- United States

- /

- Specialty Stores

- /

- NasdaqGS:WOOF

Does Petco’s Recent 5% Stock Rebound Signal a Shift in Market Sentiment for 2025?

Reviewed by Bailey Pemberton

If you are grappling with what to do about Petco Health and Wellness Company stock, you are far from alone. The last few years have been rocky terrain for this pet care retailer, with shares tumbling by around 64% over three years and down nearly 26% in the past twelve months. And yet, there have been some flashes of green. Over the last week, shares rebounded 5.5%, and the past month has seen a modest climb of 4.4%. These short-term bumps suggest investors are beginning to rethink the stock’s risk profile, or perhaps the market is starting to notice value where it previously saw only headwinds.

Given all the volatility, it is no wonder many investors are zooming in on valuation. According to the latest checks, Petco earns a value score of 3 out of 6. For context, this means it passes half of the standard metrics that analysts use to spot undervalued opportunities. That is neither a strong buy nor a reason to flee, but it does hint at possible upside if the company manages to deliver on key fronts.

So, how does Petco stack up across those classic valuation screens, and which ones highlight the most opportunity? Before you decide your next move, let’s break down each of the traditional methods used to value this stock. At the end, we will also touch on a fresh approach that might give you an edge beyond the usual numbers.

Why Petco Health and Wellness Company is lagging behind its peers

Approach 1: Petco Health and Wellness Company Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to their present value. For Petco Health and Wellness Company, this involves reviewing how much cash the business is expected to generate over time and determining what those future dollars are really worth right now.

Currently, Petco's Last Twelve Months Free Cash Flow sits at $4.93 million. Analysts provide more robust estimates for the next five years, while projections beyond that are extrapolated. Notably, free cash flow is forecasted to grow significantly and peak around $167.9 million in 2027 before tapering off and stabilizing in later years. By 2028, free cash flow is expected to be $38.4 million, with continued but modest declines extending out to 2035 as market dynamics shift and growth matures.

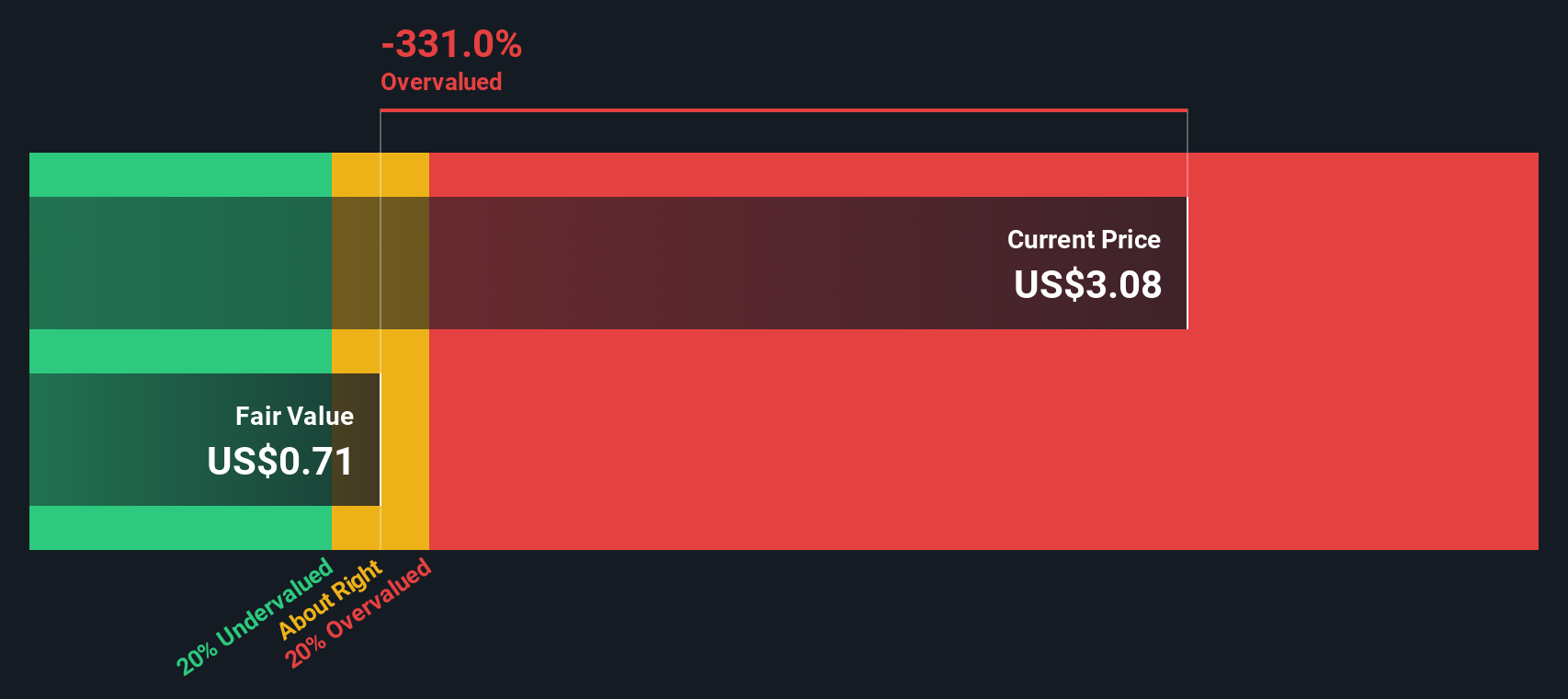

After applying these future cash flows and discounting them using the DCF approach, the model calculates Petco's intrinsic value at approximately $0.85 per share. In comparison, the current share price implies a 348.2% premium over this calculated intrinsic value, which suggests that the stock is dramatically overvalued at today’s levels.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Petco Health and Wellness Company may be overvalued by 348.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Petco Health and Wellness Company Price vs Sales

The price-to-sales (P/S) ratio is the preferred valuation metric for Petco Health and Wellness Company. This metric is especially useful when examining companies where profit margins may fluctuate or earnings are negative, as is the case here. It helps investors understand how much they are paying for each dollar of the company's sales, providing a clearer view of valuation for businesses with volatile or minimal net income.

Growth expectations and risk appetite play a significant role in what investors consider a “normal” or “fair” P/S ratio. Companies with higher expected revenue growth and lower risk typically trade at a higher multiple, while those facing sluggish growth or increased uncertainty see lower ratios.

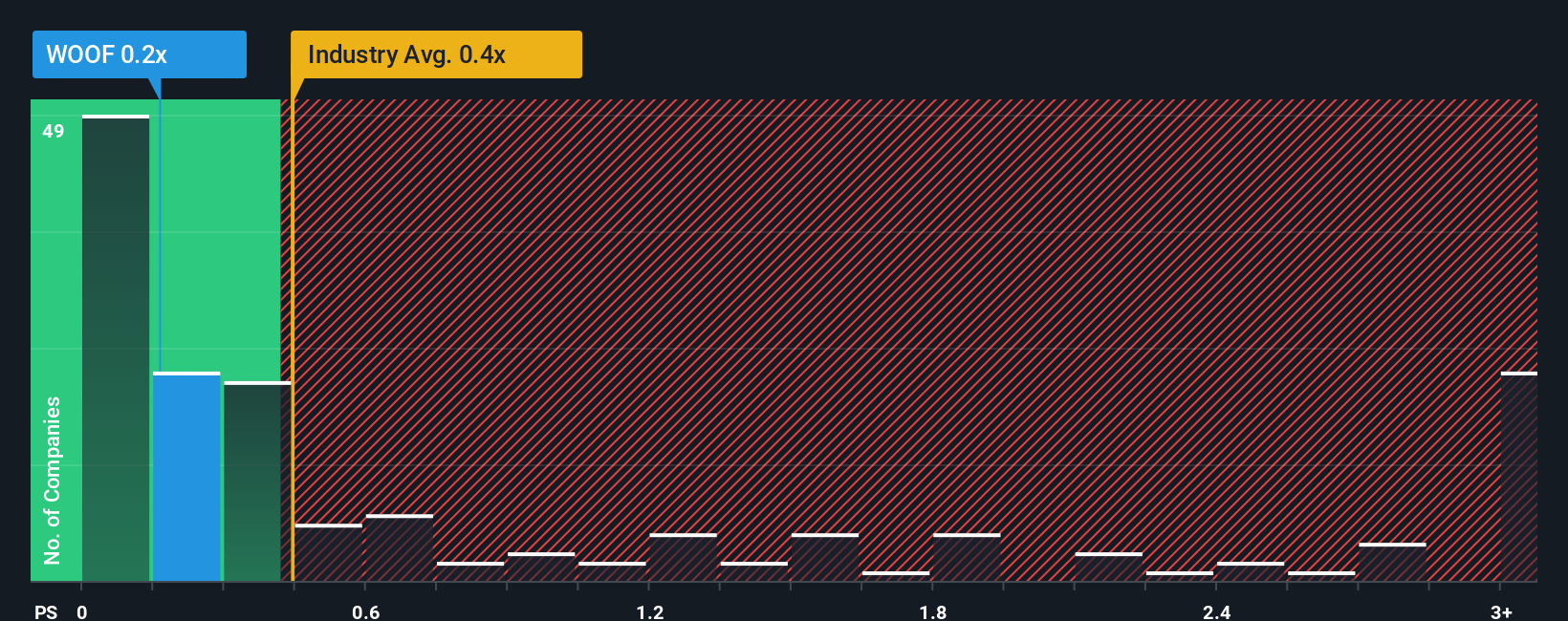

Currently, Petco trades at a P/S ratio of 0.18x, which is well below both the Specialty Retail industry average of 0.51x and its closest peers at 0.59x. However, industry averages do not consider unique factors such as Petco’s specific growth trajectory, profitability, margins, and risk profile.

This is where Simply Wall St’s Fair Ratio offers an edge. Rather than comparing only the top-line numbers, the Fair Ratio reflects a holistic view incorporating Petco’s projected growth, industry context, profit margins, company size, and the risks it faces. For Petco, the Fair Ratio is 0.32x, suggesting what the stock should trade at given its fundamentals.

Comparing the company’s actual P/S of 0.18x to its Fair Ratio of 0.32x highlights that the stock appears undervalued on this measure, since the current valuation is well below what should be expected for a company with Petco’s profile.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Petco Health and Wellness Company Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a powerful tool that lets you build a story about a company’s future by connecting your perspective on its business with financial forecasts, such as expected revenue, profit margins, and the fair value you believe is reasonable. Narratives bridge the gap between numbers and real-world events, helping you link what is happening at Petco Health and Wellness Company to your investment outlook.

On Simply Wall St’s Community page, used by millions of investors worldwide, you can easily find, create, or join Narratives. They help you decide when to buy or sell by updating fair value estimates in real time as new news, earnings releases, or major developments occur. This means your thesis stays relevant, whether it is based on Petco’s latest in-store innovations or challenges in e-commerce.

For example, some investors believe that Petco’s upgraded stores and service expansion will drive a strong recovery, giving them a high fair value target. Others point to stagnant industry growth and rising costs, arriving at a much lower valuation. Narratives capture both optimistic and cautious views, giving you a dynamic and flexible way to track your investment case as new information emerges.

Do you think there's more to the story for Petco Health and Wellness Company? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WOOF

Petco Health and Wellness Company

Operates as a health and wellness company, focuses on enhancing the lives of pets, pet parents, and its Petco partners in the United States, Mexico, and Puerto Rico.

Fair value with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success