- United States

- /

- Specialty Stores

- /

- NYSE:AEO

A Deep Dive Into American Eagle Outfitters (AEO) Valuation Following Recent Share Price Volatility

Reviewed by Simply Wall St

American Eagle Outfitters (AEO) stock has recently shown some interesting movement, drawing attention from investors curious about its longer-term potential. While performance has fluctuated over the past month, broader trends offer a fresh perspective on the company’s outlook.

See our latest analysis for American Eagle Outfitters.

The momentum for American Eagle Outfitters has been anything but boring. After surging almost 40% over the past three months, the share price recently cooled off with a rough patch in the past month. Even with these fluctuations, the stock’s current weakness comes after a rebound that has resulted in long-term total shareholder returns of 54% over three years and 33% over five years. This highlights that the store’s story is far from over.

If you’re curious where other fast-moving opportunities are emerging, now is an ideal time to broaden your watchlist and discover fast growing stocks with high insider ownership

This raises the question: Is American Eagle Outfitters currently trading at an attractive value, or has the recent rebound already factored in the company’s future growth potential, leaving little room for upside?

Most Popular Narrative: 1.3% Undervalued

American Eagle Outfitters’ fair value, based on the most widely followed narrative, edges slightly above the last close price. The calculation brings recent operational improvements and future projections into sharp focus.

The ongoing share repurchase program shows confidence in long-term growth prospects and is expected to drive earnings per share (EPS) growth, supporting stock value. A focus on expanding product assortments and targeting activewear and denim markets is expected to capture further market share, contributing positively to revenue growth and profitability.

Think company strategy is just marketing spin? The narrative hinges on bold profit growth, margin expansion, and dramatic market share gains. Discover what combination powers this valuation.

Result: Fair Value of $15.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent consumer uncertainty and potential increased markdowns could weigh on margins, which may make the growth narrative harder to realize.

Find out about the key risks to this American Eagle Outfitters narrative.

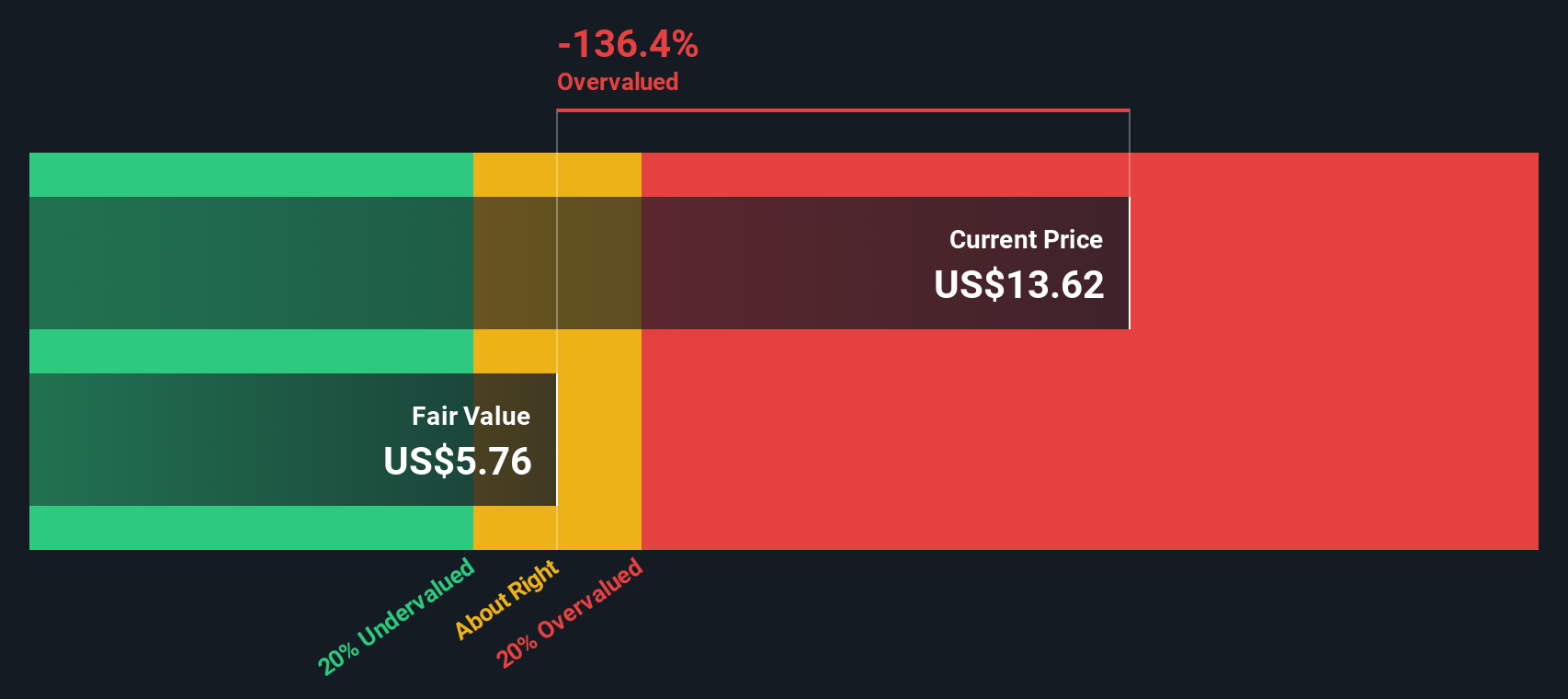

Another View: Discounted Cash Flow Model

The SWS DCF model paints a different picture for American Eagle Outfitters. While peer comparisons and multiples suggest the stock is attractively priced, the DCF result indicates the current share price actually sits above what underlying cash flows might justify. Could the market be pricing in more optimism than fundamentals support?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Eagle Outfitters for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Eagle Outfitters Narrative

If you see the data from a different angle or want to test your own assumptions, you can put together a personal narrative in just a few minutes. Do it your way

A great starting point for your American Eagle Outfitters research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your edge as an investor and check out where some of the brightest opportunities are unfolding right now. Expand your investment universe with these top ideas:

- Capitalize on strong income potential by checking out these 17 dividend stocks with yields > 3% with yields over 3% and robust fundamentals.

- Spot hidden gems early by starting with these 872 undervalued stocks based on cash flows that are priced below their true cash flow value.

- Embrace the future of healthcare by tapping into these 33 healthcare AI stocks that are powering innovation and next-level medical breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEO

American Eagle Outfitters

Operates as a multi-brand specialty retailer in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives