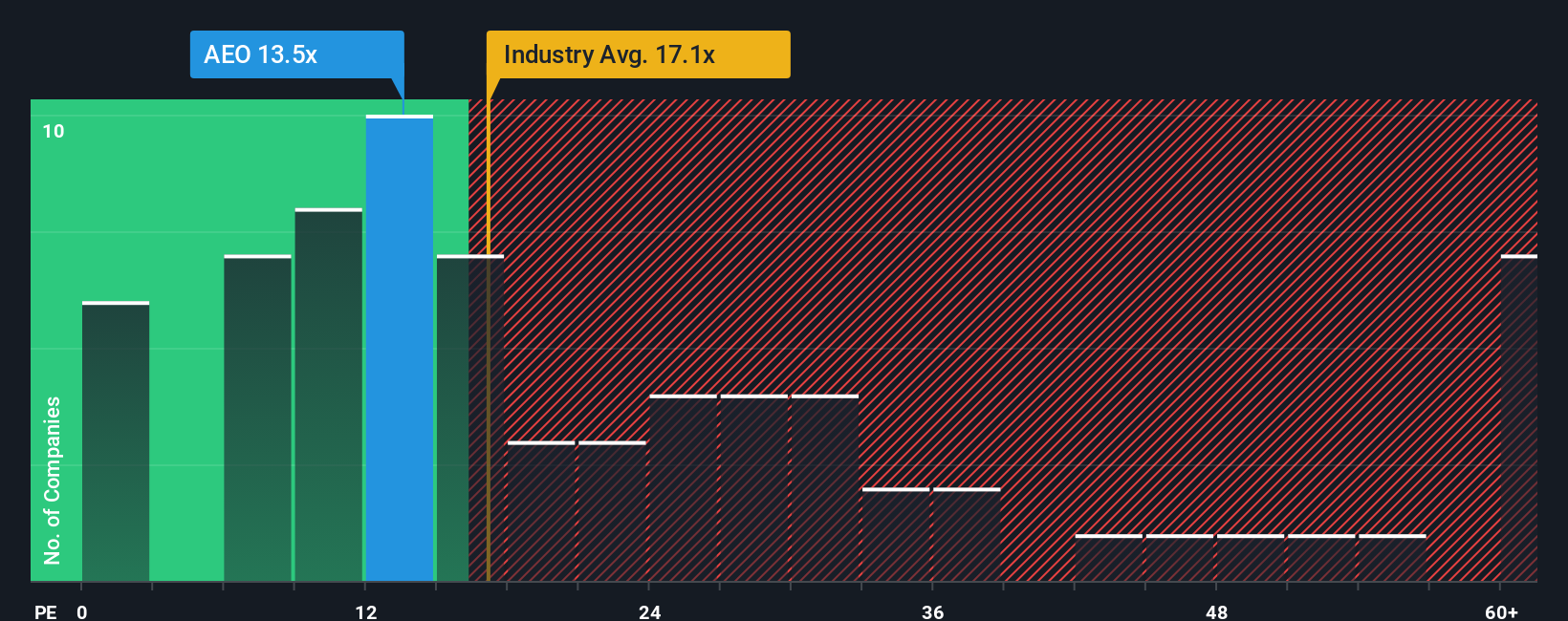

Approach 2: American Eagle Outfitters Price vs Earnings

When it comes to valuing profitable companies like American Eagle Outfitters, the Price-to-Earnings (PE) ratio tends to be a go-to metric. The PE ratio is especially useful because it shows how much investors are willing to pay for each dollar of earnings, which makes it easier to gauge whether a stock is pricey or a potential bargain.

The “right” PE ratio for any company does not exist in a vacuum. It is shaped by expectations around earnings growth, profit stability, and the level of risk investors see ahead. Fast-growing or low-risk firms generally get higher PE multiples, while mature or riskier companies trade closer to the industry average.

Currently, American Eagle Outfitters trades at a PE ratio of 12.8x. This is below both the specialty retail industry average of 16.1x and the peer group average of 17.1x. Rather than simply comparing with benchmarks, Simply Wall St calculates a unique “Fair Ratio” for AEO, which stands at 22.9x. The Fair Ratio goes beyond surface-level comparisons by factoring in detailed aspects like earnings growth prospects, profit margins, industry dynamics, company size, and risks. This makes it a much sharper lens than industry or peer averages alone.

Comparing the Fair Ratio to the actual PE, American Eagle Outfitters' 12.8x multiple is well below its Fair Ratio of 22.9x. This points to the stock being undervalued by this measure, suggesting the market may be overlooking AEO’s strengths and future potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

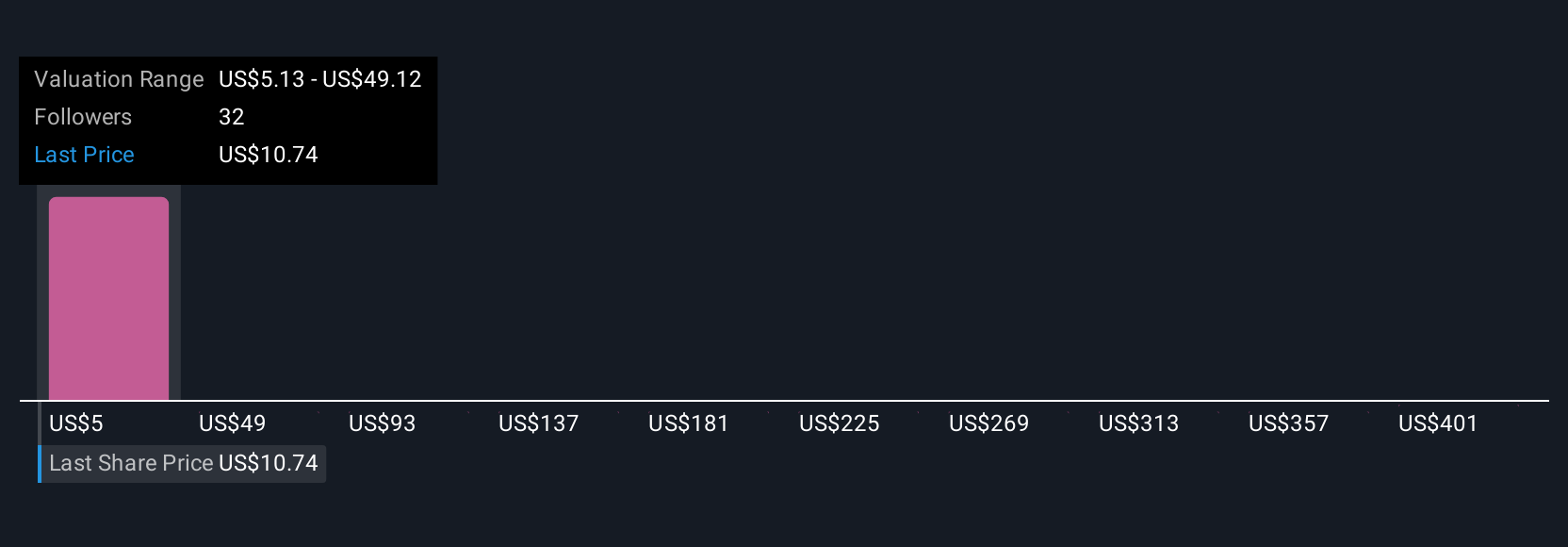

Upgrade Your Decision Making: Choose your American Eagle Outfitters Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your chance to connect your perspective, or story, on a company directly to the numbers by outlining what you believe about its future revenue, earnings, and margins, then seeing how that translates into a fair value.

Unlike traditional analysis, Narratives help you link what is happening with American Eagle Outfitters, such as brand launches, supply chain improvements, or market risks, to a full financial forecast in a few easy steps. On Simply Wall St’s Community page, millions of investors build and share Narratives, making it a simple, accessible tool for any user to visualize how their own story about the company lines up against others and the current price.

These Narratives are updated live whenever big news, earnings results, or macro factors emerge, enabling you to instantly see how fresh information could tip your buy or sell decision by comparing your Fair Value to the market price.

For example, some investors believe American Eagle Outfitters could be worth as much as $21.50 per share by 2028, driven by confident revenue and margin growth. Others see a more cautious scenario, with a fair value closer to $10.00 if consumer uncertainty and costs drag on profits.

Do you think there's more to the story for American Eagle Outfitters? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEO

American Eagle Outfitters

Operates as a multi-brand specialty retailer in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives