- United States

- /

- Specialty Stores

- /

- NYSE:AEO

Is American Eagle Outfitters’ (AEO) Efficiency Drive Enough to Offset Tariff Headwinds and Soft Sales?

Reviewed by Sasha Jovanovic

- In recent days, American Eagle Outfitters reported a trend of increasing return on capital employed and efficiencies despite a flat capital base, while outlining tariff mitigation measures to reduce expected costs from US$180 million to US$70 million for the fiscal year ending January 2026.

- The company's outlook points to limited comparable sales growth for the remainder of 2025, amid heightened inventory levels, ongoing tariff risks, and shifting consumer spending priorities across the retail sector.

- We will explore how American Eagle Outfitters' efforts to address tariff pressures and improve efficiencies may reshape its investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

American Eagle Outfitters Investment Narrative Recap

To invest in American Eagle Outfitters, you need to believe that its operational improvements, focus on supply chain efficiencies, and management of tariff pressures can sustain steady returns, even with flat comparable sales and ongoing consumer uncertainty. While recent news highlights significant tariff mitigation lowering expected costs, the flat sales outlook and elevated inventories mean the near-term catalyst remains efficient cost control; the biggest risk is persistent margin pressure from inventory and consumer spending shifts. Among recent developments, the company’s plan to reduce expected tariff costs from US$180 million to US$70 million by early 2026 directly addresses a core operational risk and is timely, given current inventory levels and shifting consumer demand. This move could help protect margins in the short term, especially as sales growth remains limited. Yet, keep in mind, even with cost-saving measures in place, the impact of softer consumer demand and the risk it poses to revenue shouldn't be overlooked...

Read the full narrative on American Eagle Outfitters (it's free!)

American Eagle Outfitters is projected to reach $5.6 billion in revenue and $340.2 million in earnings by 2028. This outlook depends on annual revenue growth of 2.2% and a $143.1 million increase in earnings from the current level of $197.1 million.

Uncover how American Eagle Outfitters' forecasts yield a $15.94 fair value, in line with its current price.

Exploring Other Perspectives

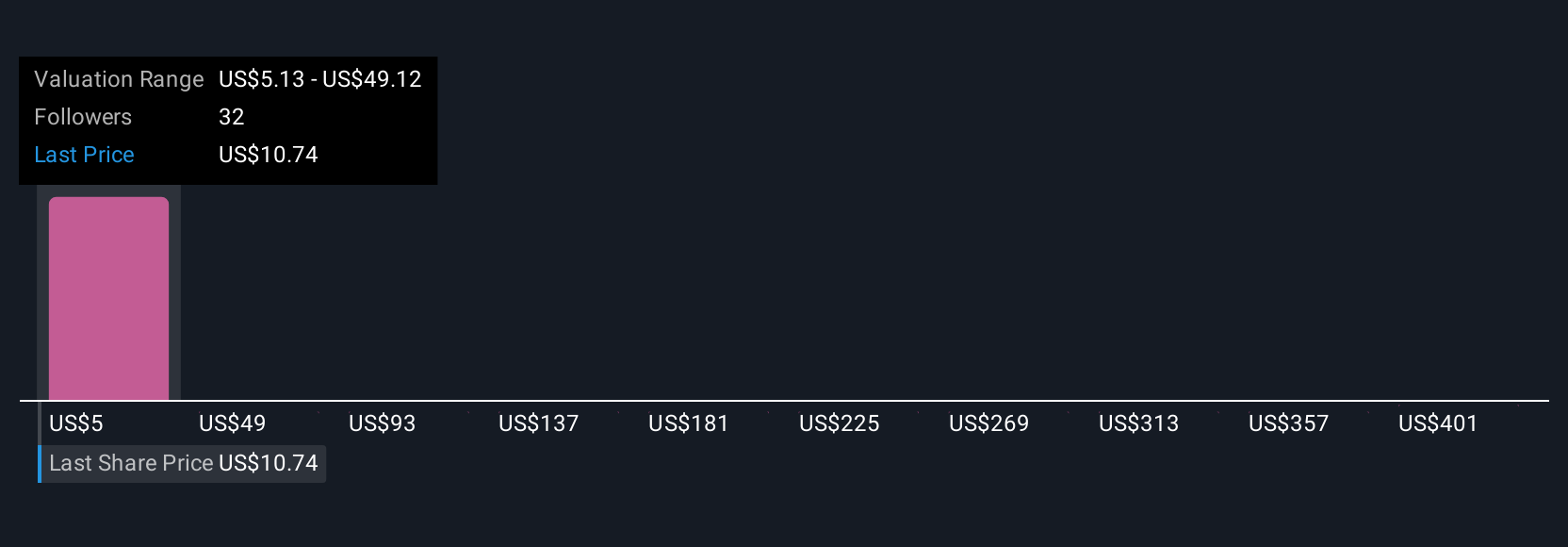

Simply Wall St Community contributors value American Eagle Outfitters anywhere from US$9.13 to US$445.03 per share across 9 different analyses. While opinions vary, ongoing margin pressures from inventory buildup highlight the importance of tracking both risks and cost recovery potential when reviewing company performance.

Explore 9 other fair value estimates on American Eagle Outfitters - why the stock might be a potential multi-bagger!

Build Your Own American Eagle Outfitters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Eagle Outfitters research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free American Eagle Outfitters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Eagle Outfitters' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEO

American Eagle Outfitters

Operates as a multi-brand specialty retailer in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives