- United States

- /

- Specialty Stores

- /

- NYSE:AAP

What Advance Auto Parts (AAP)'s Competitor-Driven Earnings Buzz Means For Shareholders

Reviewed by Sasha Jovanovic

- Advance Auto Parts recently saw heightened investor interest after a major competitor, Genuine Parts Company, reported improved third-quarter sales results, reflecting upbeat sector sentiment ahead of Advance Auto Parts’ upcoming earnings announcement.

- This shift in sentiment highlights the influence that peer performance can have on expectations for others in the auto parts retail industry, especially during key earnings periods.

- We'll explore how Genuine Parts Company's upbeat sales, particularly in the 'do-it-for-me' segment, could shape Advance Auto Parts' investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Advance Auto Parts Investment Narrative Recap

To be a shareholder in Advance Auto Parts right now, you need to believe in the company’s turnaround strategy and its potential to capture profitable growth through operational and supply chain improvements. While the recent jump in AAP shares reflects positive peer results and rising sector optimism, this enthusiasm does not appear to fundamentally change the key short-term catalyst: the company’s upcoming earnings announcement, a critical moment given weaker recent quarters. The main risk remains the financial impact of large-scale store closures and continued margin pressures that could weigh on recovery plans.

Among the recent updates, Advance Auto Parts' revised full year sales guidance announced in August is particularly relevant. The new range of US$8,400 million to US$8,600 million serves as a direct benchmark against which the upcoming third-quarter results will be measured, especially following the stronger-than-expected performance from a competitor and sector-wide attention on near-term sales momentum.

In contrast, investors should be mindful of the significant costs and challenges associated with closing hundreds of stores and how these might further impact margins, especially...

Read the full narrative on Advance Auto Parts (it's free!)

Advance Auto Parts is projected to reach $9.0 billion in revenue and $295.3 million in earnings by 2028. This outlook reflects an annual revenue decline of 0.9% and an earnings increase of $891.3 million from the current level of -$596.0 million.

Uncover how Advance Auto Parts' forecasts yield a $53.20 fair value, in line with its current price.

Exploring Other Perspectives

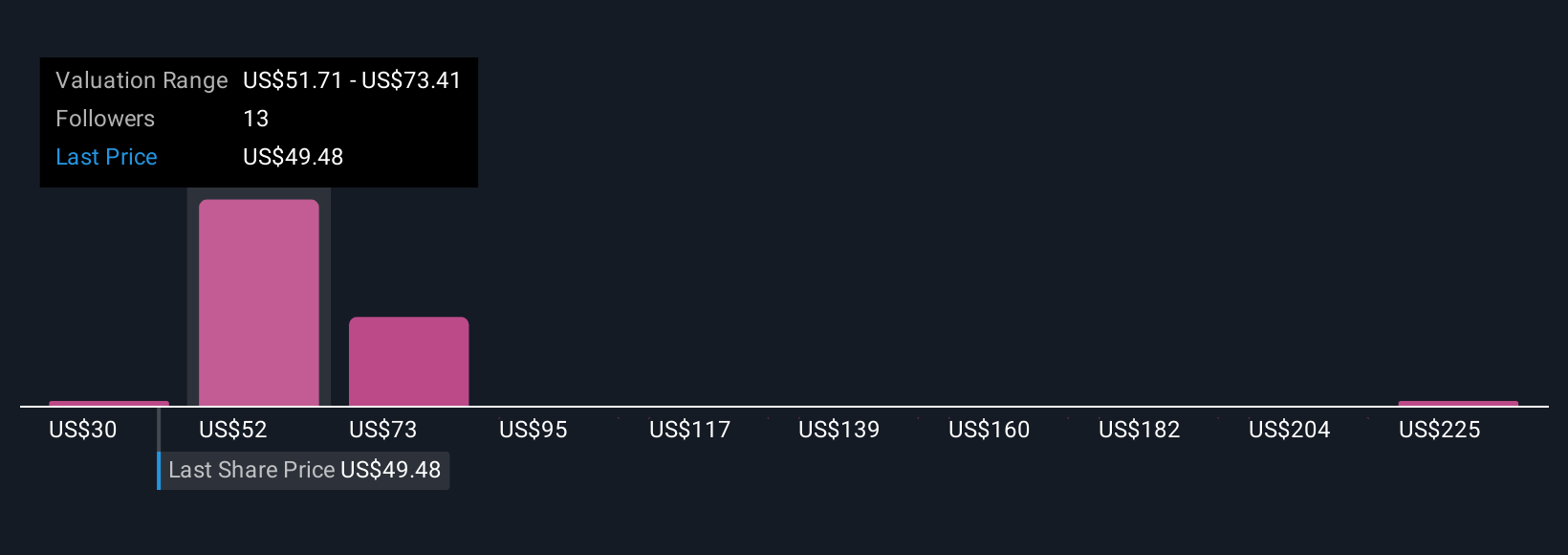

Five Simply Wall St Community members peg fair value estimates for AAP from US$30 to US$247.07. As you compare these views, remember that near-term margins are under pressure from store closure costs, potentially affecting outlooks across the board.

Explore 5 other fair value estimates on Advance Auto Parts - why the stock might be worth over 4x more than the current price!

Build Your Own Advance Auto Parts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Advance Auto Parts research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Advance Auto Parts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Advance Auto Parts' overall financial health at a glance.

No Opportunity In Advance Auto Parts?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AAP

Advance Auto Parts

Engages in the provision of automotive aftermarket parts in the United States and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives