- United States

- /

- Specialty Stores

- /

- NYSE:AEO

American Eagle Outfitters (AEO): Assessing Valuation After Recent Share Price Surge

Reviewed by Kshitija Bhandaru

See our latest analysis for American Eagle Outfitters.

American Eagle Outfitters’ share price momentum has shifted gears lately, bouncing back sharply over the last three months after a sluggish start to the year. Longer-term investors have barely broken even, as the total shareholder return for the past year is effectively flat. However, recent gains suggest sentiment could be improving as investors weigh both growth prospects and changing risk perceptions for retailers.

If you’re interested in where momentum like this could pop up next, it might be time to broaden your investing horizons and discover fast growing stocks with high insider ownership

This recent surge raises the big question: Is American Eagle Outfitters trading at a bargain right now, or is all that optimistic outlook already reflected in the price?

Most Popular Narrative: 6% Overvalued

According to the most widely followed narrative, American Eagle Outfitters' analyst fair value of $15.94 is now below the latest close of $16.94. This suggests that renewed optimism from recent gains may have already been factored into the current share price.

The analysts have a consensus price target of $15.167 for American Eagle Outfitters based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.5, and the most bearish reporting a price target of just $10.0.

Want to know what’s fueling that price tag? The market is betting on a sharp earnings surge, shrinking profit multiples, and a big transformation over the next three years. Curious what assumptions shape those bold expectations? The full narrative breaks it down to show what really drives the fair value debate.

Result: Fair Value of $15.94 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing consumer uncertainty and higher operating costs could still derail the optimistic outlook if expected sales growth does not materialize.

Find out about the key risks to this American Eagle Outfitters narrative.

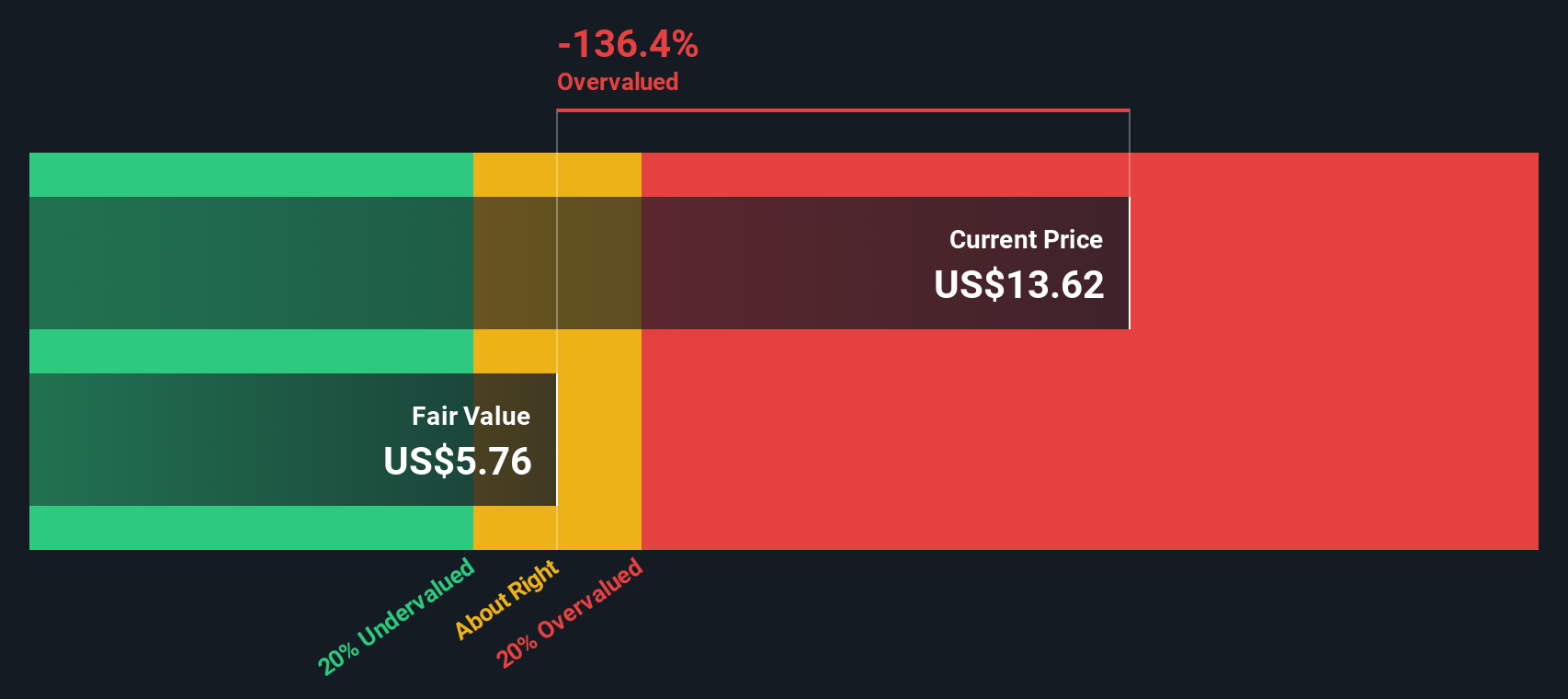

Another View: SWS DCF Model Suggests Overvaluation

Looking at American Eagle Outfitters through the lens of our DCF model offers a very different picture. The DCF suggests the fair value is just $9.92 per share, much lower than where the stock is trading now. This method calculates value based on future cash flows, so why the big disconnect?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own American Eagle Outfitters Narrative

If you have a different take or want to dig deeper into the numbers on your own, it only takes a few minutes to craft your personal view. Do it your way

A great starting point for your American Eagle Outfitters research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Missing out on the next big opportunity can set you back, so make sure you’re always a step ahead with these tailored stock ideas from Simply Wall Street.

- Spot opportunities in undervalued sectors where pricing power matters. Jump into these 896 undervalued stocks based on cash flows to see which companies are flying under the radar based on future cash flows.

- Capitalize on groundbreaking trends in artificial intelligence by checking these 24 AI penny stocks for businesses set to shape tomorrow’s markets.

- Maximize your passive income by reviewing these 19 dividend stocks with yields > 3%, handpicked for strong yields and solid dividend histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEO

American Eagle Outfitters

Operates as a multi-brand specialty retailer in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives