- United States

- /

- Specialty Stores

- /

- NYSE:AEO

American Eagle Outfitters (AEO): Evaluating Value as Investor Interest Surges and Earnings Recovery Is Forecast

Reviewed by Simply Wall St

If you have been eyeing American Eagle Outfitters (AEO) lately, you are not alone. The company's name has appeared across financial newsfeeds and seen a surge in investor searches, which often points to shifting sentiment or the early stages of a trend. With attention building, what is catching investors’ eyes are not just short-term results but the disconnect between clearly flagged near-term challenges and the possibility of a turnaround in the coming year. At the same time, the stock trades at what looks like a considerable discount compared to other retailers.

Looking more closely, American Eagle’s recent performance tells a story of momentum shifts. Shares have jumped nearly 24% in the past month and posted a gain of 16% over the past three months, reversing a longer-term slide that has seen the stock down 41% over the past year. Even as annual revenue and net income growth have remained positive, the share price has not kept up. This could reflect concerns about falling earnings this year or the market’s uncertainty regarding the recovery timeline.

This divergence raises a critical question: Is the stock’s discounted price offering real value after a rough year, or is the market already factoring in every bit of future growth? Let’s take a closer look at what the numbers say.

Most Popular Narrative: 10.1% Overvalued

According to community narrative, American Eagle Outfitters is currently trading above its assessed fair value by 10.1%. The narrative points to modest future growth, margin pressures, and consensus among analysts that the stock is slightly overvalued relative to its outlook.

“The analysts have a consensus price target of $11.667 for American Eagle Outfitters based on their expectations of its future earnings growth, profit margins, and other risk factors. However, there is a degree of disagreement among analysts, with the most bullish setting a price target of $19.0 and the most bearish setting a price target of just $9.0.”

Is analyst caution overlooking a hidden turnaround story, or are the numbers too stubborn to ignore? There is one assumption in this narrative that, if adjusted, could significantly change the conclusion. Want to see the figure the consensus relies on and how the outlook shifts if it changes? Explore further to understand what is driving this valuation assessment.

Result: Fair Value of $11.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, factors such as persistent consumer uncertainty or weaker-than-expected first-quarter sales could quickly challenge today's valuation outlook and shift sentiment again.

Find out about the key risks to this American Eagle Outfitters narrative.Another View: SWS DCF Model Suggests a Different Story

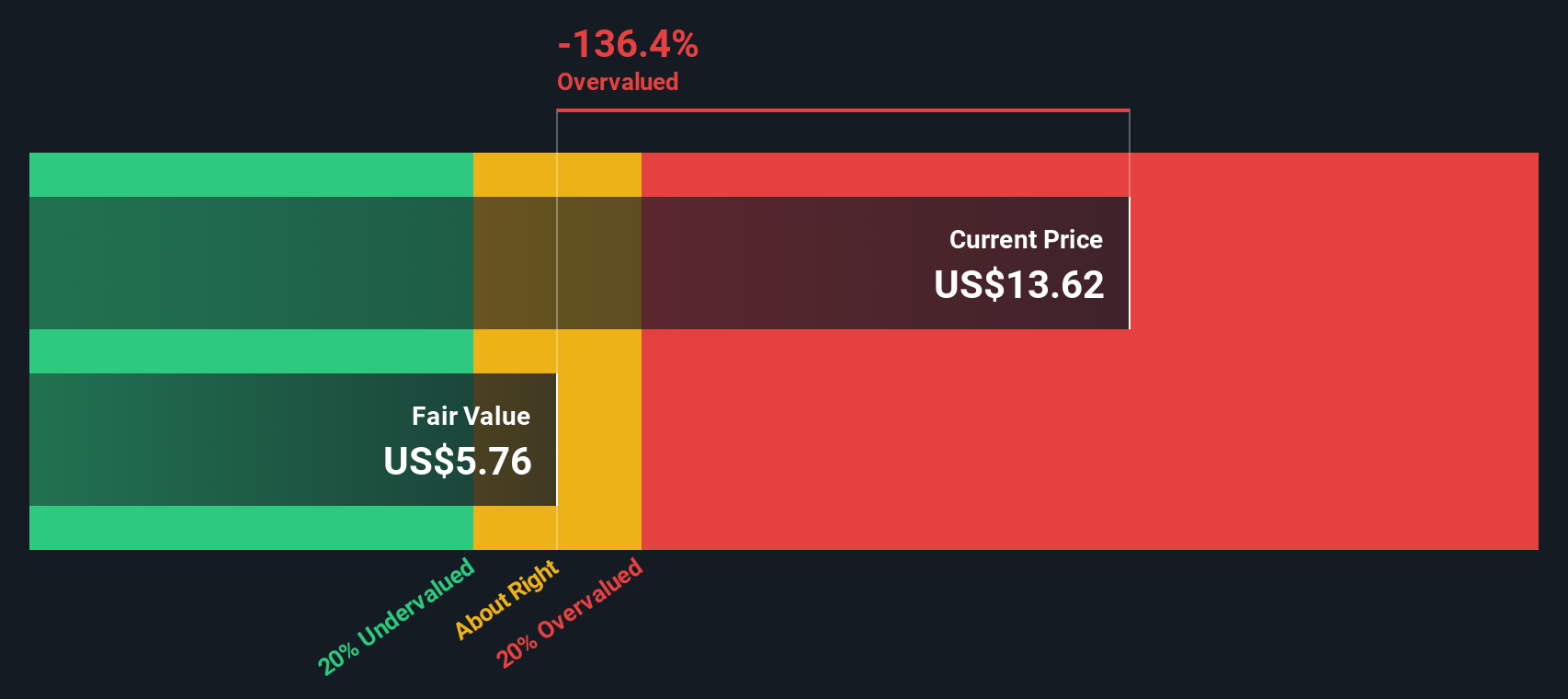

Taking a look through the lens of the SWS DCF model presents a starkly different view. This approach implies the stock may be overvalued by a much wider margin, which challenges the optimism in the first analysis. Which method gives the clearest signal? Could both be missing something important?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own American Eagle Outfitters Narrative

If you are not convinced by these conclusions or want to test your own assumptions, you can easily build a personalized outlook based on the latest data. Start now and do it your way.

A great starting point for your American Eagle Outfitters research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Do not settle for just one opportunity when you could be seizing the next big winner. Expand your options and uncover compelling picks that align with your goals using the power of the Simply Wall Street Screener. Here are three distinctive avenues you should not miss today:

- Target reliable returns by checking out high-yield picks among dividend stocks with yields > 3%. These can boost your portfolio’s income even in uncertain times.

- Strengthen your holdings by tapping into undervalued stocks based on cash flows. This may help you spot stocks trading below their cash flow value for long-term growth potential.

- Get ahead of market trends by scouting healthcare AI stocks. Consider healthcare companies driving innovation with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEO

American Eagle Outfitters

Operates as a multi-brand specialty retailer in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives